US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 18.84 points or 0.45 per cent higher at 4,202.13, Dow Jones Industrial Average Index surged by 153.01 points or 0.45 per cent higher at 33,973.39, and the technology benchmark index Nasdaq Composite traded higher at 14,062.60, up by 11.57 points or 0.08 per cent against the previous day close (at the time of writing - 2:15 PM ET).

US Market News: The major indices of Wall Street traded in a green zone after stellar earnings from Apple and Facebook had driven a rally in tech stocks. Among the gaining stocks, Facebook shares climbed by about 6.17% after the Company had reported quarterly profit more than the estimates. Apple shares went up by around 0.49% after the Company had reported quarterly earnings of USD 1.40 per share. Among the declining stocks, eBay shares went down by about 11.34% after the Company had forecasted a weaker-than-expected outlook for the current quarter. Merck & Co shares plunged by about 4.71% after the Company had missed the quarterly profit forecast.

US Stocks Performance*

UK Market News: The London markets traded on a mixed note after the US Federal Reserve had decided to keep interest rates unchanged at near-zero levels. FTSE 100 ended marginally lower by 0.03%, despite the strong performance of Standard Chartered and Smith & Nephew.

Medical products supplier Smith & Nephew shares rose by about 6.06% after the Company had resumed full-year guidance after reporting robust revenue growth during Q1 FY21, driven by acquisitions and increased surgery volumes.

Natwest Group had reported a pre-tax operating profit of 946 million pounds during Q1 FY21 as compared to 519 million pounds for Q1 FY20. However, the shares went down by around 3.88%.

Consumer giant Unilever shares surged by about 3.38% after the Company had announced a share buyback worth 3.0 billion euros as the Company had estimated first-half sales growth near the top end of its target.

Standard Chartered had shown underlying profit growth of around 18% during Q1 FY21 as compared to Q1 FY20 as lower provision for bad debt partially offset the falling income. Moreover, the shares jumped by about 6.12%.

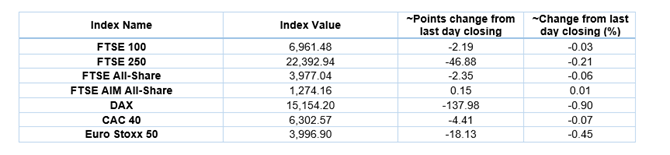

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 29 April 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC); BP Plc (BP.).

Top 3 Sectors traded in green*: Consumer Non-Cyclicals (+1.02%), Financials (+0.81%) and Technology (+0.43%).

Top 3 Sectors traded in red*: Industrials (-0.76%), Utilities (-0.66%) and Consumer Cyclicals (-0.32%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $67.89/barrel and $64.85/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,769.25 per ounce, down by 0.26% against the prior day closing.

Currency Rates*: GBP to USD: 1.3939; EUR to GBP: 0.8691.

Bond Yields*: US 10-Year Treasury yield: 1.647%; UK 10-Year Government Bond yield: 0.8430%.

*At the time of writing

.jpg)

_09_03_2024_01_03_36_873870.jpg)