Summary

- One in seven small- and medium-sized businesses are likely to declare bankruptcy or shut down due to the pandemic, says Canadian Federation of Independent Business

- Federal government has rolled out Canada Emergency Business Account (CEBA) to help small business weather the downturn

- Business loans can be sought from banks, financial institutions and online and community lenders

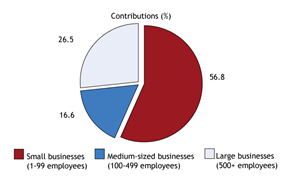

Canada is home to nearly 1.2 million business enterprises of which a whopping 1.18 million or 97.9 percent are small businesses, says Statistics Canada (December 2018 figures). Just 1.9 percent or 22,266 qualify as medium-sized businesses, while 3,010 or 0.2 percent are large businesses.

Any organization with less than 100 paid employees is defined as a small business, as per the Canada Revenue Agency (CRA). Businesses employing between 100 to 499 individuals qualify as medium businesses and any place with over 499 employees forms a large business.

Small businesses also employ 97.9 percent of the private sector workforce and are a critical part of the Canadian economy. Between 2012 and 2016, over 95,900 businesses were created every year while more than 90,000 disappeared, says federal statistics body StatsCan.

Employment Contributors in Private Sector by Business Size (2013-2018)

(Source: Statistics Canada, Labour Force Survey; and ISED calculations)

As markets shuttered following federal lockdown measures, the small businesses segment suffered the most. One in seven small- and medium-sized businesses are now at the risk of going under due to the pandemic crisis, says the Canadian Federation of Independent Business (CFIB).

In March 2020, Canadian business loans grew at the fastest pace in nearly 40 years (since 1981) as companies sought out credit to stay afloat during the coronavirus crisis, highlights a Bank of Canada report.

To safeguard financial needs of the small and medium businesses and save them, the federal government has rolled out the Canada Emergency Business Account (CEBA). Apart from the CEBA, these businesses can also borrow from banks, credit unions, online lenders and community loan funds.

Here is a brief look at the lenders and the credit programs:

- CEBA

The C$ 55-billion government-backed CEBA program offers C$ 40,000 loan that is interest-free until December 31, 2022. Of this, C$ 10,000 or up to 25 per cent of each loan will be forgiven if the remaining amount is paid on time. For those unable to repay by December 31, 2022, the loan can be converted into three-year term at 5 percent interest rate.

The program was launched on April 9 to support small businesses and not-for-profits by providing financing to safely navigate the shutdown period and relaunch when the economy reopens. CEBA will soon be adopted by over 230 financial institutions, including banks, across the country. To apply, borrowers need their T4SUM summary document and 15-digit business number from CRA or employer’s account number and bank account information. ?

- Canada Small Business Financing Program

Under this federal program, applicants can borrow a maximum of C$ 1,000,000 at an interest rate (variable or fixed) determined by the financial institution. Of the entire loan amount, a total of C$ 350,000 can be used to purchase leasehold improvements or improving leased property or purchasing /improving equipment. The loan cannot be used to fund working capital or inventory.

All small businesses and startups with gross annual revenues of $10 million or less and operating for profit in Canada are eligible for these small business loans. Not-for-profit, charitable and religious organizations and farming businesses are not eligible to apply for this program. For more details, visit here.

- Credit Unions

Credit unions are owned by private investors in not-for-profit status. Like banks, they offer savings accounts, credit and debit cards, ATM facilities and loans, etc. Credit unions offer competitive interest rates. However, to qualify for the loan, borrowers need to become the credit union members and have good credit scores, collateral, and strong business plans.

- Online Lenders

The number of online lenders and lending platforms have multiplied in the last few years. They offer competitive rates and terms that suit the small business ecosystem. They have easy approvals, no collateral requirements and a quick application turnaround time. Some of the online lenders are Loans Canada, OnDeck and SharpShooter Funding.

- Community Loan Funds

Several non-profit organization funds provide flexible, low-cost loans and investments to small business, especially to those that do not qualify for bank loans. These funds aim to help local business, especially small businesses owned by people of low-income group, women and minorities.

Requirements for Procuring Small Business Loans

Before applying for small business loans, the borrowers need to keep in mind the following facts:

- Collateral

Several banks and financial institutions offer loan capital only if backed by collateral such as real estate, vehicle and stocks. Lenders often conduct a loan-to-value analysis of the proposed collateral to make ensure there is no loan default.

- Credit Score

Two aspects come into play here:

- Personal credit score

- Business credit profile (credit score and credit history)

Both these details allow lenders to weigh the application through creditworthiness.

You can ask for your credit data from the Office of Human Affairs and business credit profile from business bureaus.

- Cash Flow and Financial Statements

Financial statements and cash flow projections are used to measure the business and the borrower’s ability to repay. Applicants need to justify the loan amount they seek via strong and valid business projections, including profitability. Financial institutes generally measure the cash expenditures against income to determine the cash flow and service debt.

- Business Plan

A detailed business plan, outlining projections such as cash flow, profit, product line and market size, can demonstrate the company’s sustainability. The plans also need to explain how the sought funds will be utilized.

- Documents

Other documents the borrowers need to provide include tax returns, income statements, T4SUM and insurance policies.