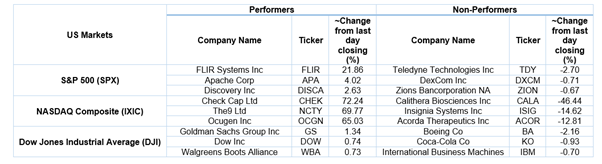

US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 79.69 points or 2.12 per cent lower at 3,676.38, Dow Jones Industrial Average Index plunged by 615.78 points or 2.01 per cent lower at 29,990.70, and the technology benchmark index Nasdaq Composite traded lower at 12,618.10, down by 270.18 points or 2.10 per cent against the previous day close (at the time of writing, before the US market close at 1:00 PM ET).

US Market News: The major indices of Wall Street traded in the red territory as investors’ will wait over the Georgia runoff elections result with riding high on the Covid-19 vaccine rollout and US stimulus package. Among the gaining stocks, Magellan Health grew by about 12.02% after Centene agreed to buy the healthcare company for US$2.2 billion. AstraZeneca gained about 2.10% after the UK started rolling out of its Covid-19 vaccine. Shares of Tesla went up by around 1.96% after the company reported a record delivery of its electric vehicles during the last three months of 2020. Among the declining stocks, Herbalife Nutrition shares fell by about 2.60% after investor Carl Icahn sold more than 50% of its stake to the company. Shares of Teledyne Technologies went down by 0.76% after the company agreed to acquire Flir Systems at around US$8 billion.

US Stocks Performance*

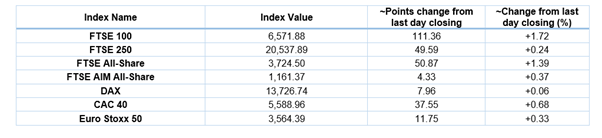

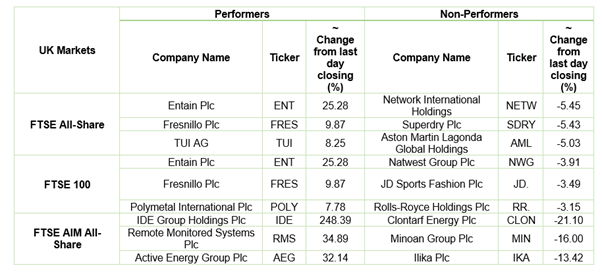

European News: The London and European markets started the new year on an optimistic note reflecting strong investor confidence over Covid-19 vaccine rollout and Brexit deal news. The UK manufacturing PMI had hit 37-months high to 57.5 in December 2020, more than the forecasted figure of 57.3. Among the gaining stocks, Shares of Entain went up by 29.47% after the company had received the MGM takeover offer of £8 billion. Shares of Tiziana Life Sciences surged by 11.48% after the company announced the completion of Foralumab clinical trials for the treatment of Covid-19 related patients in Brazil. Shares of Fresnillo grew by 9.03% due to an increase in gold prices. Among the decliners, Rolls-Royce was plunged by about 3.19% after the company put a halt on the UltraFan engine programme. Hipgnosis Songs Fund was declined by about 0.41% after the company announced an acquisition of a music catalogue. Shares of Natwest Group had dropped the most on the FTSE-100 index.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 4 January 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Basic Materials (+5.24%), Utilities (+2.13%) and Industrials (+2.00%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $51.14/barrel and $47.72/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,945.70 per ounce, up by 2.67% against the prior day closing.

Currency Rates*: GBP to USD: 1.3561; EUR to GBP: 0.9032.

Bond Yields*: US 10-Year Treasury yield: 0.912%; UK 10-Year Government Bond yield: 0.168%.

*At the time of writing

.jpg)