US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 7.52 points or 0.17 per cent higher at 4,530.20, Dow Jones Industrial Average Index dipped by 22.93 points or 0.06 per cent lower at 35,337.80, and the technology benchmark index Nasdaq Composite traded higher at 15,362.00, up by 102.80 points or 0.67 per cent against the previous day close (at the time of writing – 11:50 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note after ADP's monthly report on private-sector hiring hinted at a slowdown in the job market recovery. Among the gaining stocks, Ambarella (AMBA) shares surged by around 19.30% after the chipmaker forecasted that the current quarter’s revenue could reach a 5-years high. Campbell Soup (CPB) shares rose by around 0.93% after the food producer’s top-line revenue and bottom-line profitability came out to be more than the consensus estimates for the latest quarter. Among the declining stocks, CrowdStrike Holdings (CRWD) shares dropped by around 2.67%, even after the cybersecurity firm raised the full-year outlook. Intuit (INTU) shares fell by about 0.78% amid the media reports that the Company remained in discussions to purchase Mailchimp for more than USD 10 billion.

UK Market News: The London markets traded in a green zone after the release of the encouraging UK manufacturing data. According to the latest figures from the IHS Markit/CIPS, the manufacturing PMI had shown a reading of 60.3 for August 2021, while it was 60.4 for the prior month. With reference to the latest figures from Nationwide, the UK house prices had shown a month-on-month increase of around 2.1% during August 2021 when compared with the prior month.

888 Holdings shares surged by about 4.07% after the Company reported record interim profit and subsequently raised the full-year guidance. Moreover, the Company’s business got benefited from the recently concluded Euro 2020.

Petropavlovsk shares climbed by around 7.48% after the Company swung back into profitability during the first half of the current fiscal year.

WH Smith had warned 2022 profit would remain at the lower end of the expectations due to uncertainty revolving around the recovery of the travel sector. Moreover, the shares dropped by around 3.92%.

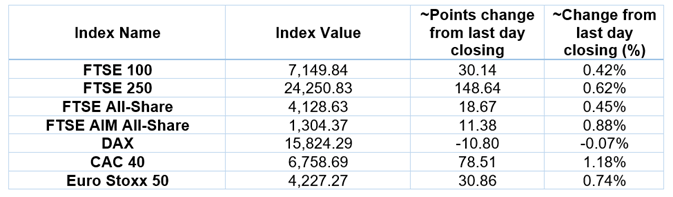

European Indices Performance (at the time of writing):

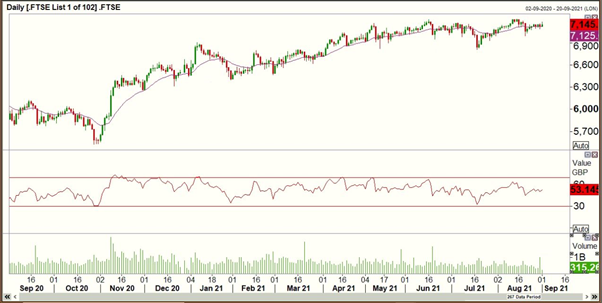

FTSE 100 Index One Year Performance (as on 1 September 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group PLC (LLOY); Barclays PLC (BARC); Vodafone Group PLC (VOD).

Top 3 Sectors traded in green*: Real Estate (+1.75%), Consumer Cyclicals (+1.37%) and Technology (+1.33%).

Top 3 Sectors traded in red*: Basic Materials (-0.80%), Energy (-0.06%) and Healthcare (-0.00%).

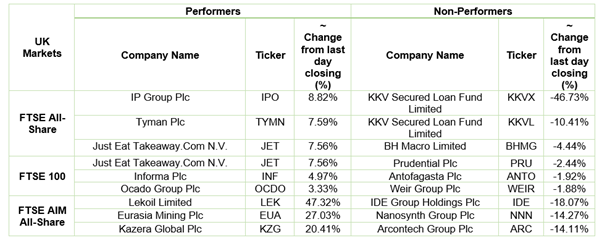

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $71.62/barrel and $68.58/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,815.05 per ounce, down by 0.17% against the prior day closing.

Currency Rates*: GBP to USD: 1.3780; EUR to USD: 1.1843.

Bond Yields*: US 10-Year Treasury yield: 1.302%; UK 10-Year Government Bond yield: 0.6950%.

*At the time of writing