Highlights

- Libero Financial is promising a very high APY to the holders of the LIBERO crypto

- A small market cap cryptocurrency as of now, LIBERO has yet to make noise in the DeFi sector

- How Libero Financial provides fixed returns to LIBERO token investors remains an interesting watch

The cryptocurrency market is intriguing. From nowhere almost a decade ago, Bitcoin now ranks among the world’s most valued assets. Altcoins like Ether and BNB have also gained immensely over the past few years.

But at the same time, being cautious is a prerequisite ahead of making any decision to invest in cryptos. Not only can prices fluctuate in the blink of an eye, popular blockchain projects can suddenly fall from grace.

That said, the cryptocurrency universe seems to have pulled off a bit of a comeback over the past 24 hours. Bitcoin, BNB, and many other assets are trading in the green as of writing.

In this light, let’s also look at one cryptocurrency that may have lost over the past 24 hours, but it makes for an interesting watch in the medium-to-long term if it can deliver on its promises.

What is Libero Financial?

The Libero project talks about “financial freedom.” It claims that the holders of its native token have a chance to earn revenue without having to sell their holding. This is what Libero calls “buy-hold-earn,” where the existing portfolio can yield income.

Also read: What is Nervos Network & CKB crypto’s price prediction?

Libero developers further claim to have the highest fixed annual percentage yield or APY in the crypto industry. Users, the official website says, can earn over two per cent fixed interest on a daily basis. And for this, users have to have LIBERO tokens in their wallets. The rewards, it is claimed, are compounded every 30 minutes.

LIBERO holders can start withdrawing one per cent of their holding from their wallets, Libero Financial website says, but after 15 days of initial investment. The website states that under this arrangement, the user would earn over 200 per cent return on investment in just 70 days.

Also read: What is VeChainThor & VET crypto’s price prediction?

LIBERO crypto

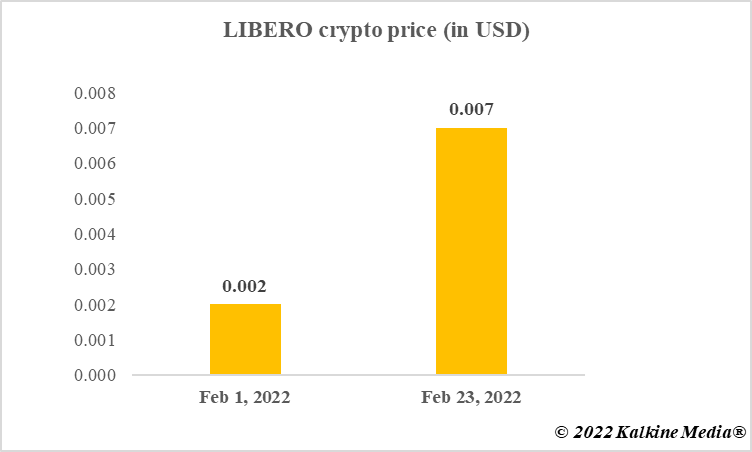

LIBERO serves as the native coin of the platform, which it uses for multi-chain yield farming. LIBERO had a market cap of nearly US$42 million as of writing, and it was trading at nearly US$0.007. The trading volume was up over the past 24 hours, but the price movement was in the red.

LIBERO crypto’s price prediction

LIBERO is both a new as well as a low market cap cryptocurrency. Such assets may be even more volatile as compared to Bitcoin or other high market cap cryptos.

That said, LIBERO may reach US$0.1 by the end of 2022 if the promise of fixed APY is kept. Crypto investors may find value in Libero Financial if they can earn a fixed return, that too very high, without having to engage in regular trading of their crypto assets.

Data provided by CoinMarketCap.com

Also read: What are CryptoPunk NFTs & which ones sold for the highest prices?

What is Libero Financial crypto

Bottom line

Libero Financial sits very low on the CoinMarketCap listing of cryptos. It does not feature in even the top 3,000 crypto assets.

Besides, the project has just started, and it is seemingly promising a fixed return on investment. Though yield farming is popular and one of the major attractions of decentralized finance (DeFi) protocols, it is yet to be seen if it can produce great returns for crypto investors.

Also read: Axie Infinity: What is AXS metaverse crypto’s price prediction?

That said, investors must be extremely careful before investing in any blockchain project. DeFi has yet to demonstrate its potential.

Moreover, there are projects in the DeFi sub-sector that have a higher market cap as compared to Libero. These platforms are enabling yield farming, and lending and borrowing in cryptos. How all this unfolds in the medium-to-long term is not yet clear.