Summary

- Confidence of small business entrepreneurs in Canada fell by 6 index points in October, to land at a five-month low of 53.3 on the CFIB Business Barometer Index.

- Hiring confidence saw a slight decrease with only 12 per cent planning to hire, and most keen on reducing full-time staff.

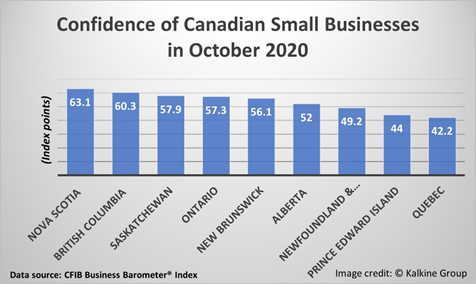

- Quebec reports the lowest business confidence at 42.2, while Nova Scotia was found to be upbeat at 63.1.

With a rapid resurgence in Covid-19 cases, business confidence of small business entrepreneurs in Canada fell by nearly 6 index points, to land at a five-month low of 53.3 on the Canadian Federation of Independent Business (CFIB)’s Business Barometer® Index in October.

Ted Mallett, CFIB’s chief economist, thinks rise in Covid-19 cases is the reason for anxiety and decline in optimism in the small business sector, noted a statement from CFIB on Thursday. Some regions seeing renewed restrictions on hospitality, transportation, and businesses in the personal services sector. Businesses have been operating at less than 71 per cent capacity in October, after having improved steadily during the months of summer and spring. There is no change reported since August.

Hiring confidence saw a slight decrease with only 12 per cent planning to hire and most Canadian businesses are keen on reducing full-time staffers in the next three months. Thirty-one per cent owners say their business in good shape, while 27 per cent say it is doing poorly. Quebec reports the lowest business confidence at 42.2, followed by Prince Edward Island at 44, and Newfoundland and Labrador at 49.2.

Entrepreneurs in Nova Scotia and British Columbia were found to be upbeat at 63.1 and 60.3, respectively. Saskatchewan at 57.9, Ontario at 57.3, New Brunswick at 56.1, and Alberta 52.0 were close to the national average. The index levels are clustered in the mid-to-high 50s in the remaining provinces. There is no significant change in hiring and wage outlook, capital spending plans and improvements in order books during these months.

The finance, insurance and real estate sector grew by 3.6 index points to 59.7, closely followed by professional and enterprises services sector and natural resources, which are up to 58.4 and 55.4, respectively. Transportation sector is worst hit by the second wave, falling 6.7 index points to 53, while health and education services fell by 8.1 index points to 60.5 and construction services dropped by 5.9 index points to 55.7 in October.

While there was rebound in economic activity and renewed business confidence after the first wave of coronavirus, the next wave has weakened efforts to see decline in optimistic business sentiments of SMBs.

The CFIB findings for October is based on collected responses from a random sample of 1,151 CFIB members to a web survey. This data reflects the responses during the period between October 5 to 19.

The data is used to create an index, with the highest possible number of 100 indicating businesses in better shape for recovery in the next one year. Those numbers closer to zero indicate that the businesses are doing poor and will continue to be in worst shape over the next 12-months. Recovery of these sectors worst hit by the pandemic will take more time.

The findings are statistically accurate to +/- 2.9 per cent 19 times in 20. The index is based on a 12-month forward expectation of business performance.