Highlights

- Bitcoin’s white paper talks largely about ‘electronic cash’ and ‘no central authority’ to issue new coins

- Bitcoin has been accepted as legal tender in a handful of small countries, but it is yet to achieve the status of a mass currency

- Advanced economies like the US, Australia, and Canada have remained skeptical of Bitcoin and altcoins’ (Bitcoin’s alternatives) use as legal tender

Does the world need a new form of money? Fiat currencies like the US or the AU dollar can be transferred digitally, and the use of paper money has radically reduced over the last few decades. However, fiat currencies, backed by sovereign countries, have not undergone any major change in their basic characteristics. Nor has the hegemony of fiat currencies endured any real blow.

Over the past few years, the rise in the popularity of cryptocurrencies has renewed discussions around the need for a modern currency for the fast-moving world. Bitcoin was launched by a Satoshi Nakamoto in the late 2000s, and the idea was to give people a modern and faster medium of currency exchange. Today, let us explore why Bitcoin was, in fact, created.

Why was Bitcoin created?

If we look closely at the Bitcoin white paper, it can be quite easy to understand the intentions of Nakamoto -- a single developer or a team -- behind creating a ‘peer-to-peer’ version of digital money. This nine-page document begins with the ‘electronic cash system’ title and explains concepts like timestamp and hashing in the following sub-headers. A brief abstract at the beginning of the document announces a kind of digital money that can function without a financial institution.

Nakamoto probably envisioned Bitcoin as either supplementing fiat currencies or completely replacing them with time. The latter is based on the idea that Bitcoin transactions are faster and cheaper than the traditional transfer of fiat currency, be it in cash or digital form. Bitcoin was considered a form of money without any central authority, with powers distributed among the arrangement’s users called nodes.

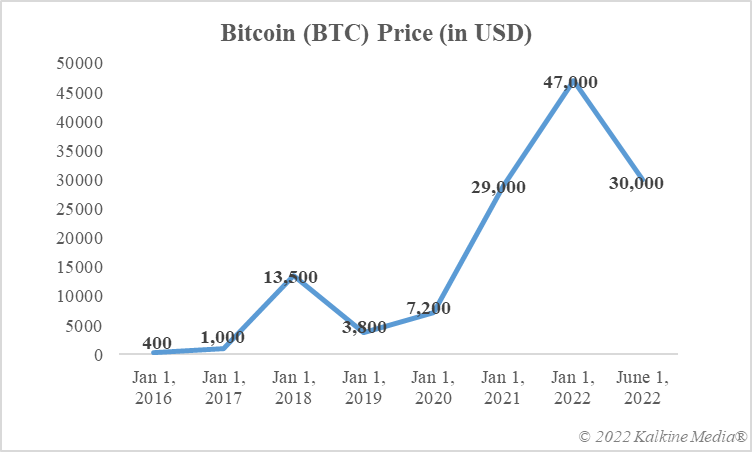

Data provided by CoinMarketCap.com

Decentralisation of money

The term ‘decentralisation’ does not appear in Bitcoin’s white paper even once. However, it is widely assumed that the document explicitly gives the idea of a decentralised digital currency. It advocates an arrangement where governments, central banks, commercial banks, or any other institution have no authority. Instead, the entire system is run by widely distributed users, who work for a variety of incentives that include the creation of a new coin as a reward for work done.

Bottom line

Even though Bitcoin’s white paper largely suggests that the idea behind creating it was to have a form of money that can run without any central authority, the motive is yet to be achieved. Bitcoin’s price volatility -- the value can rise or fall very sharply in a few minutes -- has made it more like a speculative asset instead of ‘electronic cash’. El Salvador’s adoption of Bitcoin last year has yet to gain momentum, and the cryptocurrency’s acceptance as money is restricted to only a few businesses.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.