Summary

- FAAMG companies clocked a combined revenue of US$321 billion in March quarter.

- The combined revenues of the five companies grew by 41%.

- Apple led the growth story, with 54% surge in revenues.

In the week gone by, five biggest tech companies – Apple Inc (NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), Alphabet Inc (NASDAQ:GOOG), Amazon Inc (NASDAQ:AMZN) and Facebook Inc (NASDAQ:FB) – announced their quarterly results for the three months ended March 2021.

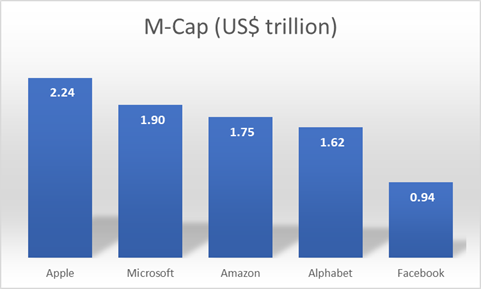

Referred to as FAAMG, each of these five firms, except the Facebook, are worth more than US$1 trillion – with the combined valuation of all five standing at a staggering US$8.4 trillion. If these five companies were an economy, it would be the world’s third largest economy after the US and China. To put things in perspective, the value of these five companies is almost equal to combined gross domestic product of world’s third and fourth largest economy – Japan and Germany.

Source: Kalkine Research. Data as on Thursday’s US Market Close

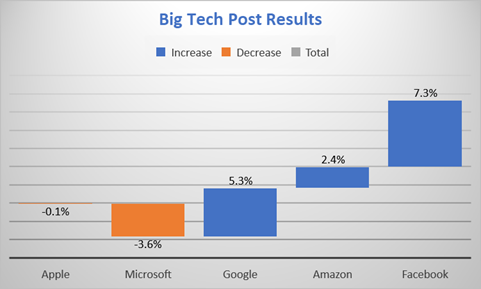

The stocks of these five companies reacted differently after the results – Microsoft was down by Thursday end, Apple was flat, and the other three were have a field day, trading in green.

Source: Kalkine Research. Data as on Thursday’s US Market Close

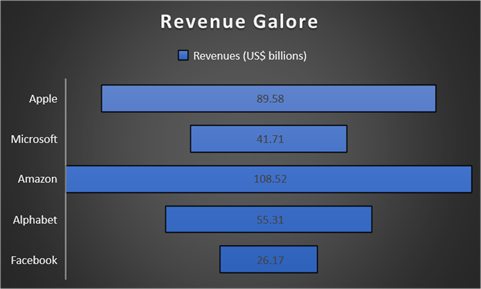

Despite the stock movements, the results of these five companies hold prime significance and are keenly watched across the globe. In the January-March 2021 quarter, these five companies reported a combined revenue of whopping US$321.3 billion – growing by a mind-boggling 41.1% on a year-on-year basis.

Source: Company Filings

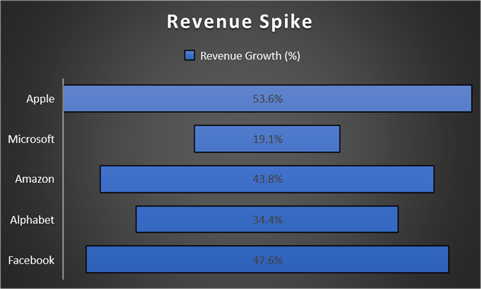

While the combined revenue grew by little over 40%, the individual company revenue growth has shown a lot of variation. On one hand, with just 19% revenue growth, Microsoft was a laggard. On the other hand, Apple led the growth story with 54% growth in topline, followed by Facebook (48%) and Amazon (44%).

Source: Kalkine Research

The revenue growth pattern of these companies aligns with the post-pandemic trends across the globe. More and more people have taken to Facebook and Instagram to share their thoughts. Also, more people are now buying from e-tailers rather than the brick-and-mortar outlets. So, that is where this variation in revenue growth is coming from.

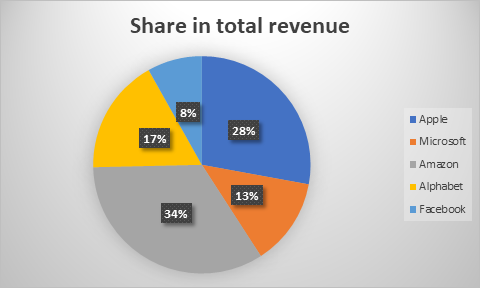

However, it is interesting to note that the market valuations of the companies do not reflect the share of these companies in the revenues of FAAMG. While Amazon is the leader, making one-third of the of US$321 billion-pie of revenue, it is a distant third after Apple and Microsoft in terms of valuation.

Source: Kalkine Research

The Big Tech seems to be getting bigger with the numbers, guidance and momentum of these five tech titans painting a brighter picture of their future.