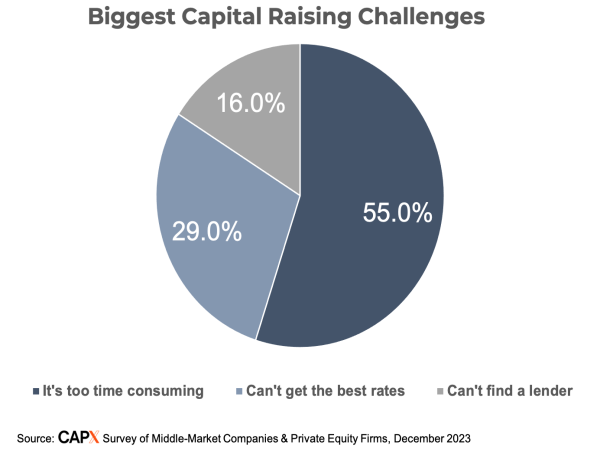

The survey results are compelling. US middle market companies and private equity firms – the growth engine of the US economy¹ - are struggling to get the capital they need in a timely manner. In fact, a resounding 55% of business leaders pointed out that the process of securing capital is too time consuming.

“Middle-Market companies and private equity firms are struggling to raise capital due to inefficient capital raising methods that are exacerbated by the current tight credit environment,” said Rocky Gor, capital markets industry veteran, Founder and CEO of CAPX. “Streamlined digital financing solutions like CAPX.io are needed to connect middle-market borrowers and lenders to accelerate capital and ensure continued growth and expansion of this critical segment of the US economy.”

CAPX Survey Finds Timely Access to Capital as #1 Challenge

Finding the right capital provider has always been crucial for middle-market companies and private equity (PE) firms. However, finding the right amount of capital with the most competitive structure can be quite time consuming. Add the economic uncertainties and tougher credit standards to the mix, and now you have a process that can overwhelm teams at any corporation or PE firm.

We validated this reality in a recent survey conducted with middle market corporations and PE firms. We asked participants to identify key pain points in the process of finding capital. 55% of survey respondents pointed out that the process of securing capital is too time consuming.

When just finding capital takes up most of your time, you wouldn’t have the time to find multiple options and get the best terms. This was also confirmed in the results of the survey where 29% of respondents mentioned that they cannot find the best rates.

CAPX Survey Takeaways:

• All types of corporate borrowers are struggling to find the capital they need when they need it, which could negatively impact both company and national growth

• The biggest challenge is how long it takes to obtain capital in the current credit environment

• PE firms said their biggest issue was finding a lender

• M&A deal makers were overwhelmed by delays in securing debt financing

• Overall, the survey highlighted the need for US corporate borrowers to diversify their lending options and seek ways to accelerate financing

Full Survey Results: https://www.capx.io/insight/survey-results-borrower-challenges

Reference 1- https://www.middlemarketcenter.org/middle-market-indicators-perspective

About CAPX

CAPX is the intelligent corporate financing platform that instantly connects borrowers with banks and alternative lenders across the US and Canada for loans of $5MM-$500MM+. CAPX streamlines and automates the entire corporate financing process to help both sides connect and collaborate with each other to close deals faster and more efficiently than ever before.

With CAPX, your financial information is always confidential and secure. Plus, there are no risks or upfront costs to either borrowers or lenders. Visit capx.io to learn more.

Additional Resources

● Follow CAPX on LinkedIn: https://www.linkedin.com/company/capital-expedited

● Both lenders and borrowers interested in providing or obtaining $5MM+ loans are invited to schedule a free 30-minute consultation to discuss joining CAPX with Founder, Rocky Gor, and see a platform demo.

Vicki Morris

CAPX

[email protected]

Visit us on social media:

Twitter

LinkedIn