Highlights:

- Cryptex Finance offers open-source financial solutions for the cryptocurrency community.

- The CTX token can be traded on exchanges like Huobi Global, Coinbase Exchange, etc.

- It returned over 112% gains in the last seven days.

The Cryptex Finance (CTX) crypto skyrocketed over 87% on Thursday morning, fuelled by positive social media comments, with some users claiming it could be the beginning of a crypto rally.

Its trading volume jumped more than 231% in the last 24 hours. Here we explore the CTX crypto and the probable reasons for its recent upswing.

Also Read: Is Chainlink (LINK) crypto rising because of its updated roadmap?

What is Cryptex Finance (CTX) crypto?

Cryptex Finance creates innovative, open-source financial solutions for the global cryptocurrency community. Cryptex builds decentralized finance (DeFi) solutions using Ethereum's smart contract system. These DeFi solutions include Total Market Cap Token (TCAP).

DeFi solutions like access to real-world data and the option to acquire tokens by depositing collaterals were not possible earlier in a centralized custodian model.

Also Read: Is LTO Network (LTO) crypto rising after Binance US listing?

But Cryptex has made it possible through its decentralized finance solutions. It also provides exposure to many decentralized finance tokens besides Bitcoin (BTC) and Ethereum (ETH).

Cryptex offers an all-inclusive coin for real-time price exposure and to attract potential investors. This facility helps investors evaluate the entire market rather than a particular project.

Also Read: What is Bluzelle (BLZ) crypto and why did it rise 40%?

The network leverages the open-source infrastructure and advanced financial solutions to achieve its goals. It claims to be one of the top investment vehicles with access to the entire crypto market.

It provides investors, funds, DeFi users, etc., access to the whole gamut of crypto products.

The network’s governance token CTX empowers and safeguards the protocol's TCAP technology. The token holders can also vote on proposed changes to the protocol. The CTX token can be traded on crypto exchanges like Huobi Global, Coinbase Exchange, Hotcoin Global, etc.

Also Read: Why is WOO Network (WOO) crypto generating interest?

Data Source: CoinMarketCap.com

Data Source: CoinMarketCap.com

Bottom line:

The CTX token was up 87.40% to US$7.80 at 9:18 am ET on June 9, while its volume jumped 231.21% to US$11.61 million in the trailing 24 hours. It has a market cap of US$27.57 million, with a fully-diluted market cap of over US$78.02 million.

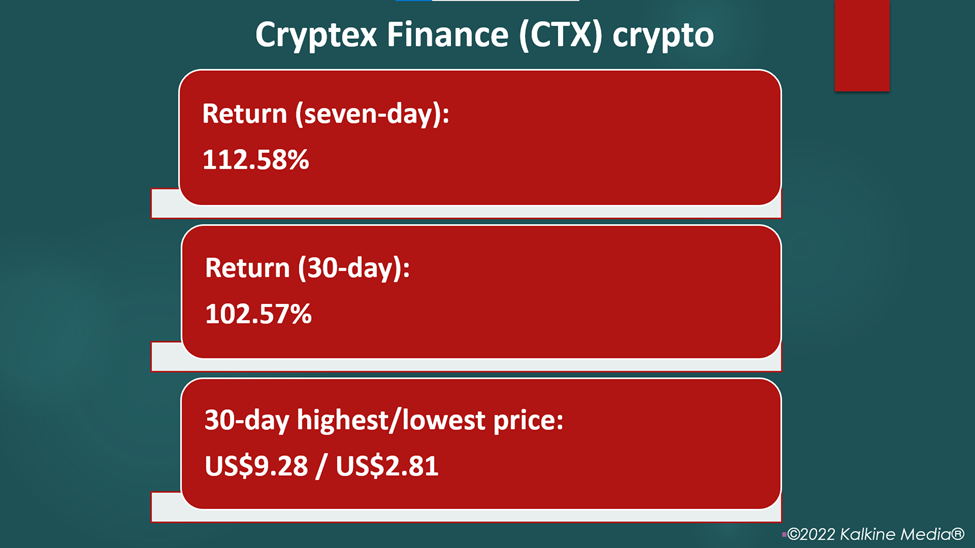

The token has a maximum and total supply of 10 million, and its current circulating supply is over 3.53 million. It returned over 112% gains in the last seven days and 102.57% gains in 30 days. Its highest price was US$9.28, and the lowest price was US$2.81 in the last 30 days.

Also Read: Why Heartcore Enterprises (HTCR) stock surged over 170%?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instruments or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete, or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.