US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 50.16 points or 1.35 per cent higher at 3,777.02, Dow Jones Industrial Average Index expanded by 599.68 points or 1.97 per cent higher at 30,991.28, and the technology benchmark index Nasdaq Composite traded higher at 12,878.24, up by 59.28 points or 0.46 per cent against the previous day close (at the time of writing, before the US market close at 1:10 PM ET).

US Market News: The major indices of Wall Street traded in the green territory as democrats turned optimistic of winning US senate election in Georgia. The Institute for Supply Management (ISM) reported a Manufacturing PMI of 60.7 for December 2020, while it was 57.5 for November 2020. Among the gaining stocks, Change Healthcare grew by about 33.44% after it received a lucrative bid of US$7.84 billion from UnitedHealth. Shares of Cal-Maine Foods went up by around 7.30% after the company reported a profit in its fiscal second quarter. AmerisourceBergen gained about 5.16% after the company announced its plan to buy Walgreens Boots Alliance. Among the declining stocks, Shares of UnitedHealth went down by 2.26% after the company announced to buy Change Healthcare. Apple shares fell by about 2.07% after the tech giant got hit by increasing probability of Democrats controlling the Senate.

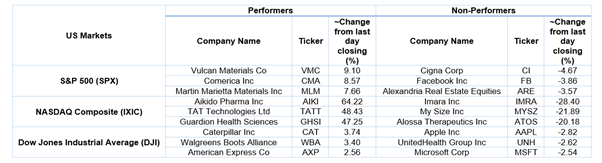

US Stocks Performance*

European News: The London and European markets traded in the green reflecting strong investor sentiments on a Demographic win in US senate election in Georgia. The UK car sales slumped to its lowest level since 1992 and dropped by 29% to 1.63 million during the year. Among the gaining stocks, Shares of Equals Group soared by 18.52% after the company said it expects revenue ahead of market expectations. Shares of Greggs grew by 10.23% although it had forecasted a loss for FY20. Informa was surged by about 5.07% after the company said 2020 results would be in line with the guidance. Shares of Marks & Spencer Group went up by 4.87% following the news that it would buy Jaeger. Among the decliners, Shares of Topps Tiles went down by 0.52% after the company warned that sales would be impacted by the lockdown. Shares of Aveva Group had dropped the most on the FTSE-100 index.

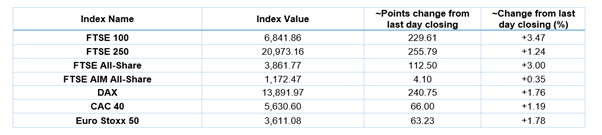

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 6 January 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD) and BP Plc (BP.).

Top 3 Sectors traded in green*: Energy (+6.52%), Financials (+5.76%) and Basic Materials (+5.44%).

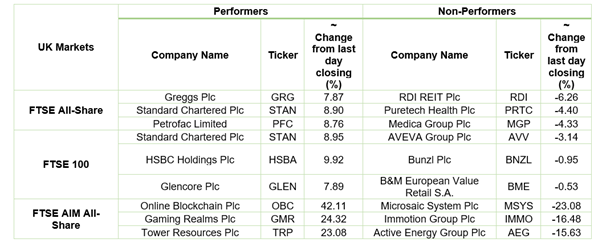

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $54.59/barrel and $50.86/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,908.60 per ounce, down by 2.34% against the prior day closing.

Currency Rates*: GBP to USD: 1.3618; EUR to GBP: 0.9040.

Bond Yields*: US 10-Year Treasury yield: 1.049%; UK 10-Year Government Bond yield: 0.242%.

*At the time of writing