Highlights

- Staking is not usually favored by those investors that look for quick capital gains in cryptos

- Many tokens come with staking features, and it is notable that Bitcoin cannot be staked

- Staking is evolving with the advent of DeFi, where a crypto lender can earn passive ‘interest’ income

There are multiple ways to make money from a cryptocurrency holding. Though cryptos come with their own set of investment risks like extreme price volatility, they have become a popular asset over the past few years.

One way of making gains is to liquidate the asset when the price at which it is trading is higher than the price at which it was acquired. This simply results in capital gains for the investor. But in a scene where HODL (hold on for dear life) has become a popular sentiment among a section of retail crypto investors, a different way can be found to earn revenue without having to liquidate -- staking.

What is crypto staking?

To quickly understand staking, let’s know how the biggest crypto Bitcoin works. Any transaction on its network is validated by miners that undertake complex computing using heavy machines, which eat up a lot of power. In contrast to this, some blockchain networks, typically those that use the proof-of-stake consensus, allow validation through staking.

Here, holders of the native token of the network can stake their assets to participate in validation. Instead of lying idle, such cryptos are put to work. In return, the holders earn rewards.

Also read: Axie Infinity rallies: What is AXS crypto’s price prediction?

Staking is further evolving with the rise of DeFi, where tokens can be staked in a bank-like arrangement under which a borrower seeks a crypto loan from a lender who in turn seeks ‘interest’ income.

That said, which are the staking tokens to watch in 2022? Here are three top staking coins.

1. Cardano (ADA)

Cardano is a top ten crypto asset by market cap, besides being one of the most popular networks using the proof-of-stake method. Cardano competes with Ethereum and other networks like Solana and Fantom.

Developers can use the Cardano blockchain to build decentralized solutions including apps and smart contracts. ADA serves a purpose in the Cardano network that mirrors Ether’s utility in Ethereum.

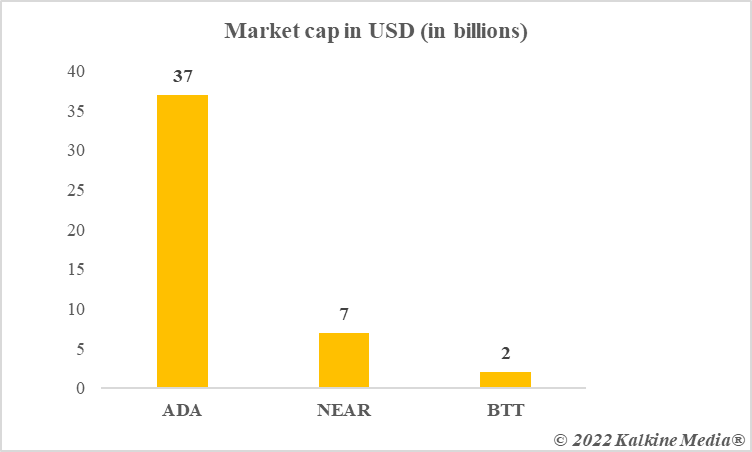

Though ADA has a market cap of nearly US$37 billion as of now, the price per token is quite low. A few Cardano backers claim that ADA may replicate the success of Solana, which grew from under US$2 to over US$150 in 2021. ADA’s price is nearly US$1.1 as of now.

Also read: BTT, SHIB & XEC: Top 3 cheap cryptocurrencies with market cap over $1B

2. NEAR Protocol (NEAR)

NEAR Protocol states that it can offer low fees to users, besides being a perfect launchpad for decentralized apps (DApps). NEAR Protocol also provides support for NFT projects.

NEAR is the native token, and in October 2020, the project announced that all token holders can participate in staking. NEAR crypto has a market cap of over US$7 billion and is one of the top 25 crypto assets as of now.

The price per token is nearly US$11. NEAR’s price prediction may depend on how successful the protocol is in the DeFi sector.

Also read: Canada Emergencies Act: Cryptos come under ‘terrorist financing’ laws

3. BitTorrent (BTT)

Peer-to-peer file sharing was launched by BitTorrent even before the arrival of Bitcoin. BitTorrent has moved to the blockchain network of TRON.

This added to the project the native token BTT. With a market cap of over US$2 billion, but a price per token of approximately US$0.000002, BTT makes an interesting watch. A few crypto investors look for low-priced cheap cryptos in anticipation of quick capital gains.

Data provided by CoinMarketCap.com

Also read: Bitcoin price prediction 2025: Can Web 3.0 catapult BTC to $300,000?

Bottom line

Dozens of other cryptocurrencies come with staking options. The above three boast very high market capitalizations, and two, Cardano and BTT, have a low price per token. The third, NEAR, also has a humble price when compared to BTC and Ether. Staking can generate revenues without the compulsion to sell the holding. This makes the above three staking tokens interesting.

That said, price fluctuations may also lead to losses. For example, if an investor purchases a crypto at a high price, which plunges deeply, even staking rewards may not be enough to make good the losses.