Summary

- Businesses expect sales and employment to return to pre-pandemic levels in next 12 months

- Canada’s consumer confidence indicators remained positive as the economy geared up to tackle its worst economic slump since the 1930s

- Key bourses will mirror the economic and market upswings as economy bounces back

Businesses across Canada expect sales and employment to return to pre-pandemic levels within the next 12 months as the country eases lockdown restrictions, the Bank of Canada said in its latest Business Outlook Survey (BOS). Despite the positive outlook, business sentiments across regions and sectors remained “negative”, falling to its lowest levels since the 2008-2009 recession.

The country’s central bank surveyed 119 businesses between mid-May and early June to gauge public sentiment during the pandemic.

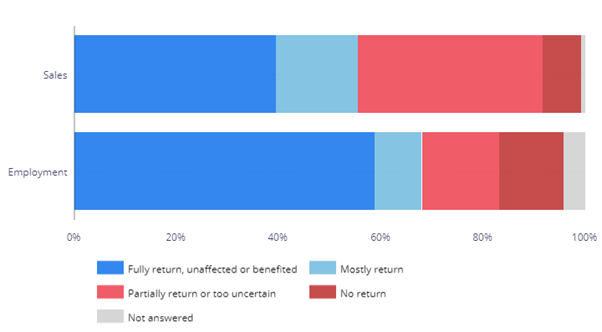

About 40 percent of the companies polled anticipate full recovery in sales by 2021. Most of the firms with a positive view produce “non-cyclical goods or services” or have long-term contracts.

Sales & Employment Outlook

Over 50 percent companies expect sales and employment levels to recover within a year (Image: Bank of Canada)

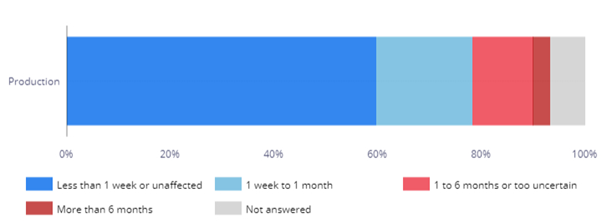

While production is expected to resume as soon as the economy reopens, businesses expect demand to remain weak. Service-sector firms are likely to see immediate resumption in full operations as the pandemic restrictions are eased but some expect a slower return due to “labour-related constraints”.

Resumption of full-scale operations/production

Over 50 percent companies expect sales and employment levels to recover within a year (Image: Bank of Canada)

Meanwhile, business sentiment plunged to a 12-year low as the Canadian economy braces for its deepest recession in the last quarter since the Great Depression of 1930s. The overall BOS indicator fell sharply to minus 7 in the second quarter of 2020. The BOS indicator had dropped to minus 8.25 in the fourth quarter of 2008.

Canadian Prime Minister Justin Trudeau is set to release a fiscal update that will provide a full deficit estimate required by the country to navigate the current economic slump and pandemic challenges. The country’s parliamentary budget office added that public coffers could end up shelling over C$ 98 billion to provide basic income to almost all Canadians from October 2020 to March 2021.

A Gradual Comeback

As Canada gears up to tackle its worst economic slump since the 1930s, a ray of hope simmered in the consumer confidence index.

Conference Board of Canada’s Index of Consumer Confidence, the nation’s consumer confidence indicator, went up by 16 points to 79.7 in June. Clocking its highest rating since March 2010, over 18 percent Canadians expressed hopes of better job prospects in the next six months.

The Bloomberg Nanos Canadian Confidence Index also reported a rise for the 10th straight week, recording a marginal 46.2 points high, from 46 a week before.

The uptick in Canadian consumer confidence is a likely indicator of future upswings on the bourses.

The S&P/TSX Composite (TSX) Index gained back 38.9 percent by June 30, after bottoming out on March 24. Similarly, the S&P/TSX Venture (TSXV) Composite Index also recovered by 79.5 percent after crashing in mid-March.

The TMX Group Ltd. (X), the parent company of TSX, TSXV, TSX Alpha Exchange and Montréal Exchange, outperformed its peers including Nasdaq Inc., the London Stock Exchange Group plc and Intercontinental Exchange Inc (owner of New York Stock Exchange).

The TMX Group stocks have registered 19.6 percent growth since January this year. In the same period, the Nasdaq Inc rose by 12.5 percent, London Stock Exchange Group plc by 9 percent while the Intercontinental Exchange Inc. is trading flat. The TMX Group also recorded a 51.7 percent jump since bottoming out on March 24, 2020.

TMX Group Limited stock performance from January 1 to July 7, 2020 (Source: TSX Exchange)

Let’s take a quick look at the some of the top performers of 2020:

Trillium Therapeutics (TSX:TRIL)

Market cap: C$ 0.85 billion

Stock price: C$ 10.25 (as on July 7, 2020)

Canadian clinical stage immuno-oncology company Trillium Therapeutics (TRIL) is among the best-performing stocks of 2020, locking a sweet 675.9 percent growth since January this year. TRILL’s scrips remained resilient to the onslaught of COVID-19. It registered a 52-week high of C$ 13.08 on June 22, 2020 and a 52-week low of C$ 0.31 on November 18, 2019.

The company is developing therapies for the treatment of cancer, using biologic and small molecule-based approach.

Real Matters (TSX:REAL)

Market cap: C$ 2.35 billion

Stock price: C$ 27.39 (as on July 7, 2020)

At a current market cap of C$ 2.35 billion, Real Matters (REAL) has witnessed a strong bull run with stocks surging over 122.3 percent since January. A network management services provider for the mortgage lending and insurance industries, Real Matter’s owes its impressive growth to an uptick in demand for its products and services. The scrips’ 52-week high stood at C$ 28.49 (on 2020-07-02) while 52-week low is C$ 7.58 (on 2019-07-09). It has a current P/E ratio of 47.80.

Conclusion

As businesses expect return to pre-COVID sale and employment levels within the next 12 months, Canadian indices is likely to mirror the economic and market upswings. Certain sectors will outperform while some will remain resilient, as the world adapts to the new normal.