Source: Copyright © 2021 Kalkine Media Pty Ltd.

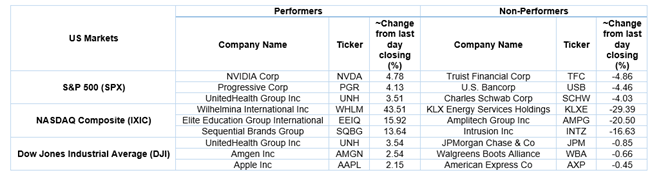

US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 34.73 points or 0.84 per cent higher at 4,159.39, Dow Jones Industrial Average Index surged by 253.21 points or 0.75 per cent higher at 33,984.10, and the technology benchmark index Nasdaq Composite traded higher at 13,993.81, up by 135.97 points or 0.98 per cent against the previous day close (at the time of writing - 11:30 AM ET).

US Market News: The major indices of Wall Street traded in a green zone fuelled by impressive jobless claims numbers and stronger-than-expected retail sales. Among the gaining stocks, Dell Technologies shares climbed by about 6.80% after the Company decided to spin off the 81% stake in VMWare. UnitedHealth Group shares rose by about 3.62% after the Company had reported top-line and bottom-line business better than the expectations for the first quarter. BlackRock shares went up by approximately 2.47% after the asset management giant had reported revenue and earnings slightly more than the estimates for the first quarter.

US Stocks Performance*

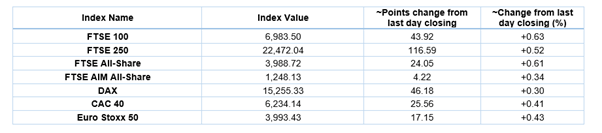

UK Market News: The London markets traded in a green zone underpinned by the good performance of the mining sector. FTSE 100 advanced higher by around 0.63%, illustrating positive investor confidence after bumper profit numbers reported by JP Morgan Chase and Goldman Sachs at the first-quarter earnings season in the US.

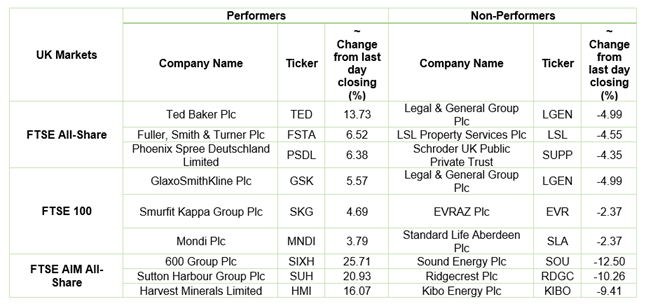

Mining shares such as Antofagasta, Fresnillo, and Rio Tinto went up by around 3.01%, 3.24%, and 2.13%, respectively, driven by higher metal prices.

Ladbrokes owner Entain shares grew by about 0.81% after the Company updated that it carried the positive momentum built during FY20 into the first quarter of FY21. Moreover, the Company had reported a significant growth in online net gaming revenue.

Wizz Air Holdings updated that it had expected a full-year net loss of up to 590 million euros. Moreover, the Company had expected a gradual traffic recovery into late summer 2021. However, the shares went up by around 0.78%.

Online electricals retailer AO World shares went up by about 1.39% after reporting outstanding revenue growth of around 62% during FY21 ended on 31 March 2021.

Builders Merchant Travis Perkins had posted like-for-like sales growth of around 17.4% for the first quarter. Meanwhile, the shares jumped by about 2.19%.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 15 April 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC); Glencore Plc (GLEN).

Top 3 Sectors traded in green*: Healthcare (+3.24%), Basic Materials (+1.67%) and Consumer Non-Cyclicals (+1.37%).

Top 2 Sectors traded in red*: Financials (-0.49%) and Energy (-0.37%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $66.88/barrel and $63.38/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,767.95 per ounce, up by 1.82% against the prior day closing.

Currency Rates*: GBP to USD: 1.3788; EUR to GBP: 0.8684.

Bond Yields*: US 10-Year Treasury yield: 1.534%; UK 10-Year Government Bond yield: 0.722%.

*At the time of writing

.jpg)