Summary

- Jeff Bezos sold about US$2.5 billion in May

- The number of shares sold stands at 739,032

- He executed these sales through six different trades

- Shares of the company have corrected by 6% in May.

The world’s richest man, Jeff Bezos, has sold 739,032 shares of the company that he founded – Amazon Inc (NASDAQ:AMZN) – for US$2.49 billion.

Source: OpenInsider. Kalkine Graphics

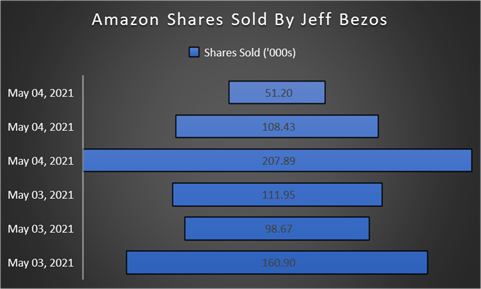

According to the filings with the US Securities and Exchange Commission compiled by OpenInsider, Mr Bezos executed these sales through six different trades this week – three deals on 3 May 2021 and three on 4 May 2021.

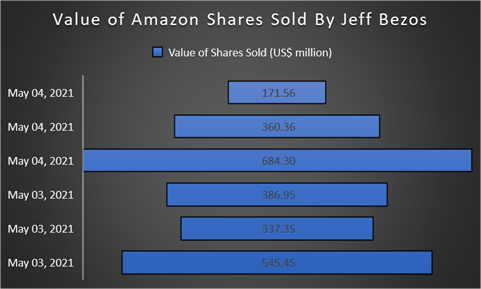

Mr Bezos sold US$1.27 billion worth of shares on Monday, followed by a sale of US$1.22 billion worth of shares on Tuesday.

Source: OpenInsider. Kalkine Graphics

The six-tranche stake sale was part of the prearranged 10b5-1 trading plan. Despite the sale, Mr Bezos still owns 52.5 million shares in Amazon, as on date.

The stake sale comes a week after Amazon reported the March quarter earnings results, outperforming market expectations as its business continues to benefit by the pandemic-fuelled e-tailing surge.

For the quarter ended March, the e-commerce major saw its revenues rise by 44% to US$108.5 billion. On the other, the company has reported more than three-fold jump in its net income -- to $8.1 billion from $2.5 billion a year ago period.

Bezos is currently the richest man on the planet – worth US$191 billion, according to the Bloomberg Billionaires Index. Bezos continues to retain the numero uno spot despite the fact that his wealth has grown the least during 2021, compared with other nine billionaires in the top 10 list.

Mr Bezos, in recent past, has stepped up his share sales at the company he founded in 1997. Earlier he had offloaded nearly US$4.1 billion worth of shares last February. He again sold over US$3 billion worth of the e-commerce company towards the end of 2020. He has also been selling lot of shares for his charity initiatives as well.

As there is a supply glut of shares of the company in market, the prices of its scrips have corrected by almost 6% in May and are currently trading at US$3,270.54 each in New York.