Highlights

- Cryptos are currently entangled in a war of sorts, as some countries, such as China and Russia, are taking tough measures on cryptos. The U.S.’ decision on cryptos is of immediate interest to all investors.

- Regulators in the United States are scrambling to stay up as digital assets gain traction among people, and traditional financial institutions join the crypto war.

- Over the past several years, federal regulatory agencies in the United States have developed a variety of policies governing cryptocurrency transactions, payment services, investment gains, and other digital asset-related activities.

Cryptocurrencies are revolutionary inventions. Regrettably, cryptos are sometimes used to conceal criminal conducts like online illegal drug rackets, infamous Silk Road, scams and a slew of other unlawful activities.

Regulators across the world are dealing with all these issues. Regulators in the United States are scrambling to stay up as digital assets gain traction among people, and traditional financial institutions join the crypto war.

Throughout the article, we will discuss the United States’ regulatory stance on cryptocurrency.

Recent Article: How Argentina’s football world is embracing crypto

What are the current regulations in the U.S. affecting cryptos?

Over the past several years, federal regulatory agencies in the United States have developed a variety of policies governing cryptocurrency transactions, payment services, investment gains, and other digital asset-related activities.

Crypto regulation bills in 2021

The 117th Congress in the US introduced 35 bills in 2021, with an emphasis on the blockchain policy and cryptocurrency.

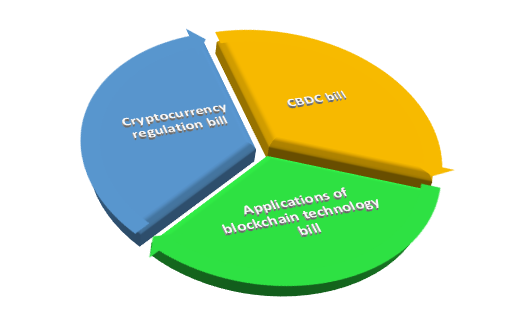

Congress introduced three different kinds of bills, each addressing a distinct issue:

©2022 Kalkine Media®

- Cryptocurrency regulation bill: It focuses primarily on how regulatory bodies like the Commodities and Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) would govern blockchain tokens and cryptos.

- Applications of blockchain technology bill: It emphasises strategies to promote the technology that underpins cryptos within the United States Government for wider application in the other sectors of the economy.

- Central bank digital currency (CBDC) bill: Some policymakers believe that technological innovations like Stablecoins pose a serious threat to the dollar’s status as the world’s reserve currency, hence the new notion of CBDCs continues to be explored.

Regulations for cryptocurrency exchanges that impact cryptos

In the US, cryptocurrency exchanges are legal and subject to the Bank Secrecy Act’s (BSA) regulation. Cryptocurrency exchange service providers must apply for an FINCEN licence, keep proper records, establish an AML/CFT and Sanctions program, and make reports to the authorities.

In the US, the Securities and Exchange Commission (SEC) has stated that it deemed cryptocurrencies to be securities, and would apply securities legislation to digital wallets in a comprehensive manner, impacting both investors and exchanges.

Retail investors are required to report realised losses and gains from crypto investments on their yearly tax returns. If anyone fails to do so, it will draw the attention of the Internal Revenue Service, which has pledged to crack down on crypto tax evaders.

The Commodities Futures Trading Commission (CFTC) has taken a more welcoming, “do-no-harm” stance to Ethereum and Bitcoin, recognising them as commodities and enabling them to trade publicly on exchanges that it supervises or controls.

Recent Article: Why is the crypto market so volatile?

Where does the FED stand on cryptocurrency?

- The Biden administration is in the process of developing a government-wide policy to regulate cryptocurrencies, probably in February. In anticipation of the Federal Reserve System’s (Fed) decision on crypto regulations, the whole crypto market was in a downtrend since December before witnessing some pullback in the last few days.

- There have been talks about the Federal Reserve issuing a U.S. digital currency. The central bank digital currency (CBDC) would be a digital form of cash that’s backed and issued by the US Fed, unlike cryptocurrencies, which usually are mined by the private sector and whose price swings are notorious.

Recent Article: Could Bitcoin plummet below US$30,000 in 2022?

Final thoughts

Cryptos are currently entangled in a war of sorts, as some countries, such as China and Russia, are taking tough measures on cryptos. The U.S.’ decision on cryptos is of immediate interest to all investors. Let’s see where the U.S. regulation of crypto will take the crypto market to.

Recent Article: Is investing in cryptocurrency a good or bad idea?