Highlights

- Ribbon Finance (RBN) is a protocol that creates structured crypto products for DeFi.

- On March 22, it announced receiving US$8.75 million from venture capital firm Paradigm.

- The Ribbon token’s total supply is one billion RBNs.

Ribbon Finance (RBN) on Tuesday announced receiving US$8.75 million in a Series A+ funding round led by venture capital firm Paradigm, which supports Web3 and crypto companies and protocols. The token traded 0.46% down at US$1.36 at 9:38 am ET after the announcement.

Ribbon Finance is growing rapidly and has been hiring for different roles. The company plans to develop new risk products for decentralized finance over the next few months.

Ribbon initially intends to leverage Paradigm’s technical expertise in mechanism design & engineering to build a structured products platform in DeFi.

But the goal is to create innovative DeFi-native risk products, adopt a multi-chain scaling approach, and scale the current platform for better execution and improved yield.

Also Read: Why is Fantom (FTM) crypto rising?

What is Ribbon Finance (RBN)?

Ribbon Finance is a protocol that creates structured crypto products for decentralized finance (DeFi). It uses financial engineering to develop structured products that can deliver sustainable yield. However, developers can create other arbitrary products by combining DeFi derivatives.

Ribbon’s first product, Theta Vault, focuses on yield through a simplified, automated options strategy, where a layperson can also earn yield.

Also Read: Why is ShibaDoge (SHIBDOGE) rising today?

Theta Vault is a high yield product on ETH and generates yield through an automated option strategy. In future, it plans to create community-generated structured products or packaged financial instruments with a specific risk-return objective, achieved through a combination of derivatives. The risk-return aim could be betting on volatility, protection, enhanced yield, etc.

Recently, Ribbon Finance was deployed on Solana and Avalanche networks, and it plans to expand its accessibility to other chains.

Also Read: What is Internet Computer (ICP) crypto and why is it rising?

Data Source: coinmarketcap.com

Data Source: coinmarketcap.com

Also Read: What is Wrapped Bitcoin (WBTC) crypto and why is it rising?

RBN Token details:

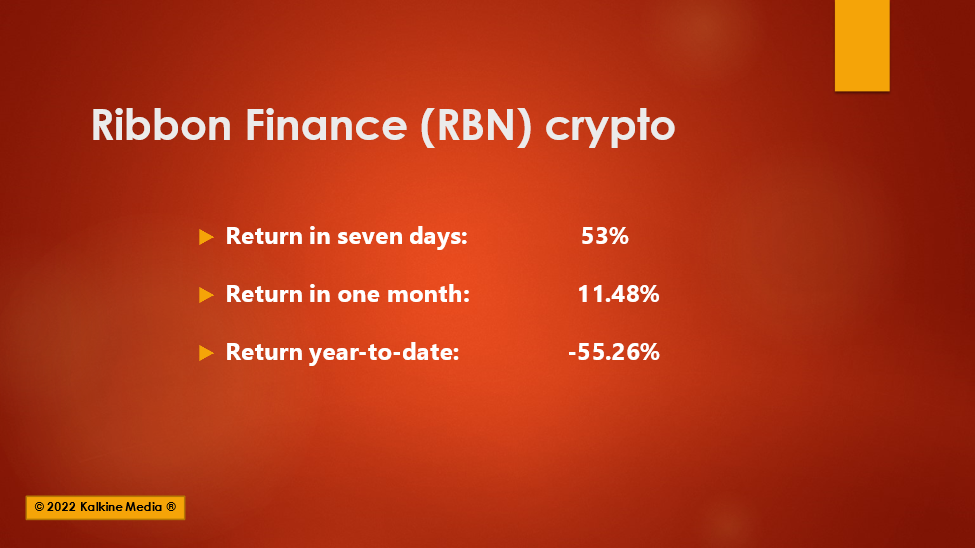

The current market capitalization of Ribbon Finance’s RBN token is US$70 million. Its 24-hour volume increased by 8.98% to US$12.37 million. RBN’s circulating supply is 51.53 million, and the total supply is one billion.

Currently, there are around 3,556 RBN token holders. RBN is available for trade on Coinbase Exchange, BingX, Gate.io, MEXC, and BTCEX cryptocurrency exchange.

Also Read: What is Zebec (ZBC) crypto? All you must know

Bottomline

Ribbon Finance’s automated strategy helps retail investors to invest in complicated crypto derivatives products. Its automated strategy allows them to earn high yields on Bitcoin, Ether, etc. The crypto market is set to see more complex financial products in future, with new structured DeFi products evolving. However, the crypto market is highly volatile and complex; hence, investors should apply due diligence before investing in the market.

Risk Disclosure: Trading in cryptocurrencies involves high risks, including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on