Source: katjen, Shutterstock

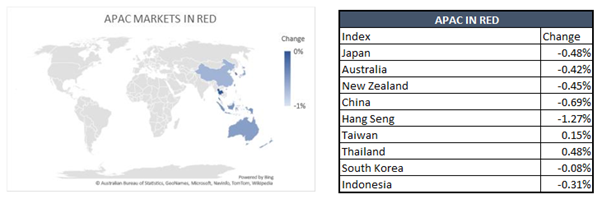

The shares across the Asia-Pacific (APAC) region are treading in red on Monday morning, as investors are trying to gauge whether the US earnings number justifies the sky-high valuations.

Source: Kalkine Research. Time: 12.50 PM AEST

At the time of filing this copy, all the APAC indices were in red, save the Thai and Taiwanese ones. The losses in the indices range from 41 basis points (bps) to 127 bps. Hong Kong’s Hang Sang index is the worst hit with a correction of 1.27%, while Bangkok’s SET Index has gained almost half a percentage, at 12:50 pm Australian time.

The Morgan Stanley Capital International’s (MSCI’s) APAC index was trading at 206.47, down half a percentage point – at little past noon in Australia.

Copyright © 2021 Kalkine Media Pty Ltd.

Experts suggest that the investors are being cautious and seeing how US earnings numbers justify the sky-high valuation that global equities are witnessing.

Investors were worried to see how shares in Alibaba Group Holding Ltd reacted after China slapped a CNY18 billion ($2.75 billion) fine on the e-commerce company. However, Alibaba’s shares, rallied by almost 7% after the move, due to positive commentary from global brokerage house Morgan Stanley.

Alibaba’s fine has a larger implication, as almost one-third of its shares are held by the US investors.

Read: Alibaba Fined A Record $2.75 Billion By Chinese Authorities

However, the biggest pain-point to global equities is likely to come from India, where the financial capital of Mumbai has yet again been ravaged by raging COVID pandemic. The futures of Indian benchmark Nifty that are traded in Singapore, SGX Nifty, have already crashed by 1.78%, almost half an hour before the Indian markets even open.