The report provides a detailed analysis of the current autism spectrum disorder marketed drugs and late-stage pipeline drugs, advancements in treatment.

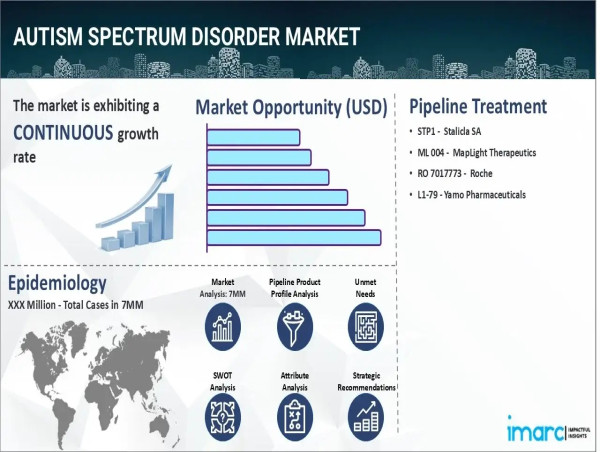

BROOKLYN, NY, UNITED STATES, June 16, 2025 /EINPresswire.com/ -- The autism spectrum disorder market size reached a value of USD 1,668.43 Million in 2024. Looking forward, IMARC Group expects the 7MM to reach USD 5,578.38 Million by 2035, exhibiting a growth rate (CAGR) of 11.8% during 2025-2035.

The Autism Spectrum Disorder market describes the worldwide field that creates and delivers diagnostic tools, treatments, therapy services, and assistive technology tailored for people on the spectrum. It includes everything from AI-assisted screening devices and behavior therapies such as Applied Behavior Analysis (ABA), to medications that ease co-occurring symptoms and digital apps that enable remote care and telehealth.

Trends Defining the Market in 2025

In 2025, early identification and cutting-edge tools lead industry trend lines. Machine-learning algorithms now power eye-tracking cameras and behavior dashboards, allowing clinicians to spot signs of ASD sooner and with greater accuracy. Meanwhile, deep-learning networks scan brain images for new neuroimaging markers that could sharpen diagnosis even further. Digital-health portals and teletherapy also widen access to proven interventions like ABA, serving families in both metropolitan centers and affluent communities.

Pharmaceutical innovation aimed at easing specific autism symptoms is picking up speed. Big companies like Pfizer, Novartis, Eli Lilly, and Roche now pursue drugs for repetitive behaviors and communication hurdles, a push backed by larger public research grants. Meanwhile, therapy blends with digital tools-AI-enhanced applied behavior analysis and virtual reality exercises-are starting to change how care is delivered. Outside hospitals, wider acceptance and new hiring programs for neurodiverse people are also driving demand for services. As more children are diagnosed because of broader criteria and heightened awareness, insurers and health systems have expanded support, covering assessments and various therapies.

Request a PDF Sample Report: https://www.imarcgroup.com/autism-spectrum-disorder-market/requestsample

Market Drivers Powering 2025 and Beyond

A key force today is the climbing number of autism spectrum disorder (ASD) diagnoses; better screening and public awareness drive the rise, not an actual surge in cases. More diagnoses mean more demand for tests, therapies, and support from both public health systems and private providers. In response, governments everywhere are adding funds and updating rules to expand early-intervention programs and boost spending at ASD clinics. At the same time, insurance mandates-in the U.S. and beyond-have broadened coverage for therapies such as applied behavior analysis (ABA), making care cheaper for families and spurring providers to grow.

Technology, too, keeps things moving. Artificial-intelligence tools now trim the time needed for screening and lift accuracy, while telehealth apps and home monitoring gadgets reach families in underserved regions. When these digital therapies are woven into a childs schedule, care stays consistent and can be customized from afar.

Money is pouring in as well. Private-equity houses back ABA clinics and diagnostic platforms, drawn by the evidence of rapid market potential. Many centers report compound annual growth rates above 50 percent and some even near 500 percent over three years. As revenues swell, large care networks are snapping up smaller players, merging services, talent, and territory to form national and regional systems.

The report also provides a detailed analysis of the current autism spectrum disorder marketed drugs and late-stage pipeline drugs.

In-Market Drugs

Drug Overview

Mechanism of Action

Regulatory Status

Clinical Trial Results

Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

Drug Overview

Mechanism of Action

Regulatory Status

Clinical Trial Results

Drug Uptake and Market Performance

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 Full 𝐑𝐞𝐩𝐨𝐫𝐭 𝐰𝐢𝐭𝐡 𝐓𝐎𝐂 – Autism Spectrum Disorder Therapeutics Market Epidemiology Report

Competitive Landscape

The competitive landscape of the autism spectrum disorder market has been studied in the report with the detailed profiles of the key players operating in the market.

Stalicla SA

MapLight Therapeutics

Roche

Yamo Pharmaceuticals

Analysis Covered Across Each Country

Historical, current, and future epidemiology scenario

Historical, current, and future performance of the autism spectrum disorder market

Historical, current, and future performance of various therapeutic categories in the market

Sales of various drugs across the autism spectrum disorder market

Reimbursement scenario in the market

In-market and pipeline drugs

Countries Covered

United States

Germany

France

United Kingdom

Italy

Spain

Japan

IMARC Group Offers Other Reports:

Female Infertility Market Epidemiology & Drug Pipeline Analysis

Erectile Dysfunction Drugs Market

Elena Anderson

IMARC Services Private Limited

+1 631-791-1145

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()