Summary

- Shares of Carnival Plc advanced as much as 14.43 per cent to an intraday peak of GBX 1,237 on Monday

- The company has issued 94.5 million shares of Carnival Corporation common stock

- With the successive stock offerings, Carnival Corporation is seemingly building a warchest

London Stock Exchange-listed shares of Carnival Plc (LON:CCL), the subsidiary of the Miami-headquartered Carnival Corporation & Plc, jumped more than 14 per cent in the mid-afternoon deals on Monday after the cruise operator completed common stock offerings. Carnival Corporation has completed the sale of 94.5 million equity shares of the common stock of the enterprise under its $1.5 billion offering announced last week.

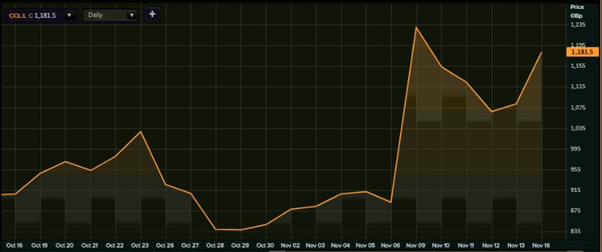

Carnival share price performance

Shares of Carnival Plc advanced as much as 14.43 per cent to intraday peak of GBX 1,237 on Monday from the previous closing share price of GBX 1,081 as on 13 November. With the recent surge in the share prices, the stock of Carnival Plc has recovered almost all the losses suffered in last week after rocketing nearly 38 per cent on 9 November. Following a profit booking on the counters after a sharp spike, the stock of Carnival Plc lost 12 per cent in the last four trading sessions.

Carnival Plc (1-month performance)

In the previous week, the stock of the parent firm Carnival Corporation & Plc (NYSE:CCL) registered a gain of approximately 16 per cent after soaring more than 39 per cent on 9 November following the news of the resumption of cruise services. Earlier last week, the US Centers for Disease Control and Prevention (CDC) allowed the cruise services operators to restart their respective services mandating a strict set of guidelines.

Carnival Corporation & Plc (1-month performance)

(Source: Thomson Reuters)

Common stock offering

The company has issued 94.5 million shares of Carnival Corporation common stock in addition to the issuance of 67.1 million shares under the $1 billion at-the-market (ATM) sale programme concluded on 30 October. According to the cruise operator, the total proceeds realised from these common stock offerings are set to be utilised for generic corporate purposes.

Carnival Cruise has employed Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC as the sales agents for its latest ATM common stock offering, while PJT Partners acted as an independent financial advisor.

Fundraising in Covid-19 environment

With the dead business activity due to the aftereffects of the pandemic, almost all the enterprises have been facing a scarcity of readily available funds that can be deployed to sustain the businesses in these tough times. With the successive common stock offerings in the last four weeks, Carnival Carnival Corporation is seemingly building a warchest as the cruise operators are about to start their operations upon the successful completion of trial runs.

The cruise operators are mandated to follow certain guidelines before commencing their commercial operations that include setting up a mini-lab within the ship and maintaining an adequately equipped first-aid centre with all the possible medications that can help in fighting the coronavirus.

Besides, the cruise operators are required to have designated free spaces that can be utilised for quarantining individuals who have tested positive for Covid-19 SARS-CoV virus after boarding the cruise.