OnTheMarket Plc

OnTheMarket Plc is the United Kingdom based online property dealing service. An agent-backed company which operates through its online portal OnTheMarket.com, is United Kingdomâs third-biggest residential property listing provider portal in terms of traffic. The company is focused on delivering a market-leading, agent-backed alternate option to Rightmove and Zoopla. The company claims to offer first-class service to agents at competitively low prices and aims to become the go-to portal for serious property-seekers.

At the IPO of the company in February 2018, OnTheMarket was 70 per cent owned by over two thousand agent firms, banking on this backing from its agent owners, the company has garnered a  unique sources of competitive advantage in terms of the thousands of "New & exclusive" property listings it gets every month through its agents to display on its portal before they move on to Rightmove or Zoopla.

The shares of the company are listed on the AIM segment of the London Stock Exchange where they trade with the ticker name OTMP.

Trading Statement Highlights

The company on 26 September 2019 came out with an operational and trading statement, followed by an announcement that its six-month unaudited interim results for the period ended 31 July 2019 will be published on 10 October 2019.

- The company has given guidance that the Group revenue for the current financial year to 31 January 2020 will be in the range of £18.0 million to £18.5 million which will be 27% to 31% higher than the revenues for the year to 31 January 2019. The company has a disciplined approach to costs management; hence its adjusted EBITDA loss for the current financial year to 31 January 2020 is expected to be in the range of £9 million to £10 million.

Stock performance at the London Stock Exchange

Price Chart as on 27 September 2019, before the market close (Source: Thomson Reuters)

On 27 September 2019, at the time of writing the report (before the market close, GMT 11.47 AM), OTMP shares were trading on the London Stock Exchange at GBX 87.79.

The stock has a 52-week High of GBX 155.00 and a 52-week low of GBX 72.00. The total market capitalization of the company was £55.90 million.

Outlook

The company is confident of its growth prospects and despite the lower revenues arising in the near term from the revised strategy, it will continue to grow the team to support its revenue growth in the long run.

Path Investments Plc

Path Investments Plc is a United Kingdom based natural resources acquisition and exploration company. The company aims to make a material acquisition in natural resources assets which are or will be production assets in near future. This will provide Company's shareholders with low risk, well-diversified portfolio of assets which will be able to deliver a good dividend stream while offering development potential for appreciation in the capital. The management of the company is looking to create a diversified portfolio of assets that is in keeping with the maturity of asset developments, the period of revenue flow and the scope for capital appreciation. In this regard, the company has scoped and evaluated a number of opportunities.

The shares of the company are listed on the London Stock Exchange where they trade with the ticker name PATH.

Result updates

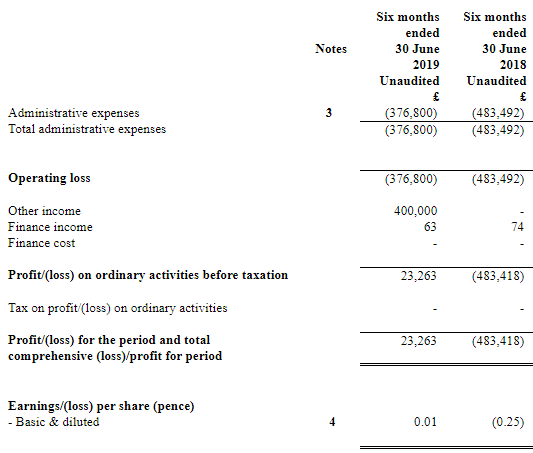

The company on 26 September 2019 came out with the interim results for the period ending 30 June 2019.

- The Profit before tax of the company for the reported period stood at£ 23,263 whereas for H1 2018 the company suffered a loss before tax of £483,418.

- The Earnings per share of the company for the reported period stood at 0.01 pence, whereas for H1 2018 it was a loss per share of 0.25pence per share.

- During the reported period the company launched its new website, www. pathinvestmentsplc.com.

Source â Companyâs interim results published on 26 September 2019.

Outlook

The reported period was a very busy period for the Company. However, post the review period on 19 August 2019, the company announced its intentions to acquire FineGems Extraction Corporation. The acquisition is in line with the companyâs strategy and is currently moving towards completion.

GYG Plc

GYG Plc is a United Kingdom domiciled company providing painting, supply and maintenance services to superyachts and cruise liners. The companyâs services are offered in the Mediterranean, Northern Europe and the United States of America. The sullies and services of the company are traded under the brand names Technocraft, Pinmar, Rolling Stock, Pinmar Supply and ACA.

The shares of the company are listed on the AIM segment of the London Stock Exchange where they trade with the ticker name GYG.

Results update

The company on 26 September 2019 came out with its results for the period ending 30 June 2019.

- The revenue of the company for the half-year increased by 31.2 per cent to be at â¬33.1 million while for H1 2018 the revenues were â¬25.2 million.

- The Operating profit of the company for the year increased to â¬0.1 million, while for H1 2018 the company suffered an operating loss of â¬1.4 million.

- The Profit before tax of the company increased to â¬0.1m for the year while for H1 2018 the loss before tax stood at â¬1.7 million.

Â

Â

Source â Companyâs interim result publication on 26 September 2019.

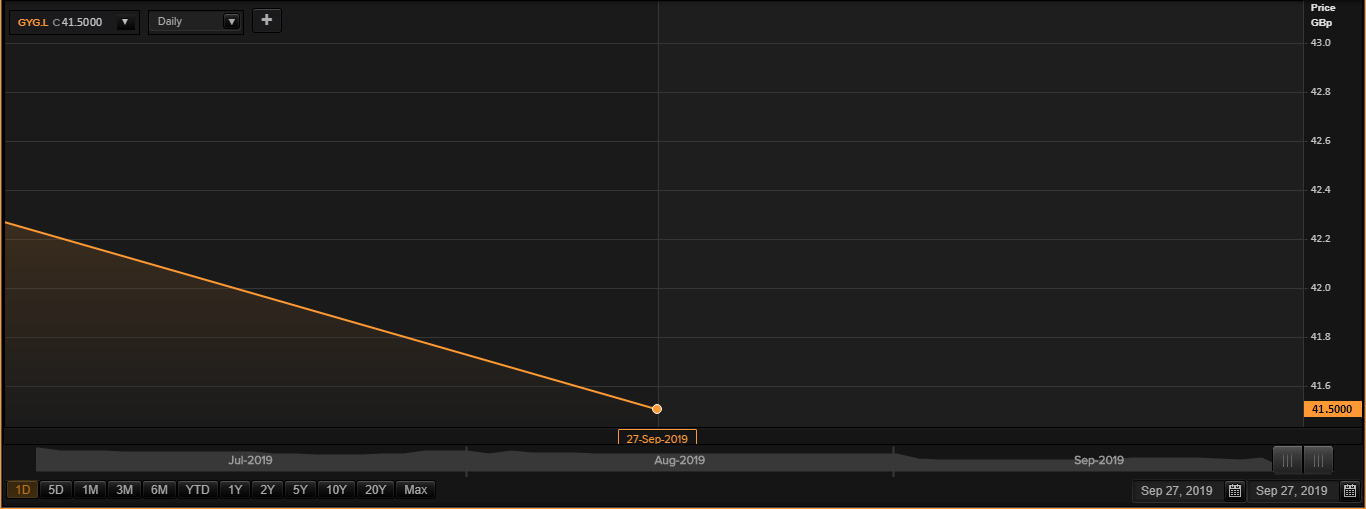

Stock performance at the London Stock Exchange

Price Chart as on 27 September 2019, before the market close (Source: Thomson Reuters)

On 27 September 2019, at the time of writing the report (before the market close, GMT 04.29 PM), GYG shares were trading on the London Stock Exchange at GBX 41.50.

The stock has a 52-week High of GBX 85.25 and a 52-week low of GBX 31.00. The total market capitalization of the company was £20.10 million.

Outlook

The company has made good progress in forging new relationships with shipyards and placing itself as a substitute favored supplier to the New Build sector. The company now is of opinion that it is well-positioned to take advantage of the growth prospects in New Build and greater shipyard capacity in Refit groups. The management maintains a forward-looking outlook towards the future.

Cora Gold Limited

Cora Gold Limited is an exploration stage gold mining company. It has several projects under various stages of development in Mali and Senegal in West Africa. Three of these projects have now achieved the de-risked status; which means, the reserves at these sites are now proven after test drilling and chemical testing, with high grades of minerals being discovered. The company also has an agreement with Hummingbird resources Plc, another gold mining company in the same region whereby it has the rights to explore on the acreages owned by the latter.

The company is based out of the British Virgin Islands; however, it is listed on AIM at the London Stock Exchange and trades with the ticker name CORA.

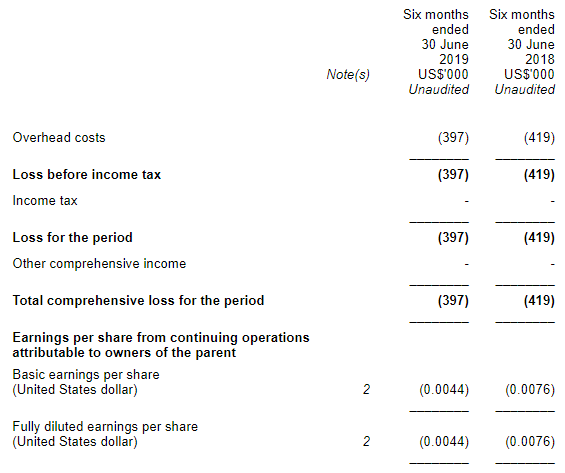

Result updates

The company on 12 September 2019 came out with its results for the period ending 30 June 2019.

- During the reported period, there was validation of constant oxide gold mineralisation of possible economic grades and widths at the Selin prospects and Zone A, Zone B at the Company's Sanankoro Gold Discovery.

- Coarse ore gold recoveries of up to 97% demonstrated to be achievable by preliminary metallurgical test work programme for oxide samples taken from Zone A and Selin prospects.

Source â Companyâs interim result publication on 12 September 2019.

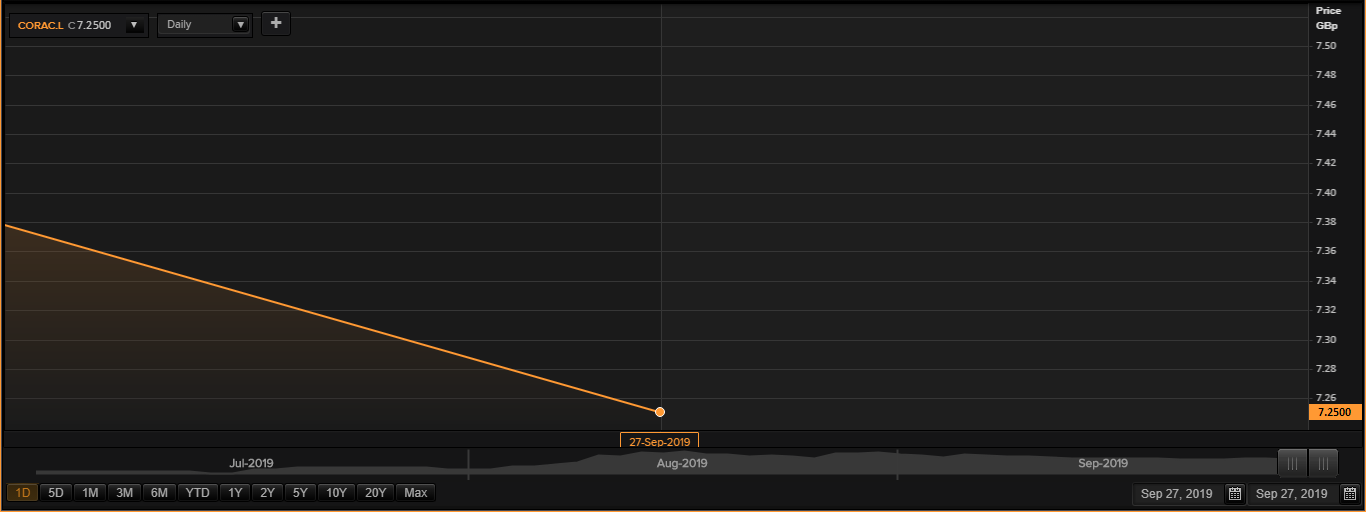

Stock performance at the London Stock Exchange

Price Chart as on 27 September 2019, before the market close (Source: Thomson Reuters)

On 27 September 2019, at the time of writing the report (before the market close, GMT 04.29 PM), CORA shares were trading on the London Stock Exchange at GBX 7.25.

The stock has a 52-week High of GBX 10.50 and a 52-week low of GBX 2.70. The total market capitalization of the company was £7.60 million.

Outlook

The companyâs proven reserves have now put it in high gear, it is ramping up its activities across its assets as it nears production. Its deal with Hummingbird Resources PLC has provided it with enough leverage to expand its exploration activities further in the area.

The company is one of the few AIM-listed gold mining companies working in West Africa, which has reached the de-risked stage, or its exploration activities have yielded positive results, with quantifiable estimates. The stocks of the company could see a substantial rise as the potential earnings of the company in future can be estimated based on the valuation of these mineral resources.