Highlights

- Bitcoin's recent performance has sparked a debate about whether the cryptocurrency is truly losing its shine.

- Ethereum, the second largest cryptocurrency by market capitalisation, may soon dethrone Bitcoin.

Bitcoin had a rough start to the year, and given the crypto’s recent performance, the road ahead does not seem to be a rosy one for 2022.

The king of cryptocurrencies had reached a new all-time high on 10 November 2021 as it crossed the US$68,000 mark. Since then, Bitcoin's price has gone downhill, and it now trades at US$41,840.24.

Bitcoin's volatile performance has sparked a debate about whether this cryptocurrency is truly losing its shine.

In this backdrop, Let’s look at the prevailing buzz in the market regarding Bitcoin’s future existence.

Recent Article: NFTs vs Bitcoin? Which one will 2022 treat better?

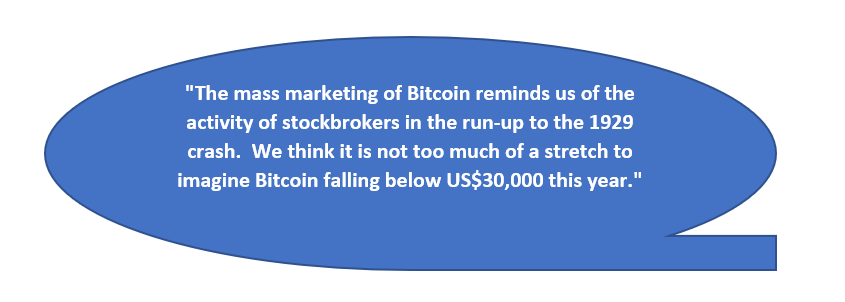

According to American independent investment management firm Invesco's list of "improbable but possible" possibilities for 2022, the Bitcoin ‘bubble’ might burst this year and the world’s largest crypto might drop below US$30,000.

When the price of an asset climbs far above its legitimate market value, an economic bubble can form at any time. A "crash" or "bubble burst" occurs when suddenly the market plummets, wiping out billions of dollars.

According to Paul Jackson, an Invesco strategist,

Bitcoin's price is expected to be in the range of US$34,000-US$37,000 by October if the current trend continues. However, Jackson believes that there is at least a 30% possibility that Bitcoin will nosedive below the US$30K mark, which in turn could lead to significant losses.

Recent Article: Bitcoin falls over Evergrande’s default risk

Crypto liquidations

Investors are becoming increasingly anxious about the future prospects of Bitcoin and other cryptocurrencies.

In the coming months, the Federal Reserve of the United States is expected to declare major rate hikes. This has resulted in the US dollar witnessing a rally over the last few days, hurting the bitcoin market's performance.

©2022 Kalkine Media®

According to Coinglass data, more than US$148.75 million in cryptocurrency liquidations was registered in last 24 hours.

Bitcoin was responsible for the majority of the losses, with BTC liquidations amounting to US$36.77 million in the last 24 hours. Among top five cryptocurrencies in terms of liquidity, Bitcoin was followed by Ethereum, Cardano, Fantom and NEAR.

Final thoughts

Since December 2021, the price of Bitcoin has been steadily declining. If Bitcoin is unable to show resilience in the market, the price may continue to plummet, and Ethereum, the second largest cryptocurrency by market capitalisation, may soon dethrone Bitcoin.

Recent Article: What is cryptocurrency and why is it so popular?