US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 10.15 points or 0.23 per cent higher at 4,379.70, Dow Jones Industrial Average Index surged by 96.05 points or 0.28 per cent higher at 34,966.21, and the technology benchmark index Nasdaq Composite traded higher at 14,706.10, up by 4.20 points or 0.03 per cent against the previous day close (at the time of writing – 12:15 PM ET).

US Market News: The major indices of Wall Street traded in green despite concerns regarding the spread of the Covid-19 pandemic. Among the gaining stocks, Cheesecake Factory (CAKE) shares rose by about 2.57% after Raymond James had upgraded the stock to “outperform”. JP Morgan Chase & Co (JPM) shares grew by around 0.89%, driven by expectations of a strong earnings report this week. Nordstrom (JWN) shares went up by about 0.14% after the Company had acquired a minority stake in four apparel brands owned by Asos. Among the declining stocks, Virgin Galactic (SPCE) shares went down by about 10.91% post witnessing a surge in the previous trading sessions after the CEO Richard Branson had completed a long-awaited flight to space this weekend.

UK Market News: The London markets traded on a mixed note as ongoing Covid-19 worries had brought down the investors’ sentiments.

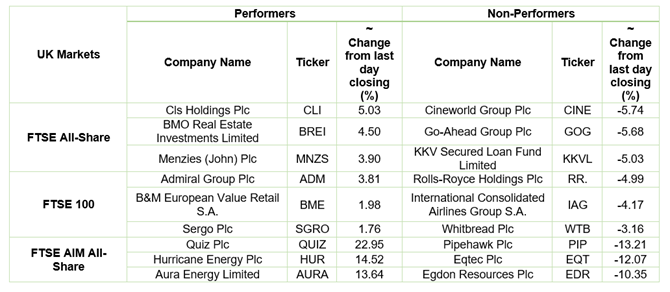

FTSE 100-listed travel stocks such as Rolls-Royce Holdings and International Consolidated Airlines Group shares plunged by around 3.57% and about 3.17%, respectively, amid worries regarding the delta variant of the Covid-19 pandemic. They remained the worst performer on the FTSE 100 index.

FTSE 250 listed Tate & Lyle shares went up by around 0.42% after it had agreed to sell a significant stake in the primary products business segment in North America & Latin America to private equity KPS Capital Partners for approximately USD 1.30 billion.

British motor insurer Admiral Group shares surged by around 3.78% after the Company had anticipated a higher-than-expected profit before tax ranging from £450 to £500 million for H1 FY21. Moreover, the Company had anticipated delivering lucrative shareholders returns in the form of special dividends.

Daily Mail & General Trust shares went up by around 3.61% after it stated that the Rothermere family was ready to make 810 million pounds in relation to the sale of the Insurance Risk division.

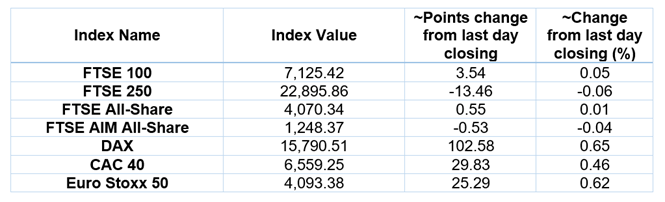

European Indices Performance (at the time of writing):

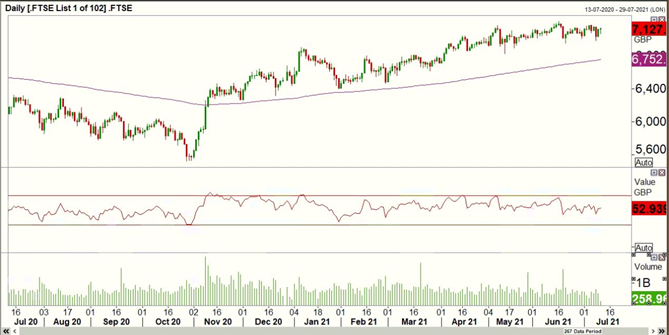

FTSE 100 Index One Year Performance (as on 12 July 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Real Estate (+1.58%), Utilities (+0.79%) and Healthcare (+0.77%).

Top 3 Sectors traded in red*: Consumer Cyclicals (-0.72%), Energy (-0.36%) and Basic Materials (-0.20%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $75.01/barrel and $73.90/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,806.15 per ounce, down by 0.25% against the prior day closing.

Currency Rates*: GBP to USD: 1.3878; EUR to GBP: 0.8544.

Bond Yields*: US 10-Year Treasury yield: 1.359%; UK 10-Year Government Bond yield: 0.6490%.

*At the time of writing