Summary

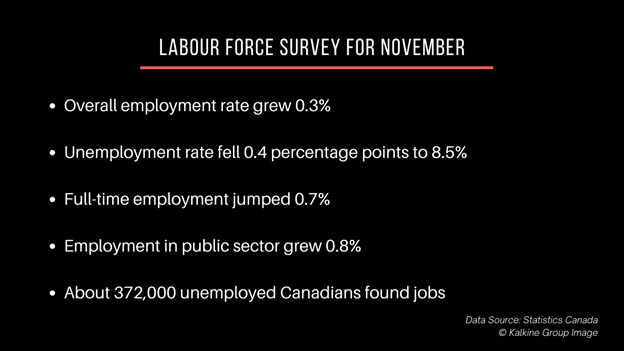

- Canada’s overall employment rate grew 0.3 per cent in November, reported StatCan.

- Since February, there has been a three per cent decline in employment.

- About 372,000 Canadians, who were jobless in October, found employment in November.

Following a growth of 2.7 per cent each month between May and September and that of 0.5 per cent in October, Canada saw its overall employment rate climb 0.3 per cent in November, found a recent report by Statistics Canada.

In the latest Labour Force Survey (LFS), which represents the state of the country’s labour market between November 8 and 14, unemployment rate had lowered by 0.4 percentage points from October at 8.5 per cent.

Canada’s job market suffered a fresh blow after a spike in COVID-19 infections saw many provinces reintroduce public health measures between September and November. As more businesses went under lockdown again, the little recovery that the employment rate was made since the onset of the pandemic, began to slump.

Canada’s Employment Growth Continues At Slow Pace

As a result of a second round of lockdown, jobs in industries that involve direct contact recorded a drop in employment, such as the accommodation and food services sectors. Industries that can afford to apply working-from-home or social distancing regimes, such as technology, continued to approach or cross their pre-COVID levels of employment.

In November, the number of Canadian workers impacted by COVID-related economic shutdown had dropped to 1 million from 5.5 million in April.

Since February, there has been a three per cent decline in employment in Canada.

Growth In Full-time Employment & Work-From-Home Hours

Full-time employment jumped by 99,000, or 0.7 per cent, in November month-on-month. Canadians with part-time jobs did not see much change in their numbers for the month.

About 4.6 million of workers who contributed at least half of their usual hours worked from home in the month of November. This was an increase of about 250,000 from October.

Employment Growth In Public Sector Vs Private Sector

Canada’s public sector registered a growth of about 0.8 per cent in its employment rate in November, exceeding its pre-pandemic levels from February by 1.5 per cent. This was a year-over-year increase of 1.6 per cent, which was fueled primarily by increasing numbers in hospitals and schools.

The private sector, meanwhile, did not record a notable change in its employment rate in November, although it was down 3.3 per cent year-over-year. The decline was largely driven by the drop in employment in the accommodation and food services industries.

The self-employment sector noted stunted growth in November while it recorded a 4.5 per cent year-over-year decline in employment rate.

Unemployment Rate Continues To Drop In November

From the record levels of 13.7 per cent in May, Canada’s unemployment rate continued its fall with a drop of 0.4 percentage points in November, standing at 8.5 per cent.

About 372,000 of Canadians who were jobless in October found employment in November, reported StatCan.

The number of employees on furlough or waiting to start a new job dropped by 78.9 per cent between April and November.

Since rocketing 36.1 per cent in April due to the pandemic, Canada’s labour underutilization rate has also dropped by 0.3 percentage point drop to 16.9 per cent in November.