Highlights

- A fuel price hike seems to have virtually nullified the excise cut offered by the government, pushing motorists into peril.

- Many states have observed a larger spike in fuel prices than others due to the varying underlying costs of procuring petrol.

- Taxi drivers have seen an unusually larger number of cancellations and fewer benefits from surcharge fees.

Petrol prices have once again taken off, putting motorists under immense financial strain. Fuel prices have risen for a third consecutive week, virtually nullifying the impact of the excise cut. Global factors have once again overpowered the domestic fuel price cut, resulting in a worrisome scenario all over again.

The current rise in petrol prices comes just days ahead of the federal election, challenging efforts taken by PM Morrison to help ease cost-of-living pressures. Given rising inflationary pressures and the recent interest rate hike, a bounce back to higher fuel prices is likely to hurt Morrison’s election campaign. However, factors leading up to the present scenario are largely beyond the control of the Australian government.

Will Rising Power Bills Impact Morrison Govt's Re-Election Bid?

The nature of the current spike in petrol prices is such that little can be done to control it on a domestic level. The heavy sanctioning on Russian oil exports is majorly the causal factor behind the observed fuel price hike. These international events have travelled throughout the globe, impacting Australian consumers in the process.

What are the petrol prices across Australia?

Petrol prices have risen throughout the country, though some regional areas are seeing the worst of it. The price of petrol at service stations usually gets impacted by several reasons, including the cost of transporting the fuel to the area. Since regional areas are relatively harder to access, the transportation costs attached to them are much higher than in main cities.

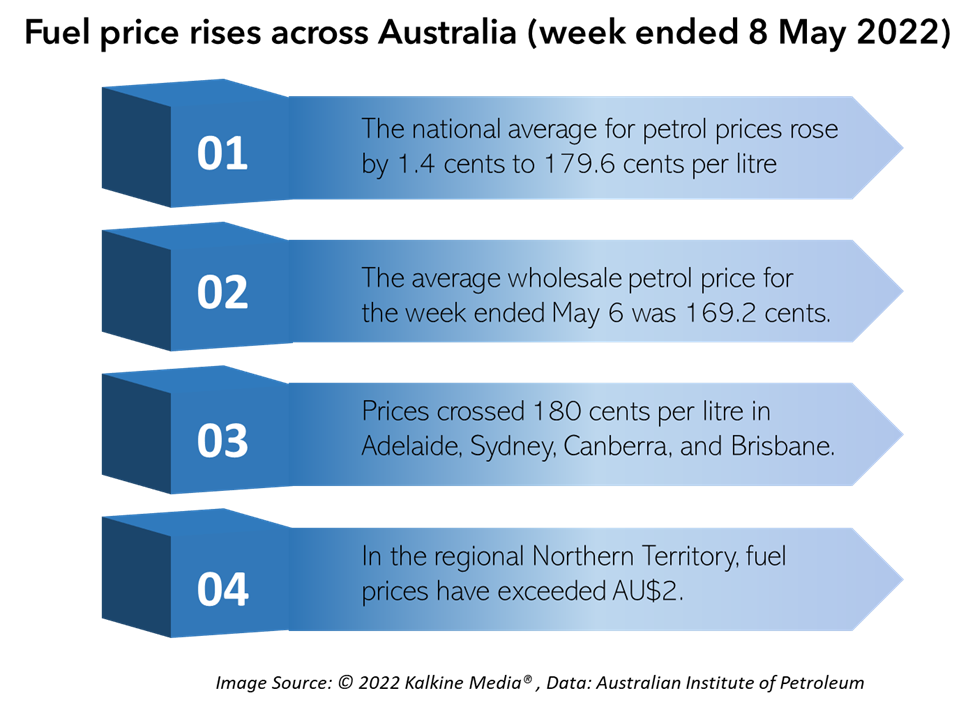

According to the Australian Institute of Petroleum, the national average for petrol prices rose by 1.4 cents to 179.6 cents per litre last week. However, in cities like Adelaide, Sydney, Canberra, and Brisbane, prices crossed 180 cents per litre during the week ended 8 May 2022. Additionally, in the regional Northern Territory, ongoing pressures have resulted in a petrol price exceeding AU$2. Unleaded petrol prices have risen in almost every city during May.

ALSO READ: Why Australian bond yields are scaling new heights

Unlike the United States, each state in Australia faces the same amount of fuel tax. However, the observed disparity is a result of differences in transportation, storage, and handling costs among these states. The distribution and marketing costs in Australia are very diverse across states due to the large geographic area that must be covered to transport fuel to all parts of the country. Thus, areas located far away from refineries and fuel terminals face the highest set of fuel prices.

Who is worst affected by fuel price hike?

Taxi services are highly sensitive to fuel price changes as even small price hikes can temporarily hinder their business. Most taxi service providers factor rising fuel costs into their travel fees, resulting in fewer customers opting for that service.

Many popular taxi services have introduced a surcharge to help adjust to the recent spike. However, this surcharge has been of minimal help to drivers as they receive only a small portion of the additional charge. Additionally, there are more than usual cancellations in a month’s time, and drivers face rising costs of maintenance, insurance, taxes, and food.

ALSO READ: ANZ, NAB and CBA release key economic data; know more

Why are Aussies worried?

The recent interest rate hike by the Reserve Bank of Australia (RBA) has already tightened lending conditions for an average citizen. Borrowers are now looking at rising monthly repayments on their mortgage loans. Reasonably, this is the worst time for a surge in fuel prices.

Despite the RBA’s claims to curb inflationary pressures faced by Australians, consumer prices are all set to rise in the coming months as well. The Reserve Bank’s own forecast suggests that the inflation rate is expected to reach 6% by the end of this year.

Moreover, interest rates are most likely to be raised further, adding to the piling mortgage repayments by households. The situation might escalate once the fuel excise cut period ends and motorists are forced to encounter a sudden rise in fuel prices. The Morrison government had introduced a fuel excise cut, slashing it from 44.2 cents per litre to half. However, the cut will only last a period of six months, after which rising fuel prices could add to an average consumer’s woes.

DO NOT MISS: Morrison-Albanese debate: key takeaways for markets