Blue hydrogen is produced from natural gas through a process called steam methane reforming (SMR) or autothermal reforming (ATR), where carbon emissions are captured and stored (CCS). This method offers a transitional solution towards a low-carbon economy, making blue hydrogen a key player in the global energy transition. As the world shifts towards cleaner energy sources, the demand for blue hydrogen is expected to rise significantly.

📍 Get Free Sample Report for Detailed Market Insights: https://www.marketresearchfuture.com/sample_request/11197

Current Trends

Several trends are shaping the blue hydrogen market:

Increasing Demand for Clean Energy: Governments and industries are seeking alternatives to fossil fuels, driving interest in hydrogen as a clean energy source.

Carbon Capture Technologies: Advancements in CCS technologies are enhancing the feasibility of blue hydrogen production.

Investment in Infrastructure: Growing investments in hydrogen infrastructure, including production facilities and distribution networks, are facilitating market growth.

Market Drivers

The growth of the blue hydrogen market is influenced by various factors:

Regulatory Support

Governments worldwide are implementing policies and incentives to reduce carbon emissions, promoting hydrogen as a cleaner alternative. Initiatives such as the European Union’s Hydrogen Strategy are encouraging investment in blue hydrogen production.

Industrial Applications

Blue hydrogen is increasingly being used in various industrial applications, including refining, ammonia production, and steel manufacturing. Its ability to replace fossil fuels in these processes is driving demand.

Energy Security

As countries seek to diversify their energy sources and reduce dependence on imported fossil fuels, blue hydrogen offers a domestic solution that can enhance energy security.

🛒 You can buy this market report at: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=11197

Key Companies

The blue hydrogen market features several prominent players:

Air Products and Chemicals, Inc.

Air Products is a leader in hydrogen production and has been actively investing in blue hydrogen projects, focusing on large-scale production and CCS technologies.

Shell

Shell is involved in multiple hydrogen projects, including blue hydrogen initiatives, and is committed to reducing its carbon footprint through innovative energy solutions.

Equinor

Equinor, a Norwegian energy company, is investing in blue hydrogen production as part of its strategy to transition to renewable energy while maintaining its oil and gas operations.

TotalEnergies

TotalEnergies is exploring blue hydrogen production as part of its broader commitment to sustainable energy, investing in projects that integrate hydrogen with renewable sources.

BP

BP is actively pursuing hydrogen initiatives, including blue hydrogen projects, as part of its strategy to transition to a low-carbon energy future.

Market Restraints

Despite its potential, the blue hydrogen market faces several challenges:

High Production Costs

The production of blue hydrogen can be expensive, particularly due to the costs associated with carbon capture and storage technologies. This can hinder its competitiveness against other hydrogen production methods, such as green hydrogen.

Infrastructure Development

The lack of existing infrastructure for hydrogen production, storage, and distribution poses a significant barrier to market growth. Significant investments are required to build the necessary infrastructure.

Environmental Concerns

While blue hydrogen is cleaner than traditional fossil fuels, concerns remain about methane emissions during natural gas extraction and production, which can offset some of its environmental benefits.

Market Segmentation Insights

The blue hydrogen market can be segmented in several ways:

By Production Method

Steam Methane Reforming (SMR): The most common method for producing blue hydrogen, where natural gas is reformed with steam.

Autothermal Reforming (ATR): A method that combines partial oxidation and steam reforming for hydrogen production.

By End-Use Industry

Refining: Blue hydrogen is used in petroleum refining processes.

Ammonia Production: A significant application for hydrogen in the production of fertilizers.

Steel Manufacturing: Hydrogen can replace coke in steel production, reducing carbon emissions.

By Geography

North America: A leading market due to abundant natural gas resources and increasing investments in hydrogen projects.

Europe: Rapidly growing market driven by regulatory support and initiatives to decarbonize industries.

Asia-Pacific: Emerging market with increasing interest in hydrogen as part of energy transition strategies.

To explore more market insights, visit us at: https://www.marketresearchfuture.com/reports/blue-hydrogen-market-11197

Future Scope

The blue hydrogen market is expected to see significant developments in the coming years:

Technological Advancements

Improvements in carbon capture and storage technologies will enhance the feasibility and cost-effectiveness of blue hydrogen production, making it more competitive.

Integration with Renewable Energy

The combination of blue hydrogen with renewable energy sources can create a more sustainable energy system, facilitating the transition towards a low-carbon economy.

Global Collaboration

International partnerships and collaborations will be crucial in advancing blue hydrogen technologies and infrastructure, promoting knowledge sharing and investment.

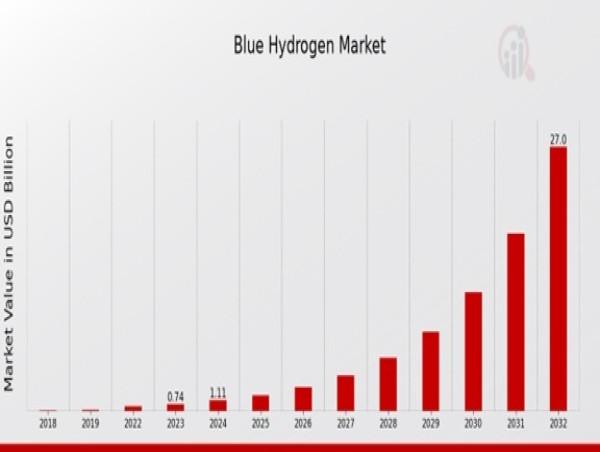

The blue hydrogen market presents a promising opportunity in the transition towards a more sustainable energy future. With increasing regulatory support, technological advancements, and growing industrial applications, blue hydrogen is poised to play a vital role in reducing carbon emissions and enhancing energy security. As the market evolves, addressing challenges related to production costs and infrastructure development will be essential for realizing its full potential.

More Related Reports from MRFR Library:

Pay Television Tv Market: https://www.marketresearchfuture.com/reports/pay-television-market-26106

Power Plant Epc Market: https://www.marketresearchfuture.com/reports/power-plant-epc-market-26088

Sodium Salt Battery Market: https://www.marketresearchfuture.com/reports/sodium-salt-battery-market-26094

Paper Recycling Market: https://www.marketresearchfuture.com/reports/paper-recycling-market-26101

Pelvic Floor Electric Stimulator Market: https://www.marketresearchfuture.com/reports/pelvic-floor-electric-stimulator-market-26108

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()