US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 59.87 points or 1.37 per cent higher at 4,423.42, Dow Jones Industrial Average Index surged by 503.53 points or 1.46 per cent higher at 34,920.52, and the technology benchmark index Nasdaq Composite traded higher at 14,732.80, up by 230.90 points or 1.59 per cent against the previous day close (at the time of writing – 11:45 AM ET).

US Market News: The major indices of Wall Street traded in a green zone boosted by the US debt-ceiling deal. Among the gaining stocks, Levi Strauss & Co (LEVI) shares surged by around 8.98% after the Company’s adjusted quarterly earnings remained more than the consensus estimates. Tilray (TLRY) shares went up by around 3.82%, even after the cannabis producer’s quarterly revenue fell short of the consensus estimates. Costco Wholesale Corp (COST) shares rose by around 1.64% after the Company’s comparable sales growth during September 2021 remained slightly higher than the prior-month levels. Among the declining stocks, Citrix Systems (CTXS) shares dropped by around 0.34% after its CEO stepped down.

UK Market News: The London markets traded in a green zone after a record monthly surge in the UK house price. With reference to the recently available data from Halifax, the UK house price rose by around 1.7% during September 2021 when compared with August 2021.

Royal Dutch Shell shares rose by about 1.63%, even after expecting an adverse impact of around USD 400 million on Adjusted Earnings and cash flow from operations in Q3 because of Hurricane Ida.

Top Global Cues to know before the Opening Bell

Carnival shares went up by around 0.96% after the Company announced the restart of some cruises in the US in January and February.

Motorpoint Group had anticipated first-half revenue to show a solid growth of around 57%, boosted by continued strong consumer demand for used vehicles. Furthermore, the shares grew by around 1.21%.

FTSE 100 listed Mondi shares grew by around 1.62% after the Company released a trading update mentioning a robust growth of 27% in the third-quarter underlying EBITDA.

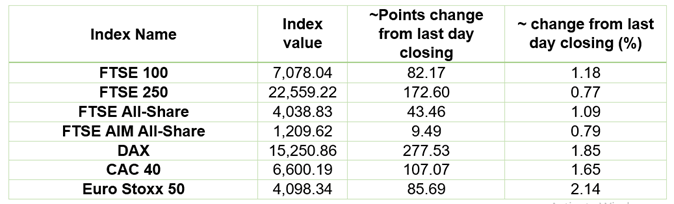

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as of 07 October 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 sectors traded in green*: Basic Materials (2.98%), Financials (1.76%), Real Estate (1.63%).

Top sector traded in red*: Utilities (-0.20%).

Top 3 gainers on FTSE All-Share index*: JTC PLC (8.36%), Luceco PLC (8.33%), Pendragon PLC (8.00%).

Top 3 losers on FTSE All-Share index*: UP Global Sourcing Holdings PLC (-5.74%), IP Group PLC (-4.96%), Marks & Spencer Group PLC (-4.68%).

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $81.88/barrel and $78.25/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,755.95 per ounce, down by 0.33% against the prior day closing.

Currency Rates*: GBP to USD: 1.3616; EUR to USD: 1.1554.

Bond Yields*: US 10-Year Treasury yield: 1.569%; UK 10-Year Government Bond yield: 1.0775%.

*At the time of writing