Highlights

- Voyager Digital’s bankruptcy filing has become the hottest talk of the crypto town

- The brokerage has filed for Chapter 11, a form that might still enable it to operate after restructuring

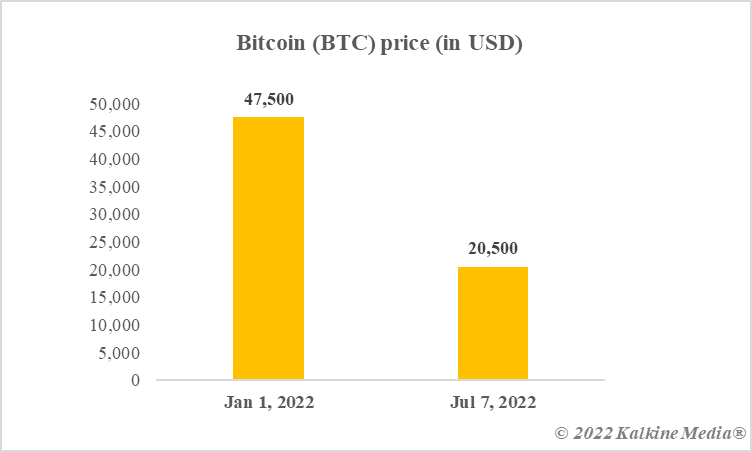

- Cryptos are down, with the biggest asset of the lot, Bitcoin, having lost almost 60%

Bankruptcy is in focus after Voyager Digital, a brokerage for cryptoassets, has filed for one. Is bankruptcy the end of operations? Does bankruptcy of a company lead to investors and creditors losing all their money?

There can be many questions, particularly from amateur crypto enthusiasts that are reeling from back-to-back blows that include a sharp decline in crypto prices and suspension of withdrawals announced by not only Voyager but also others like Celsius and Vauld. Let us quickly explore what is Chapter 11 bankruptcy, which Voyager has filed in a New York bankruptcy court.

What is Chapter 11 bankruptcy?

It is one of the many forms of what any debtor might use to deal with the debt. Chapter 11, however, can be a good start for the overall restructuring of debts, which makes it more of a bankruptcy targeted toward reorganisation and not winding up.

Chapter 11 has been used by leading companies of the US in the past to restructure their debt and tide over a crisis phase. Many might recall automobile giant General Motors filing for one in 2009 in the wake of its liabilities growing more than double as compared to the company’s assets. Today, General Motors is operating with the same glory.

In a Chapter 11 bankruptcy, the company files a reorganisation plan with the court. This can restructure their debt, which can be in the best interest of creditors. Voyager’s filing reportedly suggests that its debt and liabilities are roughly in the same range. Second, much of the pain of the brokerage emanates from another crypto player, Three Arrows Capital, going bust.

Voyager has also stated that Chapter 11 can enable it to reimburse its customers. It is also being said that users that had their fiat currency assets in Voyager would be able to access them once the reorganisation is effectively implemented.

Also read: Understanding basics of cryptocurrency taxation in Australia

State of cryptos

Voyager is not the only crypto market participant that has troubled its users. Vauld, a so-called interest provider on crypto deposits, also declared a halt on withdrawals earlier this week. Almost every such participant has pinned the blame for suspending operations on market volatility.

Bitcoin (BTC), often called the bellwether of the cryptoverse, has lost over half its value so far this year. Altcoins like Ethereum (ETH) are faring even worse. The cumulative market cap of cryptos is finding it hard to regain the trillion-dollar level.

Data provided by CoinMarketCap.com

Also read: Everything you need to know about Vauld suspending withdrawals

Bottom line

Chapter 11 bankruptcy might not be a bad deal for Voyager customers. A reorganisation of debt and restructuring of operations can enable the company to return funds to enthusiasts who flocked to the platform anticipating high returns from cryptos.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.