Highlights

- The Australian Bureau of Statistics (ABS) has released the quarterly GDP growth data for the first three months of 2022.

- Australia’s GDP grew for the second consecutive quarter, driven by a rise in domestic demand.

- A higher-than-expected GDP growth rate of 0.8% in the March quarter has fuelled expectations of an interest rate hike.

The Australian GDP data for the March 2022 quarter exceeded all expectations, with the latest report from the Australian Bureau of Statistics (ABS) showing that the economy expanded 0.8% during the quarter. In a highly unanticipated turn of events, the Gross Domestic Product has surpassed even the highest forecast presented by economists.

The first three months of 2022 marked the second consecutive quarter, where the economy grew after a contraction in the September 2021 quarter. The higher-than-expected data has been a breath of fresh air for Australia at a time when inflationary concerns are meddling with the country's post-pandemic recovery. Rising prices of goods and services have affected not just Australians but also residents of most advanced nations.

The annual growth rate of the economy stood at 3.3% in the March quarter, lower than the annual inflation rate of 5.1% reported by the ABS. Though higher prices have proved to be a boon for Australian exporters, subdued demand for goods and services has fuelled fears of a recession. Meanwhile, GDP data beyond expectations is pointing towards more aggressive interest rate hikes by the Reserve Bank of Australia (RBA).

DO NOT MISS: Aussie petrol prices set for record highs: Factors fuelling rise

Key pointers to note about the economy:

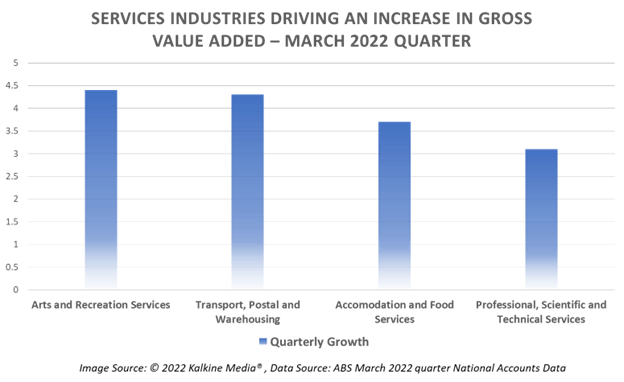

- Domestic demand remains high: A key constituent of the observed rise in GDP is the rise in demand across several discretionary categories. Household and government spending led to the rise in GDP, with the total final consumption contributing 1.4 percentage points to GDP. As COVID-related restrictions eased, household spending on transport, hotels, cafes, and restaurants also picked up. Recreational activities took centre stage as individuals were finally able to step out of their homes.

- Government expenditure on relief measures: The government put in efforts to ensure that the flood-affected areas of New South Wales and Queensland receive the necessary relief measures. Australia has witnessed many climate adversities in a relatively short span of time, including bush fires and floods.

- Lower household saving ratio: The household saving ratio of 11.4% during the March quarter was the lowest since the start of the pandemic but was above the pre-pandemic levels. This, in turn, signifies that consumer demand took off during the period as many individuals dug into their savings from the pandemic period.

- Rising prices were a blessing in disguise: Australian businesses profited from the higher prices of commodities and other consumer goods. As supply constraints plagued European nations, Australia’s exports remained stable with only a small decline. Australia’s terms of trade, which is the ratio of the price of goods exported to the price of goods imported, reached a record high level in the March quarter.

- Slower home building: Home building remained lower paced in the second consecutive quarter. This was majorly due to the lack of adequate skilled workers and a delay in the shipment of raw materials, along with challenging weather conditions. The removal of the HomeBuilder grant also contributed to this slowdown.

GOOD READ: Will EV demand explode under Labor government?

What to expect next?

The latest GDP data has surpassed most market expectations, most of which saw a GDP growth rate of close to zero per cent. Some of the old forecasts by big four banks included:

- Westpac Banking Corporation (ASX: WBC) - 0.2%

- National Australia Bank Limited (ASX: NAB) - 0.1%

- Australia and New Zealand Banking Group Limited (ASX: ANZ) - 0.6%

- Commonwealth Bank of Australia (ASX: CBA) - 0.5%

Thus, the latest GDP figure is well beyond the expectations of the big four banks. Essentially, this means the economy might be in for further monetary policy tightening, with the RBA embracing more rate hikes in the coming months. Like most other central banks, the RBA can also conduct a larger rate hike in subsequent periods after its first-rate hike.

Fears loom that high interest rates would remove some of the existing momenta away from the economy. Overall, this would be burdensome for mortgage holders, while it could help ease inflationary pressures in the long run.

ALSO READ: What's the buzz around a new agriculture index in Australia?