As economic activities are set to reopen from the shutdown, the market sentiments are upbeat. Consequently, British and the European markets looked bullish today (before the close on 1st June 2020), and some of the significant triggers were as follows:

- The US initiated the process of ending special treatment for Hong Kong; however, the US President Trump did not mention over China phase 1 trade deal.

- As per IHS Markit, the Britain’s Manufacturing Purchasing Managers’ Index rose to 40.7 in May from 32.6 in April.

- World stocks hovered near 3-month high as optimism over economic reopening bolstered risk appetite.

Today, we are going to discuss two industrial stocks operating in the ‘Construction & Material’ sector - Forterra PLC (LON:FORT) and Balfour Beatty PLC (LON:BBY). It is mindful to note that Britain’s construction sector tumbled to a record low in April due to sites closure during the pandemic. The output of construction sector in the UK contributes nearly 7 per cent of GDP and over £110 billion per annum. However, the reopening of sites with lockdown easing has considerably improved the trading performance of the sector. As on 1st June 2020 (before the market close at 2.30 PM GMT), FORT gained around 0.62 per cent, whereas BBY was up by around 0.24 per cent. For better understanding regarding the share price movement, we will skim through their respective financial and operational position to gauge upon the Company prospects.

Forterra PLC (LON:FORT) – Resilient Performer Against a Challenging Market Backdrop

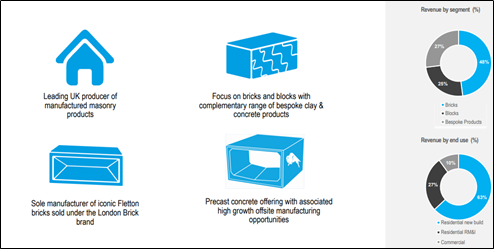

Founded in the 1960s, Forterra PLC is a manufacturer of building and masonry products, which is focused on the United Kingdom market. Operationally, the Group bifurcates its revenue into two segments – Bricks, Blocks and Bespoke Products. Previously, it was operating as Hanson’s UK building products division, and in 2015, it was rebranded under the name Forterra. Presently, it has 18 manufacturing sites and employs a workforce of 1,900 people. The Company is a constituent of FTSE 250 index of the London Stock Exchange.

(Source: Presentation, Company Website)

Recent Major Regulatory Developments

- 28th April 2020: The Group announced the recommencement of business operations, which were shut since 24th March 2020.

- 24th March 2020: Pursuant to the Government guidance regarding COVID-19, the Group suspended its operations. Further, the Company reported access of £150 million in revolving credit facility and around £70 million in cash reserves. To manage the financial impact, the Group decided to adopt cash preservatives, cash reduction programme while decided to suspend dividend for the financial year 2019.

Financial Highlights – Progressing Well During the Pandemic

Overall results reflected a robust revenue increase from Bespoke Products, albeit at the lower margin; revenue increase from Bricks and Blocks despite slightly reduced sales volumes; construction of new Desford brick factory progressing well; resilient performance against a challenging market backdrop; robust balance sheet. Additional Highlights are stated below:

- Despite the economic headwinds, the Group delivered a 3.4 per cent increase in revenue to GBP 380.0 million (2018: GBP 367.5 million). Profit before tax (before exceptional items) reduced to GBP 62.5 million (2018: GBP 64.8 million).

- Earnings per share (EPS) (before exceptional items) stood at 25.6 pence which is 3.4 per cent lower than in 2018. Basic EPS after accounting for exceptional items was stated at 23.8 pence, a decline of 10.2 per cent in 2018.

- The Group has a strong balance sheet, with net debt of GBP 43.2 million as compared to a previous year of GBP 38.8 million. This increase was reflecting the commencement of spend on the new Desford facility.

- Capital expenditure was reported at GBP 24.3 million with GBP 14.4 million of this related to strategic projects being the Desford expansion and the project to upgrade the Newbury aircrete facility to utilise conditioned ash.

Share Price Performance Analysis

(Source: Refinitiv, Thomson Reuters) - Daily Chart as of June 1st, 2020, before the market close

FORT’s shares were trading at GBX 196.80 on 1st June 2020 (before the market close at 2:32 PM GMT+1). Stock's 52 weeks High is GBX 376.00 and Low is GBX 157.40. Total outstanding M-Cap. (market capitalization) stood at approximately GBP 390.86 million.

Outlook

The Company stays optimistic that demand will recover through the year, although this may take some time given an extremely wet winter. The management continues to expect the challenging market conditions experienced in H2 FY19 to gradually improve but expects that the Company’s performance in H1 FY20 will be below that achieved in H1 FY19. Considering the uncertainties caused by Covid-19 restrictions, the group has taken several measures to reduce cost and preserve liquidity such as capital expenditure cut and final dividend suspension. However, the group has entered 2020 with a strong balance sheet, and the group is confident about its sustainable position in the medium to long term prospects.

Balfour Beatty PLC (LON:BBY) - Well-Positioned in Challenging and Uncertain Times

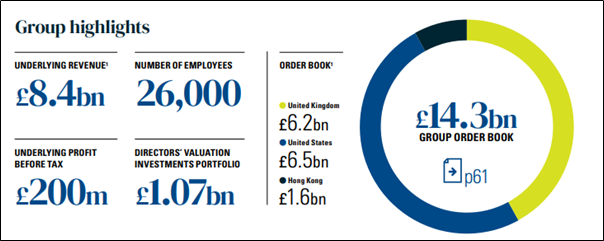

Balfour Beatty PLC is a FTSE 250 listed infrastructure Company. The Company bifurcates its business into three divisions – Construction services, Support services and Infrastructure. Its construction division provides services related to ground engineering, civil engineering, building, rail engineering, mechanical and electrical installation services. Its support services division manages gas, water, and electricity network. The infrastructure business finances and develops private and public infrastructure projects. Its primary geographies are the UK, US, and Hong Kong and it employs around 26,000 people worldwide.

(Source: Annual Report, Company Website)

Recent Significant Developments of 2020

- 1st June 2020: The Company unveiled a notice to cancel its convertible redeemable preference shares of 1 penny each. Further, the Group cancelled its 2019 dividend disbursement.

- 1st June 2020: The Group reported that 83 per cent of its sites were operational in May. Further, as of 27th May 2020, the Company reported decent liquidity with £452 million in net cash and £375 million in the undrawn facility.

Trading Update – Prudently Decided to Cancel the 2019 Final Dividend, Due to COVID-19 Pandemic

On 1st June 2020, the Company provided the update on current trading. Balfour Beatty continues to benefit from the robust financial position that it has built up over the last 5 years. The Group cancelled its 2019 final dividend. Additional Highlights are as follows:

- On 30th April 2020, the Group’s order book increased by more than 20 per cent to £17.4 billion as compared with the prior year-end position (2019: £14.3 billion).

- The Company will proceed with its repurchase of the £112 million worth of preference shares, that fall due on July 1, 2020.

- Balfour Beatty had a robust first quarter of 2020, building on the positive momentum from 2019. Thereafter the subsequent government-enforced lockdown and the Coronavirus pandemic had an impact on the financial performance of 2020 across all divisions.

- In the Construction division, most projects remained operational. In April 2020, 78 per cent of its sites were open across the US and UK. In May, while 83 per cent of sites were open and 17 per cent were closed, of those open 17 per cent experienced substantial disruption, driven by the availability of employees, subcontractors or materials.

- The most affected areas in the UK have been Scotland and London in Construction unit, while Washington State and Florida were the most affected areas in the US.

- In Support Services division, the Company has been negatively impacted by the COVID-19; many of the BBY’s employees were designated as key workers and has shown good resilience with limited closure.

- On 27th May 2020, the Group had £375 million of undrawn facilities and £452 million of net cash. For the first four months of the year, the average net cash stood at £464 million (2019: £325 million).

Share Price Performance Analysis

(Source: Refinitiv, Thomson Reuters) - Daily Chart as of June 1st, 2020, before the market close

BBY’s shares were trading at GBX 248.20 on 1st June 2020 (before the market close at 2:35 PM GMT+1). Stock's 52 weeks High is GBX 296.94 and Low is GBX 165.30. Total outstanding M-Cap. (market capitalization) stood at approximately GBP 1.73 billion.

Outlook

Further, the Board will review the group’s capital structure once there is a clearer understanding of the coronavirus (COVID-19) situation. While the crisis of COVID-19 continues to evolve, the company is monitoring developments closely, looking to mitigate the risk that it might have on the employees, clients and supply chain. Balford Beatty is a resilient organisation with a robust balance sheet and with a high-quality order book. BBY said its postponed AGM (annual general meeting) will now be held on 25th June 2020.