Highlights:

- Idex is a hybrid liquidity decentralized exchange (DEX) that functions as an order book and an automated market maker (AMM).

- The token is available for trading on exchanges like Binance, Uniswap V2, etc.

- It returned over 20% gains in the last seven days.

The IDEX crypto caught the eyes of investors on Tuesday, evidenced by its price surge. The IDEX token skyrocketed by over 122%, while its volume in the last 24 hours jumped more than 1153%.

What is IDEX crypto and why is it rising?

Idex is a hybrid liquidity decentralized exchange (DEX) that functions as an order book and an automated market maker (AMM). It claims to be the first to combine the features of a traditional order book with the security and liquidity of the automated market maker.

It brought a unique approach to the decentralized exchange (DEX) functions by combining the off-chain trading engine with the on-chain trade settlement, which provides users various benefits.

Also Read: Why is Celsius (CEL) crypto gaining attention?

For instance, the approach eliminates failed trades and the waste of money on gas fees. It claims to offer users an efficient trading experience. Its instant trade execution implies that users can continue their trading without waiting for the previous trades to settle.

It claims that advanced order types and trading strategies can be executed through this approach, as limit orders are possible while opening up arbitrage scope with other exchanges.

Idex was co-founded by brothers Alex Wearn and Phil Wearn, who currently serve as the project's CEO and COO, respectively. IDEX, an ERC-20 token on Ethereum, is the native token of the platform. It is available for trading on exchanges like Binance, Uniswap V2, Gate.io, etc.

Also Read: Bitcoin (BTC) dips below US$30,000, sliding for seventh straight week

Its recent gains may have been driven by social media discussions about the token.

It recently announced to start working on a decentralized perpetual swaps exchange, IDEX v4. The project's infrastructure is "perfectly aligned" with the traders' requirements, which is a high-performance derivative DEX, it said. It also provided a four-to-eight month timeline for the development of IDEX v4.

Also Read: Why Beefy Finance (BIFI) crypto volume surged 3000%?

Data source: CoinMarketCap.com

Data source: CoinMarketCap.com

Bottom line:

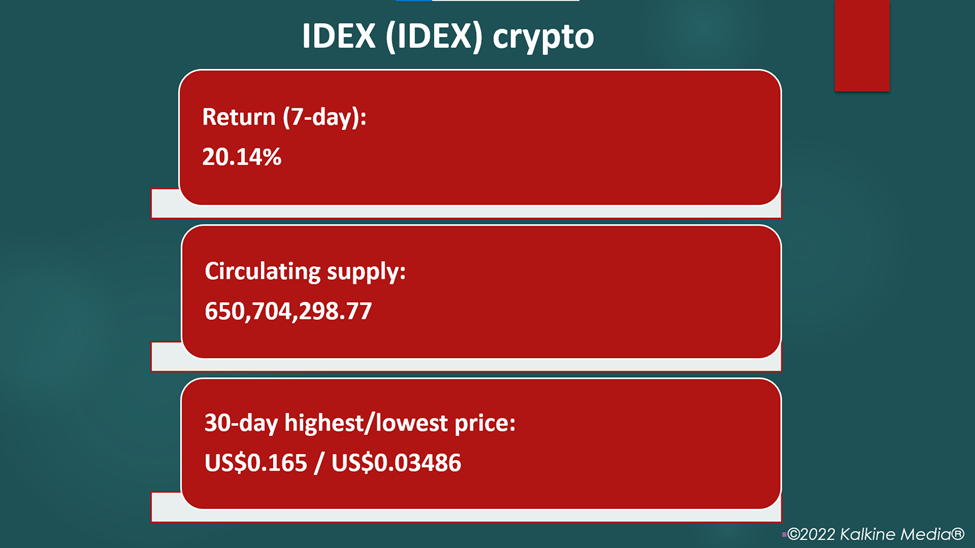

The IDEX token was priced at US$0.1099 at 10:24 am ET on May 17, up 122.78%, while its volume for the trailing 24 hours skyrocketed 1153.88% to US$221.62 million. The token has a total supply of 1 billion, and its current circulating supply is over 650.70 million.

It has a market cap of US$71.79 million, and its fully diluted market cap is more than US$107.70 million. It returned 20.14% gains in the last seven days.

The IDEX token saw the highest price of US$0.165 and the lowest price of US$0.03486 in the last 30 days.

Also Read: Warren Buffett packs a punch as he goes bottom-fishing for stocks

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instruments or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete, or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.