Summary

- SAP SE published its Q4 2020 and FY 2020 results, which exceeded its own expectations.

- The cloud revenue of the company saw an 8 per cent increase YoY in the fourth quarter.

Germany-headquartered multinational software company SAP SE (NYSE:SAP) released its results for the fourth quarter of FY 2020 along with the full year results on Friday, 29 January. The report highlighted that the company’s performance sequentially improved in Q4 despite the lingering Covid-19 crisis and frequent lockdowns and restrictions. Let’s take a look at the details of the results.

(Image Source: © Kalkine Group 2021)

Operational Updates

- 28 January: Successful IPO of Qualtrics takes place to look for an opportunity to expand the business. The company was valued at almost $18 billion, which closed 50 per cent higher on the first day of trading.

- 27 January: The software company launched its RISE with SAP initiative.

- 4 November 2020: The acquisition of Emarsys, a leading omnichannel customer engagement platform provider, was completed.

Financial Highlights

(Source: Company Website)

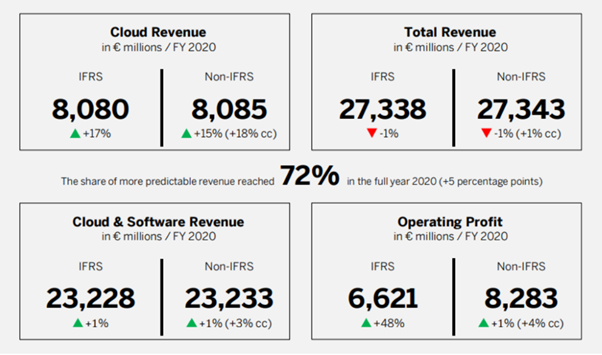

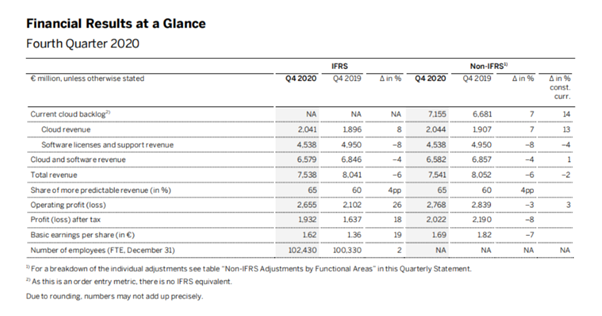

Cloud revenue: The fourth quarter witnessed 8% growth to €2.04 billion (IFRS) year-on-year (YoY), 7% to €2.04 billion (non-IFRS) and 13% (non-IFRS at constant currencies). For the overall year, there was a 17 per cent growth in cloud revenue Y-o-Y to €8.08 billion (IFRS), 15% to €8.09 billion (non-IFRS) and 18% to €8.24 billion (non-IFRS at constant currencies).

Transactional revenue: Transactional revenue, especially in the travel related Concur segment, continued to remain lower, negatively impacting the cloud growth by 2 percentage points in Q4 and by 4 percentage points for the entire year.

Software licenses revenue recorded a 15% decline to €1.70 billion Y-o-Y (IFRS and non-IFRS) and 11% (non-IFRS at constant currencies) in Q4 and was lower by 20% to €3.64 billion (IFRS and non-IFRS) and 17% (non-IFRS at constant currencies) in FY 2020.

Cloud and software revenue: The company posted a 4 per cent decline to €6.58 billion (IFRS and non-IFRS) and 1 per cent increase (non-IFRS at constant currencies) Y-o-Y in Q4. For FY 2020, the cloud and software revenue surged by 1 per cent to €23.23 billion (IFRS and non-IFRS) and by 3% to €23.72 billion (non-IFRS at constant currencies) Y-o-Y.

Total revenue: SAP reported a 6% downfall to €7.54 billion (IFRS and non-IFRS) and a 2% drop (non-IFRS at constant currencies) Y-o-Y in Q4. For the whole year, it was down 1% to €27.34 billion (IFRS and non-IFRS) and increased 1% to €27.90 billion (non-IFRS at constant currencies) Y-o-Y.

Cloud gross margin recorded 2.1 percentage points increase to 67.2 per cent (IFRS) and by 0.5 percentage points to 70 per cent (non-IFRS) Y-o-Y in Q4. The cloud gross margin for FY 2020 surged 3.1 percentage points to 66.5% (IFRS) and by 1.4 percentage points to 69.6 per cent (non-IFRS) YoY in FY 2020.

Low share-based compensation and restructuring charges had a positive impact on the IFRS operating profit and operating margin in both Q4 and FY 2020.

Operating profit: There was a 26 per cent increase in operating profit to €2.66 billion (IFRS), a 3 per cent decline to €2.77 billion (non-IFRS) and a 3 per cent surge (non-IFRS at constant currencies) Y-o-Y in Q4. At the same time, the operating profit for the whole year observed a 48 per cent increased to €6.62 billion (IFRS), 1 per cent rise to €8.28 billion (non-IFRS) and 4 per cent increase to €8.50 billion (non-IFRS at constant currencies) Y-o-Y.

Operating margin- The company’s operating margin increased by 9.1 percentage points to 35.2 per cent (IFRS), by 1.4 percentage points to 36.7 per cent (non-IFRS) and by 1.5 percentage points to 36.8 per cent (non-IFRS at constant currencies) YoY in Q4. For FY 2020, there was an 8.0 percentage points increase to 24.2 per cent (IFRS), 0.6 percentage points rise to 30.3 per cent (non-IFRS) and 0.8 percentage points upsurge to 30.5 per cent (non-IFRS at constant currencies) Y-o-Y for the full year.

EPS: SAP reported a 19 per cent surge to €1.62 (IFRS) and 7 per cent decline to €1.69 (non-IFRS) Y-o-Y in Q4. However, a strong contribution from Sapphire Ventures was reflected in the full year 2020 EPS, as there was a 56 per cent increase to €4.35 (IFRS) and a rise of 6 per cent to €5.41 (non-IFRS) YoY.

(Source: Company Website)

SAP’s Outlook for 2021

The company has also provided an outlook for the full-year 2021, reflecting SAP’s solid business momentum, assuming that the coronavirus crisis will be eradicated with a mass rollout of vaccine programmes worldwide.

- Non-IFRS cloud revenue in the range of €9.1-9.5 billion at constant currencies (2020: €8.09 billion) is expected, surging between 13 per cent and 18 per cent at constant currencies.

- The company estimates the non-IFRS cloud and software revenue to be between €23.3 to €23.8 billion at constant currencies (2020: €23.23 billion), increasing 2 per cent.

- Non-IFRS operating profit projected by SAP lies in the range of €7.8 to €8.2 billion at constant currencies (2020: €8.28 billion), being a 1-6 per cent decline at constant currencies.

- The company expects the operating cash flow to be approximately €6.0 billion (2020 €7.2 billion), following a record cash flow performance in 2020. This is primarily driven by adverse currency exchange movements, higher expected income tax payments, and moderately lower profit.

- Modest increase in capex has led to the company expecting the free cash flow to be above €4.5 billion (2020 €6.0 billion).