US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 2.12 points or 0.06 per cent higher at 3,387.63, Dow Jones Industrial Average Index accelerated by 61.18 points or 0.22 per cent higher at 27,800.91, and the technology benchmark index Nasdaq Composite traded higher at 11,289.71, up by 24.76 points or 0.22 per cent against the previous day close (at the time of writing, before the US market close at 12:10 PM ET).

US Market News: The Wall Street opened in the green as key indices trended upwards. The US Existing Home Sales were 5.86 million in July 2020 and were up by 24.7 percent month on month. Meanwhile, the Manufacturing PMI in the US was 53.6 in August 2020 above expected PMI of 51.9. Among the gaining stocks, BioNTech was up by around 12.72 percent after the company and its partner Pfizer stated that covid-19 vaccine could be out in October 2020. Deere’s shares increased by around 4.5 percent after the company reported earnings better than the market’s expectation. Foot Locker was up by around 2.6 percent after the company reported an increase in same-store sales. General Electric’s shares were up by about 0.96 percent after the company’s CEO Larry Culp contract was extended. Among the decliners, Lyft was down by around 2.2 percent after the reported that it may shut its operations in California. Viacom CBS was down by close to 0.37 percent after the reports that the company is asking increased ad-payment for the next year’s super bowl game.

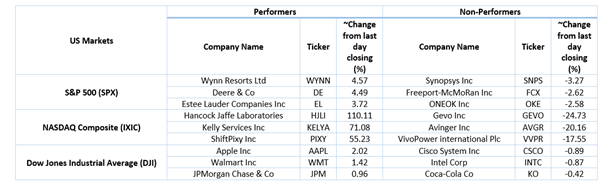

US Stocks Performance (at the time of writing)

European News: The London and the European market traded in the red. As per the Office for National Statistics report, the retail sales in the UK increased by 3.6 percent month on month in July 2020. The retail sales were up by 1.4 percent year on year in July 2020. Meanwhile, the UK’s public debt was more than £2 trillion in July. Among the gaining stocks, HG Capital was up by about 8.0 percent after the company reported investment in Visma. Silence Therapeutics was up by close to 3.6 percent after the company filed a registration with the SEC. GYG’s shares were up by about 0.6 percent after the company stated that it is on track to meet full years expectation. Relx was up by around 0.1 percent after the company’s analytics business Elsevier bought Scibite. Among the decliners, AstraZeneca was down by around 1.6 percent after its Imfinzi drug got approval in Japan for treatment of small cell lung cancer. Greencore’s shares were down by close to 1.5 percent after the company reported that it would temporarily close its Northampton facility.

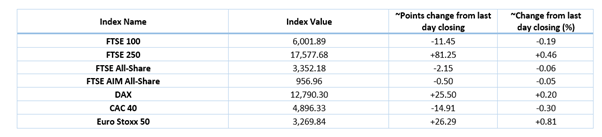

European Indices Performance (at the time of writing)

FTSE 100 Index Chart

1 Year FTSE 100 Index Performance (21 August 2020), before the market closed (Source: Refinitiv, Thomson Reuters)

Stocks traded with decent volume*: (LLOY) LLOYDS BANKING GROUP PLC; (VOD) VODAFONE GROUP PLC; (GLEN) GLENCORE PLC.

Sectors traded in the positive zone*: Consumer Cyclicals (+0.83%), Technology (+0.35%) and Basic Materials (+0.08%).

Sectors traded in the negative zone*: Healthcare (-1.23%), Telecommunications Services (-1.14%) and Energy (-0.58%).

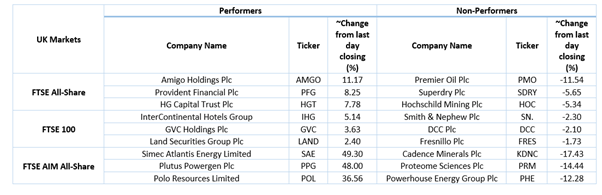

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: WTI crude oil (future) price and Brent future crude oil (future) price were hovering at $42.27 per barrel and $44.28 per barrel, respectively.

Gold Price*: Gold price was trading at USD 1,947.45 per ounce, up by 0.05% from previous day closing.

Currency Rates*: GBP to USD and EUR to GBP were hovering at 1.3095 and 0.9005, respectively.

Bond Yields*: U.S 10-Year Treasury yield and UK 10-Year Government Bond yield were trading at 0.640 per cent and 0.205 per cent, respectively.

*At the time of writing