Highlights

- Australia and many other countries are contemplating the launch and use of CBDCs, with or without blockchain

- Australia’s central bank released a white paper in this regard in September 2022, which shines a light on the technology that could be used

- The pilot, according to the white paper, can begin from January next year, and by mid-2023, its findings could be published

Are central bank digital currencies (CBDCs) and cryptocurrencies like Bitcoin (BTC) and Ether (ETH) the same thing? The answer to this is an emphatic ‘no’, simply because central banks like the Reserve Bank of Australia (RBA) have no role in regulating cryptocurrencies. Any cryptocurrency is launched by a specific project, usually based on blockchain technology. For example, BTC was launched by the Bitcoin blockchain project, and ETH by Ethereum. Central banks do not control either the issuance or circulation of cryptocurrencies.

The term CBDC, however, has ‘central bank’ in its name. Here, it is expected that the fiat currency of any country, for example, the Australian dollar (AUD), would be infused with some new features and released as a digital-only currency for regular payments. However, there has not been much progress in this regard. China’s e-RMB is in its pilot phase, and a full launch is not expected soon. Where does Australia stand with respect to CBDC? Let us explore.

Australia’s CBDC

Now that the RBA has released the white paper of its CBDC project, things have become quite clear. According to this paper, released almost two months back, the announcement on ‘selected use cases’ for the pilot eAUD is due in December 2022. This can be a surprise because most other developed economies, including the US, have not shown such eagerness in their CBDC projects. The Digital Finance CRC (DFCRC) and the RBA have joined hands on the CBDC research project, and the white paper also suggests that regulators – the ASIC and AUSTRAC - would also be involved.

The most interesting aspect is the mention of Ethereum. Ethereum is a blockchain service provider which has supported the release of many ERC-20 tokens on its platform. The RBA’s CBDC could use Ethereum’s Quorum blockchain, which is an enterprise-level, permissioned chain. This can help in restricting the access to the network, unlike in permissionless blockchains like Bitcoin. The RBA has also said that the eAUD’s ledger would be ‘private’, with ‘no KYC data’.

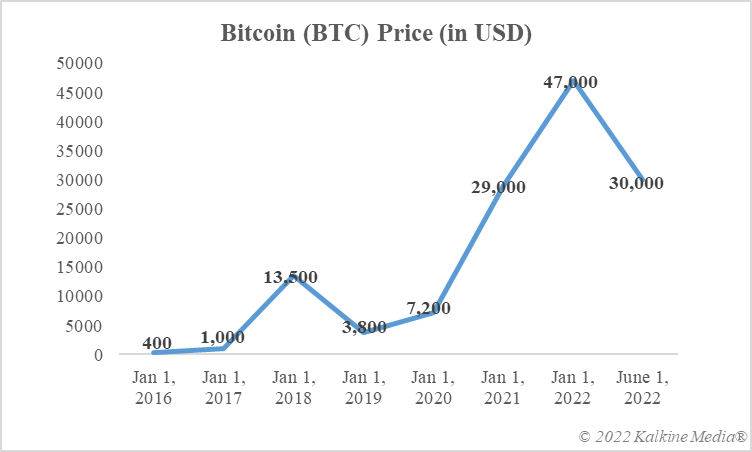

Data provided by CoinMarketCap.com

Timeline

For now, details only on Australia’s CBDC pilot launch have been provided in the white paper. The pilot would be conducted for ‘selected use cases’ between January and April next year. By mid-2023, the findings of the project would be published in a report. Interestingly, it is also mentioned in the white paper that the eventual CBDC of the country would not necessarily be based on blockchain and/or Ethereum. One thing is certain unlike cryptos like Bitcoin, which have very volatile prices, CBDC prices would come with fiat currency-like certainty.

Bottom line

There is definite work being done with regard to a CBDC in Australia. The September white paper has even provided clear timelines for the launch and completion of the pilot phase. For now, Ethereum’s permissioned blockchain is the platform of choice. However, it can change when the eventual design of Australia’s eAUD is finalised.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.