Highlights

- Policymakers and households are keeping a keen eye on economic data, especially in a high-interest rate environment.

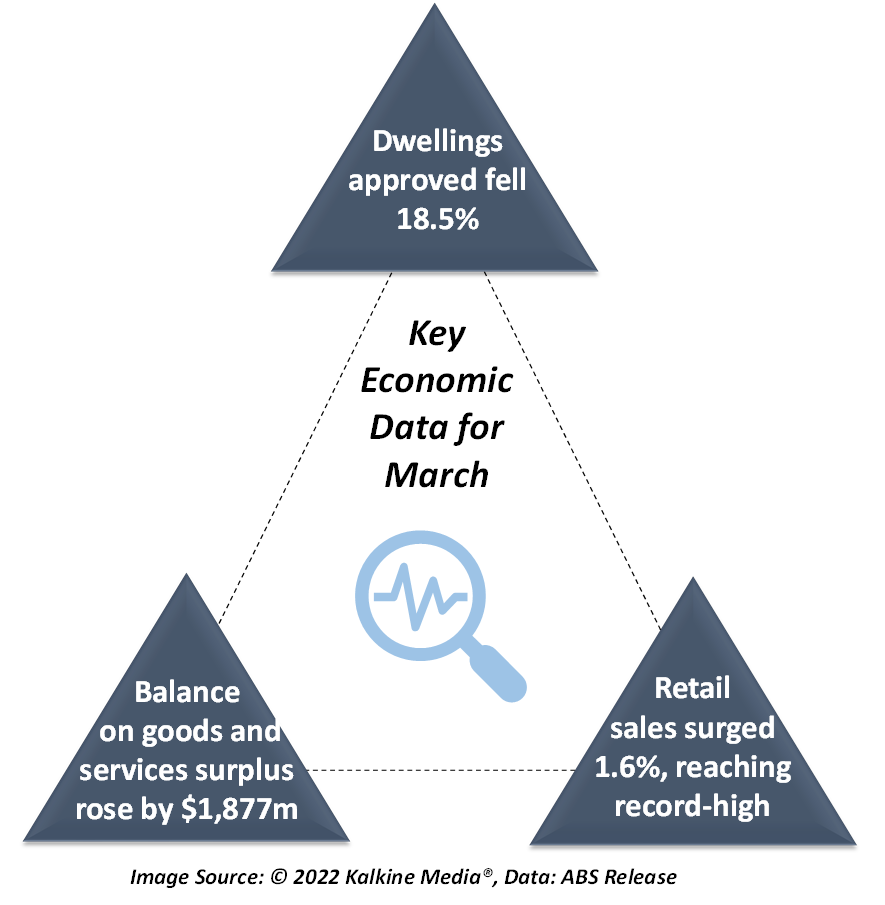

- ABS released the data for dwellings approvals, international trade balance and retail sales soon after the RBA announced its rate hike.

- The data gives an overall mixed view of the economy, with experts anticipating a clearer picture once wages data is released.

The current scenario is no less than a transitioning phase for the Australian economy. After a major shock to global operations caused by the pandemic, the world had only begun to show signs of normalcy. However, this recovery was interrupted by supply chain issues and a re-emergence of infections. The varying factors have led to authorities and policymakers relying heavily on economic data to sense the well-being of its citizens.

Most importantly, property market data has kept market pundits glued to upcoming reports and analyses of the economy. The skyrocketing value of houses and record-low interest rates had meant that the economy was in a highly vulnerable state. Nevertheless, the official data has seldom been a disappointment as solid numbers reflected Australia’s revival to regular conditions even as global headwinds continued.

Another crucial data recently making the headlines is retail trade, which is essentially a metric to judge how well the households are doing. The Australian Bureau of Statistics (ABS) released a series of data on the economy soon after the cash rate hike was announced by the Reserve Bank.

Here is a closer look at the latest economic data and what it means.

Building approvals tumble

According to the ABS data, the total number of dwellings approved fell in March after rising by a shocking 42% in February. The drop in approvals is in sync with a drop in property prices seen in Sydney and Melbourne. Additionally, the March fall was driven by a drop in approvals for private sector dwellings excluding houses, which fell 29.9%.

Approvals for private sector housing also declined in March, but only by 3%. Though approvals for private sector houses increased in Queensland and Western Australia, they fell in other states. Most importantly, the value of total building approved fell by 10.8% in March. Among these, the value of total residential buildings fell by 18.3%, led by a 20.7% decline in new residential buildings.

The declining housing value points to the visible cracks in the housing ecosystem, which include newly constructed houses being valued lower than previous ones. On the brighter side, there was an uptick in public developments during March, with 11 projects valuing over AU$ 30 million approved.

ALSO READ: How much extra mortgage owners will be paying after rate hike?

International trade balance rises

The next set of data reflects the balance on goods and services surplus, which increased by AU$1,877 million in March. On a broader scale, an uptick in the balance reflects that the domestic economy is becoming more self-reliant and is depending lesser on imports. However, the real picture suggests otherwise.

Global supply chain woes have led to lower Australian imports. ABS reported that goods and services imports fell AU$1,949 million in March, which amounted to a 5% decline. At the same time, exports also declined, though by a significantly lower amount of AU$72 million.

The fall in imports was led by a slower inflow of international processed industrial supplies and consumption goods. Meanwhile, exports fell majorly because of a drop in non-monetary gold and cereal grains and cereal preparations.

ALSO READ: Big 4 banks respond to rate hike: What are the new rates for ANZ, WBC, CBA, NAB?

Retail sales reach record level

Another promising set of data was released by the ABS yesterday in the retail sales category. The retail turnover in Australia reached a record high in March after rising by 1.6%. The previous record high level was set in November 2021, which was 0.8% lower than March 2022 statistics.

1 in 9 Australians experience personal fraud in 2020-21

The data highlights that consumer spending has picked up across both discretionary and non-discretionary categories. Additionally, businesses have seen a recovery from domestic headwinds such as flooding and reduced business activity.

These factors, along with an evident uptick in consumer prices caused by global factors, have helped push up retail sales in March. Household goods retailing remained strong and rose by a massive 3.4%, followed by other retailing, cafes, restaurants and takeaway food services, department stores and food retailing. Easing restrictions and rebounding consumer confidence were key highlights of March.

Though the Australian economy has been resilient against global challenges, increased cost-of-living pressures have impacted households. Unless the upcoming wages data show any recovery, the economy seems to be at risk of losing all momentum in the long run. Thus, many experts have suggested that the wages index release on May 18 would give a clearer picture of the economy.

ALSO READ: Explained: How Russian economy is holding on despite heavy sanctions