Highlights

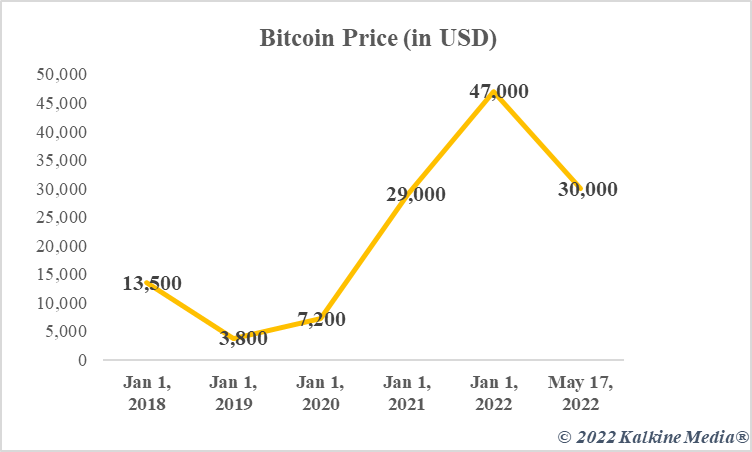

- Bitcoin’s subdued phase in 2018 coincided with dull performance of the S&P 500 Index in the same year

- TerraUSD was one of the factors widely blamed by experts for the fall in Bitcoin price in May 2022

- How governments react to the crypto’s May crash might become clear in the coming month

Bitcoin, with its highest share in cryptocurrencies’ total market cap, is a closely watched asset. Arguably, a rise or fall in the price of Bitcoin can trigger fluctuations in the entire cryptoverse.

CoinMarketCap tracks a total of approximately 20,000 cryptoassets, which is no mean figure for an asset class notorious for its high volatility. In May, bears gripped the crypto market and Bitcoin plunged below US$30,000, which had a deep impact on sentiments. For past several days, BTC has hovered near this level, with no sharp rise or fall.

What will June bring for Bitcoin? Will Bitcoin recover and pare losses? Or will losses widen? Nothing can be predicted with certainty. But by keeping tabs on the below-mentioned developments, crypto enthusiasts might be able to guess the trajectory.

1. Inflation, interest rates, and stock market

It may be no coincidence that both S&P 500 Index and Bitcoin had a subdued year in 2018. Also, the pandemic-hit years of 2020 and 2021 were largely rewarding for both stocks and BTC.

The year 2022 has so far been a period of high inflation. Though inflation had seeped in much earlier, central banks were yet to react. And they finally did react in 2022. From Australia to Canada to the US, central banks have shifted their policy stance. In Australia, cash rate was hiked earlier this month to fight inflation. Stock markets in all these economies have reacted to this new scheme of things. Now, analysts are debating if there is a global stock market crash on the cards or is it just a cyclical correction.

Bitcoin is a variable return asset, just like stocks. From over US$47,000 at the start of this year, Bitcoin is now trading at under US$30,000. If inflation cools down and the wider market absorbs rate hikes in the near-term, Bitcoin might show some positive movement.

Also read: Bitcoin at $30,000: What does 5-year historical price data indicate?

2. Stablecoins

No doubt, Bitcoin’s price is prone to extreme fluctuations. But at least one category in the crypto world was designed with stable prices in mind. These were termed stablecoins and were pegged to an asset like fiat currency.

However, in May, this so-called stable category defied expectations. One of the biggest stablecoin assets, UST, lost its peg and came crashing down. This was quickly followed by a fall in most other major cryptos including BTC. Now, the Terra ecosystem has announced a new token, although with the same name LUNA. Some analysts are suggesting that the new launch might bring back some positivity.

Separately, Tether has recently launched a stablecoin pegged to the Mexican Peso. Other major tokens in the category have not behaved like TerraUSD. Bitcoin’s fall in May due to stablecoin category’s crash might become a thing of the past with the start of a new month.

Also read: Top 5 costliest NFTs ever sold

3. Regulations

Bitcoin is a legal tender or an official form of money in two countries. Most developed countries do not seem in favour of this.

The crypto market crash in May has renewed debates around regulations. Will major economies resort to new ways to protect the interests of crypto enthusiasts? Will the stablecoin category face restrictions? These are matters of speculation. But if governments steer clear of tough calls, Bitcoin and altcoins like Ether might have some elbowroom to recover in June.

Besides, if more countries decide to adopt Bitcoin, it might support BTC price movement.

Data provided by CoinMarketCap.com

Also read: Bitcoin bond and Bividend: 2 new extensions of Bitcoin?

Viewpoint

Bitcoin’s recovery might depend largely on price movements in other variable return assets like stocks. Besides, how governments across the world react to the May crypto crash can also shape sentiments. A new LUNA token is expected to infuse some optimism in the cryptoverse.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.