Highlights

- The possibility of the US economy going into recession has hit international markets, including Australia.

- Inflationary pressures and rapid interest rate hikes can potentially cause a drop in consumer and investor sentiment.

- Australia remains relatively better off in terms of inflation, but it is imperative to be prepared for all possibilities.

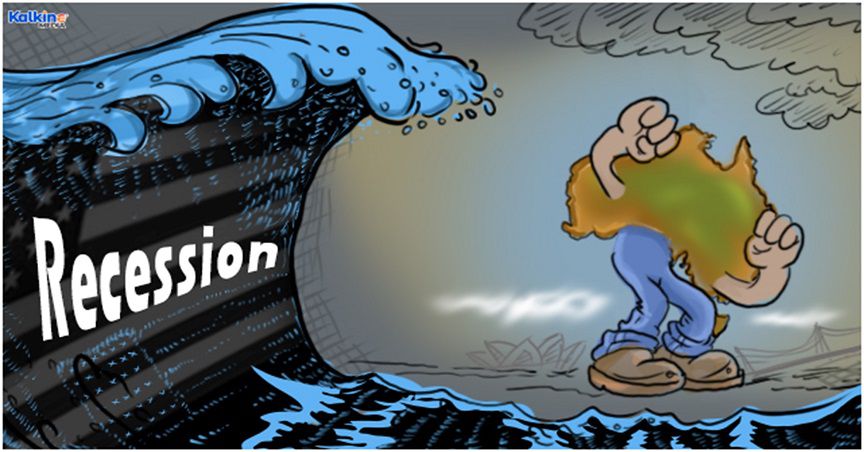

Fears of recession building in the US economy have emerged as a warning sign for the rest of the world. Australia is one of the major nations that is being affected by developments in the US. One can say that concerns of a recession in the US have travelled all the way to Australia, making the situation tougher for businesses and households.

However, Australia has generally escaped phases of high volatility and has remained relatively stable over the past many years. Even in the post-pandemic era, Australia’s inflation rate has been relatively lower than many other advanced economies. Thus, the country has remained fairly stable despite a range of global headwinds, as opposed to major economies, like the US.

Experts are hinting at Australia’s possibility of dodging the predicted recession yet another time. Even as the Russia-Ukraine war lingers on and creates uncertainty, Australia is expected to tap its domestic potential and elude this disaster.

Just as all great things come at a cost, it seems important for Australia to be well-prepared to ward off any possibility of a recession. Adjusting to a period of low economic activity and high prices would require robust policy action.

No end in sight for inflation

In the post-pandemic era, inflation is turning out as a nasty stain on a shirt that just refuses to go away. Central banks across the globe are on an interest rate tightening spree, which is doing little to curb the ongoing rise in prices. Essential items such as food and non-discretionary consumer goods have also become increasingly unaffordable for low-income households.

Thus, lifting the cash rate is yet to bring the desired results. The same applies to other nations across the globe, where rising prices have been a constant source of uncertainty. The remedy of raising interest rates has impacted economies in a different way than anticipated.

Concerns loom that higher interest rates could foster a decline in investment and spending. As households find it hard to manage finances alongside rising interest repayments, many people might be forced to cut down on other types of spending. At the same, business investment could go to a standstill with high interest rates. Thus, economists fear that a fall in consumer activity and slower investment could stall economic growth.

RELATED READ: Why sending parcels may cost Aussies more?

What can be done to combat recession?

The 2008 global financial crisis (GFC) can be considered a learning chapter for the current economic crisis. Most economies were able to develop a decisive strategy to combat slow consumer demand and high inflation through a mix of monetary and fiscal policy in the GFC. The same strategy was applied by most central banks during the pandemic, including the Reserve Bank of Australia and the US Fed.

What's Warren Buffet's Advice For The Recession?

Interest rate rises by the Fed deeply impact the global economy. Most Australian banks have large borrowings from American banks, which means that the US interest rates are applicable to these borrowings. As interest repayments of banks increase, they are forced to pass on this burden to consumers in the form of higher interest rates.

Meanwhile, other aspects of the US economy can also be credited for changes seen across other economies. Most importantly, the Australian stock market seems to be the first to react to the news of a possible recession hitting the US. The stock market has plunged following these reports, bringing down investor and consumer sentiment. This drop in consumer sentiment could impact savings, investments, and superannuation to some extent.

ALSO READ: Central banks double down in fight against 'galloping' inflation

Should Australia be afraid?

While some impact of US events is inevitable, the Australian market might remain largely stable even as recessionary fears crawl in. Australian households have maintained adequate savings to help them get through the current period of uncertainty.

On the policy front, Australia’s new Treasurer, Jim Chalmers, is well-versed in handling monetary policy during recessionary periods. His previous experience on the board during the 2008 crisis is expected to be exceptionally helpful in the present context.

Overall, Australia has many sources of strength, such as a tight labour market and rising minimum wages that provide a stable economic outlook. However, it seems best to be prepared for the worst possible scenario. Thus, the onus of bringing Australia safely out of a recession falls on the RBA and the newly elected government.

ALSO READ: Fair Work Commission’s minimum wages decision: Key takeaways