Highlights

- After the recent interest rate hike by the RBA, the cash rate now stands at 0.35%.

- The RBA has announced an uptick in its inflation forecast as sources of inflation are expected to change.

- Rising wages due to labour market strengthening are likely to prompt higher inflation.

The Reserve Bank of Australia (RBA) recently raised the cash rate by 25 basis points to 0.35%. The rate hike marks one of the country’s first hikes in over a decade and has been placed to combat ongoing inflation. The upward pressure on inflation has resulted from a concoction of worrying global events. While it could not do much, the central bank has tried to curtail inflationary pressure to a certain degree.

With a limited spare capacity of essential commodities, countries are struggling with rising prices of food, energy, and various other commodities. Australia is no stranger to these challenges, as the rising cost-of-living pressures have reached a crisis-like stage, exacerbated by stagnated wages.

However, as the labour market gains strength from a sharp downturn in unemployment, wages could pick up in the coming months. Thus, high labour costs arising from a tighter labour market could compel the RBA to conduct even more aggressive monetary tightening. Essentially, this means more consistent and large rate hikes. The move could effectively reduce the momentum gained by the domestic economy through the monetary and fiscal stimulus.

INTERESTING READ: How much extra mortgage owners will be paying after rate hike?

A change in inflation forecasts

The Reserve Bank has reported a significant update in its inflation forecast under its latest statement on monetary policy. Given the recent update in the inflation forecast, experts are worried about the extent to which interest rates may rise to combat inflation.

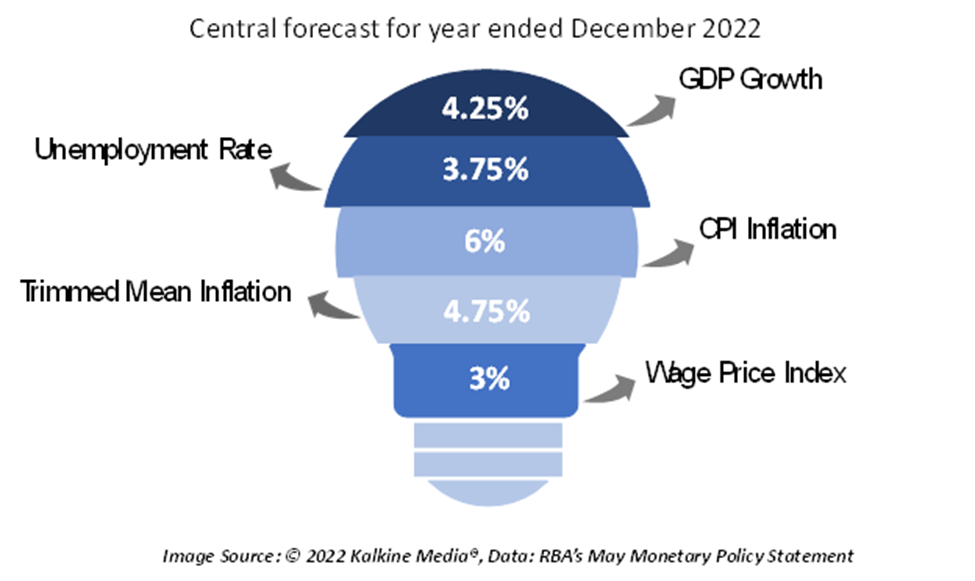

The RBA’s statement showed that underlying inflation could reach 4.75% by December. This forecast is higher by two percentage points than the previous forecast of 2.75%. Headline inflation is also expected to remain well above Trimmed mean inflation in the near term.

ABS Releases Fresh Data On International Trade

The RBA has also stated that there can be a shift in the sources of inflation over the forecast period. The cost-side pressures leading to a rise in consumer prices are expected to linger on for a longer duration than previously estimated. A rise in oil prices is likely to be the key reason behind other prices inching higher. Much of this can be accrued to the war in Ukraine and the lockdowns in China due to the resurgence of infections.

Based on these expectations, the Reserve Bank has carved out a potential path for interest rate hikes this year based on surveys of professional economists and financial market pricing. The cash rate is expected to reach 1.75% in the December 2022 quarter and 2.5% in the December 2023 quarter. This forecast is also based on the assumption that future COVID streams would only have a temporary impact and may not be as economically damaging.

RELATED READ: Explained: How Russian economy is holding on despite heavy sanctions

Australia’s economic outlook

The central bank has highlighted that the rising cost-of-living pressures could lead to workers demanding higher compensation from employers. This would effectively result in an uptick in wages, higher than previously estimated.

The central bank has stated that the revised forecast for wages growth is 3% by the end of 2022 and 3.75% by mid-2024. A rate of 3.75% would be the fastest in 12 years. A spur in wages growth is expected to feed into the ongoing inflation and foster an even sharper rise in consumer goods prices.

Firms are likely to use bonuses, allowances and other non-wage based measures to retain the existing workforce and attract others. With the expiration of multi-year enterprise agreements and private sector benchmarks flowing through to public sector wage policies, aggregate wages may increase with a lag.

However, average earnings are expected to increase faster than the wages growth forecast over the forecast period. This is based on the fact that there are scheduled increases in the Superannuation Guarantee along with hikes in bonus payments and overtime rates. Workers might also become more flexible to a shift in jobs and could switch more easily to higher-paying roles.

DO NOT MISS: How can RBA’s latest interest rate hike impact elections?