US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 1.61 points or 0.04 per cent higher at 4,362.80, Dow Jones Industrial Average Index surged by 30.19 points or 0.09 per cent higher at 34,526.25, and the technology benchmark index Nasdaq Composite traded lower at 14,483.10, down by 3.10 points or 0.02 per cent against the previous day close (at the time of writing – 11:45 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note ahead of the crucial US inflation data. Among the gaining stocks, Fastenal (FAST) shares rose by approximately 3.00%, even after it had highlighted inflated raw materials & freight costs. Tesla (TSLA) shares grew by around 1.82% after the Company was able to sell its highest monthly volume of vehicles in China during September 2021 since it started production in Shanghai two years ago. Among the declining stocks, CureVac (CVAC) shares plunged by about 7.87% after the Company decided to discontinue the development of the most advanced Covid-19 vaccine. Signet Jewelers (SIG) shares dropped by around 1.77% after the Company updated regarding the acquisition of rival Diamonds Direct for the consideration of USD 490 million.

UK Market News: The London markets traded in a red zone amid ongoing worries regarding inflation. According to the recently available data from the Office for National Statistics, the UK unemployment rate had dropped to 4.5% for the three months period ended August 2021 as compared to 4.6% for May-July 2021 period.

Must know Global cues before the ASX opening bell

Easyjet shares dropped by about 3.31%, even after the Company had turned cash positive in the final quarter of the fiscal year, boosted by an improvement in intra-European and UK domestic travel.

Hummingbird Resources PLC shares surged by around 15.78% after the Company had received a group level financing package from Coris Bank International to fund the Kouroussa Gold Mine project.

Entain had anticipated significant revenue growth for the third quarter driven by the improvement of in-shop volumes. However, the shares fell by around 1.52%.

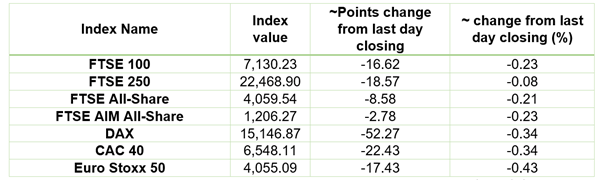

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as of 12 October 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 2 sectors traded in green*: Real Estate (0.80%), Utilities (0.56%).

Top 3 sectors traded in red*: Basic Materials (-0.63%), Financials (-0.53%), Consumer Cyclicals (-0.43%).

Top 3 gainers on FTSE All-Share index*: Petropavlovsk PLC (7.89%), Clipper Logistics PLC (5.60%), Ocado Group PLC (5.30%).

Top 3 losers on FTSE All-Share index*: Diversified Energy Company PLC (-18.17%), Foresight Group Holdings Limited (-8.08%), Carr’s Group PLC (-6.77%).

Crude Oil Future Prices*: Brent crude oil (future) price and WTI crude oil (future) price were hovering at $83.38/barrel and $80.52/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,759.85 per ounce, up by 0.24% against the prior day closing.

Currency Rates*: GBP to USD: 1.3588; EUR to USD: 1.1528.

Bond Yields*: US 10-Year Treasury yield: 1.579%; UK 10-Year Government Bond yield: 1.1395%.

*At the time of writing