Summary

- Standard Chartered reported a 40 per cent fall in its underlying profits during the Q3 of 2020.

- HSBC reported a 46 per cent decline in its reported profit after tax for Q3 2020.

- Lower interest rates continued to impact StanChart’s income. Despite challenges, it showcased cost control and improved credit impairment.

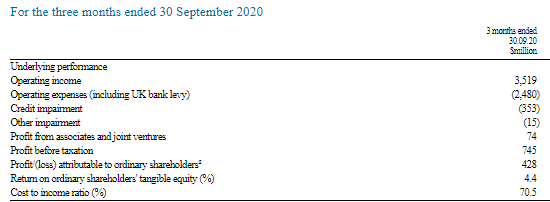

Standard Chartered PLC's third-quarter pretax underlying profit fell by 40 per cent due to higher credit impairment because of the pandemic and lower interest rates. It also reported a 12 per cent fall in its operating income at $3.5 billion for the third quarter ending on 30 September. The group said the 40 per cent plunge is worth $0.7 billion.

CEO Bill Winters said lower interest rates continued to impact its income but at the same time the bank was well positioned to meet its financial targets.

On the other hand, HSBC Holdings Plc reported that its Q3 post-tax profits fell by 46 per cent as the banking giant suffered due to the pandemic and spiralling China-United States tensions. The bank’s post-tax profits were $2 billion for the period.

Standard Chartered Plc

The coronavirus pandemic has hit most global banks, which has seen them cutting costs and jobs, facing the increasing bad loans pressure, squeezing lending margins and interest rates or even turning it negative.

Standard Chartered Plc is trying to control costs to fund innovations. The company statement mentioned that the group was well provided against credit impairments. The bank said that the winter was focussed on reducing operating expenses for maximising investment in digital capabilities. It targeted these expenses to be below $10 billion in FY2020 as well as in FY2021.

A few quick points on the financial performance of the group:

- The banking group recorded a 16 per cent decline in its net interest margins (NIM), reaching a value of $1,620 million for the quarter. A fall in the interest rates affected the decline.

- However, the average NIM was expected to stabilise slightly below this level over the next two quarters.

- The group’s ‘other income’ reported a 7 per cent drop as compared to Q3 2019, which was at $2,041 million. The statutory fees and commissions increased by 3 per cent. Wealth management and financial market categories performed well but those gains were offset by a $157 million reduction in the group’s treasury segment for Q3.

- Operating expenses were also down by 1 per cent, absorbing continued investment into strategic initiatives. There was a 7 percentage points increase in cost-to-income ratio to 70 per cent. It was negatively impacted by a fall in the interest rates and net interest income.

- The credit impairment increased by $74 million to touch a value of $353 million for Q3. Stage 1 and 2 impairments of $109 million increased by 50 per cent. However, impairments of Stage 3 assets were up 9 per cent only.

- ‘Profit from associates and joint ventures’ was up by 64 per cent to $74 million for the July to September 2020 period.

- On a statutory basis, taxation was $274 million with an underlying year-to-date effective tax rate of 31.3 per cent, up from the prior year’s rate of 28.1 per cent.

- Earnings per share weres down 13.0 cents, or 49 per cent, to 13.6 cents.

(Source: Company website)

Stock Performance

On October 29, at 2:28 PM, Standard Chartered plc (LON: STAN) shares were trading at GBX 348.90, down by 6.64 per cent from its previous close of GBX 373.70. It had a market capitalization of £11,794.65 million.

HSBC Holdings PLC

A day before Standard Chartered released its Q3 2020 report, HSBC Holdings plc disclosed its financial performance for the same period, reporting a 46 per cent YOY decline in the reported profit after tax to $2 billion.

There was a 36 per cent decrease YOY in the reported profit before tax to $3.1 billion, driven by the lower revenue. The reported revenue also witnessed a 11 per cent decline YOY to $11.9 billion, because of the impact of reductions in interest rate on its deposit franchises across all global businesses.

The Net Interest Margin was recorded at 1.20 per cent, which was down 36 basis points in comparison to Q3 2019, reflecting the continuing impact of interest rate reductions due to the Covid-19 outbreak.

The global slowdown in economic activities along with factors such lower interest rates, bad loans, thinner lending margins have impacted HSBC’s earnings in a big way. Besides, another growing concern for HSBC is the geopolitical tensions between China and the West. HSBC derives close to 90 per cent of its profit from the continent of Asia, with China and Hong Kong being as main growth drivers. And hence, it is more “vulnerable” than most due to the crossfire.

FTSE 100 stock HSBC Holdings, after recording a decline of around 36 per cent in the profits, said that it could be charging its customers for the basic banking services such as current accounts. UK customers, who have standard bank accounts that offer overdraft facilities, could soon witness the free banking coming to an end.

Stock Performance

On 29 October at 2:56 PM, HSBC Holdings PLC (LON: HSBA) shares were trading at GBX 325.60, up by 2.07 per cent from its previous close of GBX 319.00. The stock had a market capitalization of £64,972.57 million at that time of the day.