Summary

- Bitcoin has hit a fresh all-time high over $23,000.

- In the last 24 hours, the crypto asset has leapfrogged 3,000-mark levels and is nearing $24,000

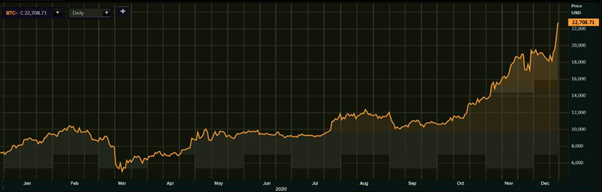

- According to the data available with Binance, Bitcoin has gained over 170 per cent in the last one year. It was trading at $5,000 in March.

The price of world's highest-profile cryptocurrency bitcoin reached an all-time high in the late trade on Wednesday surpassing the psychological level of $20,000 for the first time in history. The year 2020 has been exceptionally upright for bitcoin and several other crypto assets including Ethereum and Litecoin as far as the per unit price rise is concerned.

(Image source: ©Kalkine Group 2020)

Bitcoin at an all-time high

According to the data available with Binance, the largest cryptocurrency exchange in the world by volume, bitcoin breached the crucial level of $20,000 in the mid-afternoon deals on 16 December. With the invariable uptick in the prices, the crypto asset has now overtaken the level of $23,000, hitting an all-time high of $23,806.78, the Binance data showed.

In the last one year, Bitcoin has gained over 170 per cent, which was trading at $5,000 in March.

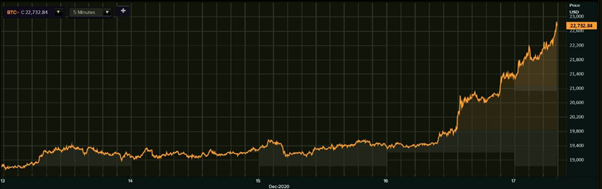

Bitcoin 1-week performance

(Source: Refinitiv, Thomson Reuters)

With the unprecedented rise in the bitcoin prices, the cryptocurrency is now on the verge of crossing another barrier of $24,000. In just 24 hours, bitcoin has quickly leapfrogged the levels of $20,000, $21,000, $22,000 and $23,000.

Interestingly, the California-headquartered cryptocurrency exchange Coinbase said that the company has administered a fix after the platform witnessed a network congestion, following the renewed interests of the investors and extraordinarily high trading volumes.

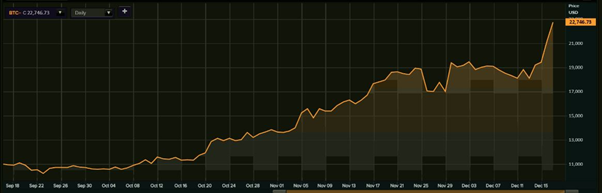

Bitcoin has seen a major upswing in the last three months with the per unit prices of bitcoin rallying more than 100 per cent, doubling the investors’ wealth in the corresponding stretch.

Bitcoin 3-month performance

(Source: Refinitiv, Thomson Reuters)

Bitcoin defies Covid uncertainty

The cryptocurrencies have once again attracted the investors with the unusual uptick in the prices defying all uncertainties due to the coronavirus pandemic. Along with the leading stock indices, individual shares, and a bunch of capital market assets, bitcoin and other cryptocurrencies had seen a massive plunge in the prices during the February-April period restating the fears of another cryptomarket crash like in 2018.

Bitcoin YTD performance

(Source: Refinitiv, Thomson Reuters)

Bitcoin’s last two years

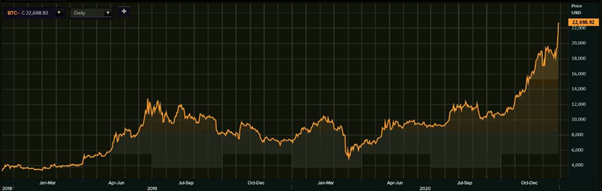

In the last two years, the cryptocurrency market has been the victim of harsh diktat of the central banks, regional governments and state regulators. The apparent plans of the central banks to launch their own digital currency have kept the crypto investors on the edge.

With the occurrence of a bunch of mini corrections in the prices of bitcoin and other cryptocurrencies, bitcoin stands with a marginal gain of 10-30 per cent barring the recent one-month surge in the prices. Between early-2018 and late-2019, bitcoin prices largely stalled around levels below $15,000 following which the experts believed that the cryptocurrency framework was stabilising with the external market forces.

Also Read | Bitcoin At an All-Time High Outperforming All Asset Classes, Why are investors Gung-ho?

Bitcoin 2-year performance

(Source: Refinitiv, Thomson Reuters)

Bitcoin’s recent journey

In the last quarter of 2017, bitcoin and other major cryptocurrencies saw a major spike in the prices for the first time since the crypto trading began. In the six-month stretch from October 2017 to March 2018, Bitcoin posted a phenomenal four-figure return from a considerable level.

Following the unforeseen spike in the prices of cryptocurrencies in that period, bitcoin mounted the then all-time high over $19,000. In November 2020, Bitcoin breached the previous record hitting a lifetime peak of $19,834.93 on 30 November. But now, bitcoin has been flirting with the $24,000 level after the crypto asset broke the level of $20,000.

The recent rally in the bitcoin prices has again created a divided forum with some investors anticipating a continued bull run in the near future, whereas few experts are predicting that the crypto assets can witness yet another collapse.

Bitcoin 5-year performance

(Source: Refinitiv, Thomson Reuters)