Summary

- The S&P 500 was down 0.03% to 3909.88, while the Dow Jones Industrial Average was up 0.20% to 31437.80. The NASDAQ Composite Index shed 0.25% to 13972.53.

- Apple, Cisco, Microsoft, Coca-Cola, and Sundial Growers, among top volume movers; General Motors reports net profit of $2.85 billion in Q4.

- Technology, healthcare, real estate, and financial sectors dominate the session.

Major US stock indices ended lower for the second day in a row on Wednesday as investors appeared to have extended their break after some turbocharged market sessions recently.

The S&P 500 was down 0.03% to 3909.88, while the Dow Jones Industrial Average was up 0.20% to 31437.80. The NASDAQ Composite Index shed 0.25% to 13972.53. The Russell 2000 dropped 0.72% to 2282.49.

Big sell-offs were absent during the session, even though large-cap stocks were in record territory. But markets may see more buying trends in the next few days, given the current bullish sentiment.

Investor sentiments were backed by positive earnings reports and government plans to rekindle the sluggish US economy. The Biden administration has already outlined a roadmap for spending.

Cisco Systems Inc. on Wednesday reported gross earnings of $12.0 billion and non-GAAP net income of $3.4 billion in the second quarter ending January 23, 2021. Twitter reported revenue growth of 28% to $1.29 billion and a net income of $222 million in Q4 of 2020 fiscal year.

Image Source: © Lessedesignen | Megapixl.com

The US’ largest automaker General Motors beat market expectations to post a robust fourth-quarter revenue of $37.52 billion, a 22% jump from the corresponding in 2019. Its net income swelled to $2.85 billion in the reporting period.

Technology, healthcare, and real estate sectors dominated the session on NASDAQ, while financials, consumer non-cyclical, and tech led the S&P 500. Dow Jones saw big gains for basic materials, energy, financials, as well as healthcare and consumer cyclicals. Sector-wise, the top losers were industrials, utilities, and academic & educational services.

Also read: Canadian Pot Stocks See A GameStop Moment, Tilray & Sundial Rallies

Top Gainers

Top performers on NASDAQ included Bio Path Holdings Inc. (145.38%), Anchiano Therapeutics Ltd (131.41%), Sundial Growers Inc (74.85%), and Torchlight Energy Resources Inc (74.38%). On S&P, Twitter Inc (9.72%), Under Armour Inc (7.96%), Tyler Technologies Inc (6.75%), and Enphase Energy Inc (5.38%) were the leaders. On Dow Jones, Walgreens Boots Alliance Inc (2.64%), Dow Inc (2.56%), American Express Co (1.43%), and UnitedHealth Group Inc (1.17%) were the top performers.

Top Losers

Top laggards on NASDAQ included Panbela Therapeutics Inc (-26.46%), Sino-Global Shipping America Ltd (-22.86%), and Comstock Holding Companies Inc (-21.72%), while on S&P, Akamai Technologies Inc (-11.63%), FMC Corp (-7.89%), Interpublic Group of Companies Inc (-5.78%), and HanesBrands Inc (-5.71%) were the top losers. On Dow Jones top laggards were Cisco Systems Inc (-4.14%), Boeing Co (-1.32%), Walmart Inc (-0.99%), and Travelers Companies Inc (-0.61%).

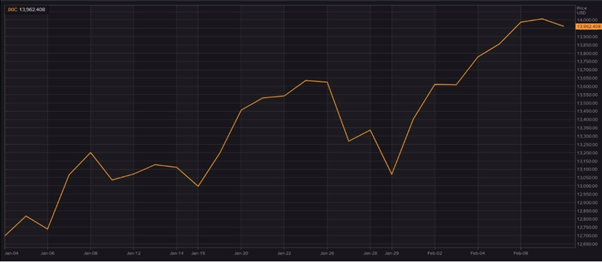

Image Source: Refinitiv, NASDAQ YTD price chart, 11 February 2021

Volume Movers

Some of the top volume movers included Apple Inc (8.73mn), Cisco Systems Inc (6.71mn), Microsoft Corp (4.48mn), Coca-Cola Co (2.54mn), Sundial Growers Inc (226.01mn), Tilray Inc (30.80mn), Naked Brand Group Ltd (27.65mn), Ford Motor Co (8.34mn), Tesla Inc (7.10mn), and Twitter Inc (6.84mn).

Futures & Commodities

Gold futures for April delivery was up 0.26% to 1842.20 per ounce, silver was down 1.31% to 27.050 per ounce, while copper was up 1.22% to 3.7662.

Brent oil futures for April delivery were up 0.08% to $61.27 and crude oil WTI futures for March delivery were up 0.27% to 58.52. Oil prices have seen an upward trend in recent days.

Bonds

The yield on the US 30-year Treasury bond was down 1.48% to 1.918. The yield on the 10-year US Treasury bond was down 2.39% to 1.129.

US Dollar Index Futures was up 0.01% to 91.427.

Also read: Elon Musk drops hints on the timing of Starlink IPO

Despite a positive market outlook, investor concerns remained on the overall pace of the economic recovery. Although lenders were sitting on heaps of cash, there were few takers, indicating the lukewarm confidence in the markets to go for capital outlays, at least in the short-term.

In another significant development, the Biden administration has indefinitely put the sale of TikTok, the US arm of the video-sharing company, on hold until a further probe into the spying controversy.

The Trump administration had ordered TikTok to shut down its operations and asked the American companies to take over the entity in a move to restrict dubious Chinese businesses from accessing the US market. Oracle and Walmart had expressed interest in the company.

.jpg)