US Markets: American equities extended the losses after opening in the negation region on Thursday, 18 November, as market participants continue to worry about the higher rate of inflation following which the US Federal Reserve is expected to take interest rate hike into consideration sooner-than-expected.

Dow Industrials cracked as much as 276 points with the heavyweight shares Cisco Systems tumbling more than 9% in the trade today after the California-headquartered technology conglomerate’s July-September earnings missed the analysts’ estimate. The weaker guidance provided by the corporation further dejected the investors.

Meanwhile, the technology heavy index Nasdaq Composite and the wider share barometer S&P 500 traded slightly lower after trimming some of the early morning losses. The falling number of unemployment claims by Americans failed to resurrect the confidence of investors as a handful of blue-chip stocks weighed on the equity market performance.

Top Global News to know before the ASX Opening Bell

According to the US Department of Labour, the number of people seeking the unemployment benefits further dropped to 268,000, witnessing a decline of 1,000, in the week ended 13 November. This has been the lowest reading for the weekly jobless claims in the pandemic era.

Labour market in the US has been continuously improving, while, on the other hand, enterprises struggle with the shortage of human capital, as a result of which, a number of commercial settings are not able operate at full scale.

Stock indices recovered in the mid-morning deals with Nasdaq Composite and S&P 500 returning to positive territory, but Dow Jones continued in the red. The Dow Jones Industrial Average shed 90.15 points, or 0.25% to 35,840.90, after sharply recovery from the intraday low of 35,654.39, Nasdaq Composite rose 52.05 points, or 0.33% to 15,973.62, and S&P 500 added 10.37 points, or 0.22% to 4,699.04.

US Market News: Other than Cisco Systems, shares of Intel, 3M, American Express, Walt Disney Company, IBM, Visa, Salesforce and Coca Cola fell 1-3%, dragging the benchmark Dow Industrials, while the shares of Home Depot emerged as the lead gainers, trying to offset the negative points. A low-to-moderate uptick in shares of Apple, Boeing, UnitedHealth Group and Microsoft briefly supported the index.

Amid the Nasdaq Composite constituents, shares of Nvidia jumped more than 10%, helping the tech heavy barometer to swing into green. Shares of JD.com, Advanced Micro Devices, Amazon, Moderna, ASML, Texas Instruments, Xilinx, eBay, Marvell Technology, Tesla and Alphabet rose 1-5%, supplementing the Nasdaq Composite. Nasdaq has been thoroughly complemented by the better corporate earnings with most of the companies raising their respective forecasts for the full year.

UK Markets: London equities extended losses on Thursday, 18 November, with the benchmark FTSE 100 remaining below 7,300 as investors awaiting key macroeconomic data scheduled to be released on Friday. The GfK Group is slated to unveil the GfK Consumer Confidence index, while the Office for National Statistics is readying to release the United Kingdom retail sales date for the month of October, the first month after the withdrawal of furlough scheme and the termination of stamp duty holiday benefits.

Earlier in September this year, the retail sales dropped by 0.2% as the proportion of online sales continue to supersede the in-store sales even after full scale resumption of almost every commercial setting following the removal of pandemic restrictions and social distancing guidelines.

Alongside the retail sales data, the ONS will be releasing the public sector net borrowing for October of 2021. The public sector debt in the UK has been hovering near record high levels with the total debt hitting £21.8 billion in September 2021. According to the data released by the ONS, the net debt excluding public sector banks stood at £2,218.9 billion at the end of September. This equates to 95.5% of the UK GDP, the highest ratio in nearly six decades. Such levels were last seen in 1963.

Local businesses have been grappling with the unfavourable business conditions including the supply side troubles, the limitedness of workforce, higher input prices with the CPI based rate of inflation hovering at a three-decade high, inadequacy of raw materials and resurgence of Covid cases in some parts.

Such operative conditions, at a time when consumers are more willing to step out of their homes and spend, make it more difficult for the businesses to realise the revenues close to the pre-Covid levels. As a result of muted business activity and anticipated downsizing in consumer-facing businesses after the disrupted trading activity in the July-September quarter, a large section of business owners are staring at store closures due to short-staffed situation and death of raw materials.

With the headline index hovering near 7,300 levels, the market index is well positioned to register new multi-month highs, but it certainly needs promising factors that can reinstate the optimism amidst the market participants.

FTSE 100 lost 35.24 points, or 0.48% to 7,255.96, whereas the mid-cap average FTSE 250 advanced 140.55 points, or 0.60% to 23,574.62, effectively narrowing the gap from 52-week high.

FTSE 100 (1-year performance)

Source: REFINITIV

Market Snapshot

Top 3 volume leaders: Lloyds Banking Group, Vodafone Group and BP

Top 3 sectoral indices: Consumer Services, Industrial Transportation and Personal Goods

Bottom 3 sectoral indices: Medicine and Biotech, Precious Metals and Industrial Metals

Crude oil prices: Brent crude up 0.52% at $80.70/barrel; US WTI crude up 0.62% at $78.03/barrel

Gold prices: An ounce of gold traded at $1,863.45, down 0.36%

Exchange rate: GBP vs USD - 1.3481, up 0.01% | GBP vs EUR - 1.1873, down 0.29%

Bond yields: US 10-Year Treasury yield - 1.579% | UK 10-Year Government Bond yield - 0.9260%

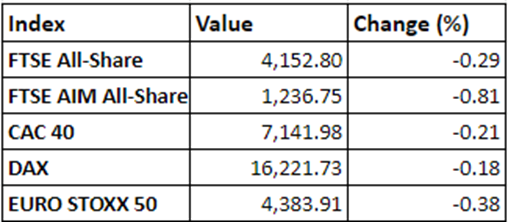

Markets @ 16:35 GMT