Source: Copyright © 2021 Kalkine Media Pty Ltd.

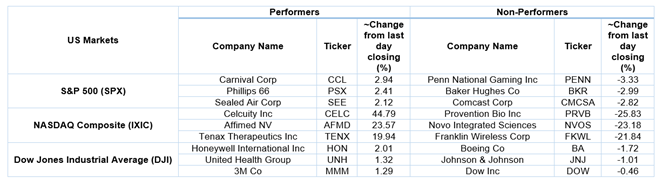

US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 8.93 points or 0.22 per cent higher at 4,106.10, Dow Jones Industrial Average Index surged by 77.47 points or 0.23 per cent higher at 33,581.04, and the technology benchmark index Nasdaq Composite traded higher at 13,840.02, up by 10.71 points or 0.08 per cent against the previous day close (at the time of writing - 11:45 AM ET).

US Market News: The major indices of Wall Street traded in green though there was an increase in the U.S. producer prices during March 2021. Among the gaining stocks, Naked Brand Group shares surged by approximately 20.05% after it revealed that Ault Global held more than 41.1 million shares. Levi Strauss & Co shares rose by around 4.42% after the Company reported the first quarter results better than expectations. Among the declining stocks. WD-40 shares went down by approximately 13.09% after the household chemical products manufacturer reported weaker than expected first-quarter results. Boeing shares dropped by about 1.08% after the Company flagged potential electrical issues in certain 737 MAX jets.

US Stocks Performance*

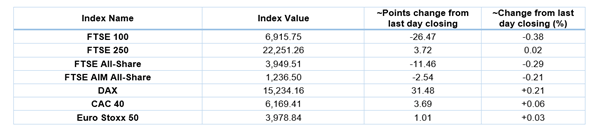

UK Market News: The London markets traded in a red zone as the recent market rally loses steam. FTSE 100 traded lower by around 0.38% as investors look ahead to the further reopening of the economy. According to Halifax’s house price index, the average house prices in the UK had shown a month-on-month jump of about 1.1% during March 2021.

Babcock International Group shares went down by around 3.59% after the media reports that the defence contractor is braced for the big asset write-down.

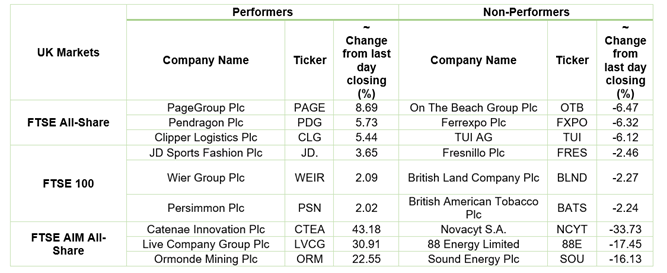

FTSE 250 listed PageGroup had delivered an improved trading performance as it reported a 2% growth in the first-quarter profit. Meanwhile, the shares jumped by around 8.69% and remained the top performer on the index.

Frasers Group had expected to face extra non-cash impairment of at least 200 million pounds due to the Covid-19 pandemic restrictions. However, the shares went up by around 0.60%.

Travel Company Tui shares dropped by about 7.35% after it announced the fundraising of around 400 million euros by selling convertible bonds amid rising restrictions caused by the Covid-19 pandemic.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 9 April 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC); Vodafone Group Plc (VOD).

Top 2 Sectors traded in green*: Consumer Cyclicals (+0.43%) and Industrials (+0.05%).

Top 3 Sectors traded in red*: Real Estate (-0.98%), Consumer Non-Cyclicals (-0.90%) and Technology (-0.80%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $62.98/barrel and $59.37/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,742.15 per ounce, down by 0.91% against the prior day closing.

Currency Rates*: GBP to USD: 1.3720; EUR to GBP: 0.8677

Bond Yields*: US 10-Year Treasury yield: 1.662%; UK 10-Year Government Bond yield: 0.780%.

*At the time of writing

.jpg)