Highlights

- Events like the fall of a major stablecoin project or the rise in the price of Ethereum’s ETH are very unpredictable

- Now, USTC crypto, which earlier was known as the TerraUSD (UST) stablecoin, is on a sudden rise

- Many are calling the event a pump and dump because there are seemingly no solid fundamentals to justify the rally

It is never easy to predict how the cryptocurrency market or any asset within it would unfold in the near future. Even big events, both negative and positive, can come without any hints. For example, no one imagined a major cryptocurrency project, Terra, to abruptly fall from grace, an incident that stunned the entire crypto market in May this year.

Similarly, for nearly a month after mid-July, Ether (ETH) gained phenomenally to rise from almost US$1,000 to US$2,000. Now, ETH is again in the red with a price under US$1,700 as of writing.

Terra’s fall incident or the ETH rally episode came largely as a surprise. Now, the latest surprise is a steep rise in the value of TerraClassicUSD (USTC) cryptocurrency. USTC is up more than 35% over the past one day. Let us explore this event in detail.

First, what is TerraClassicUSD?

TerraClassicUSD (USTC) crypto is nothing but the same TerraUSD (UST) stablecoin that collapsed in May after losing its peg to the US dollar. While other cryptos like Bitcoin lost heaving this year, TerraUSD maintained its stable value of nearly US$1 until May 9. TerraUSD was considered an ‘algorithmic’ stablecoin with an associated LUNA crypto.

The Terra blockchain project, after the collapse of TerraUSD and LUNA cryptos, launched the Terra 2.0 ecosystem. The older TerraUSD was rechristened TerraClassicUSD with ticker, USTC.

Also read: How does Terra 2.0 differ from Terra? How is Luna 2.0 faring?

USTC rises sharply

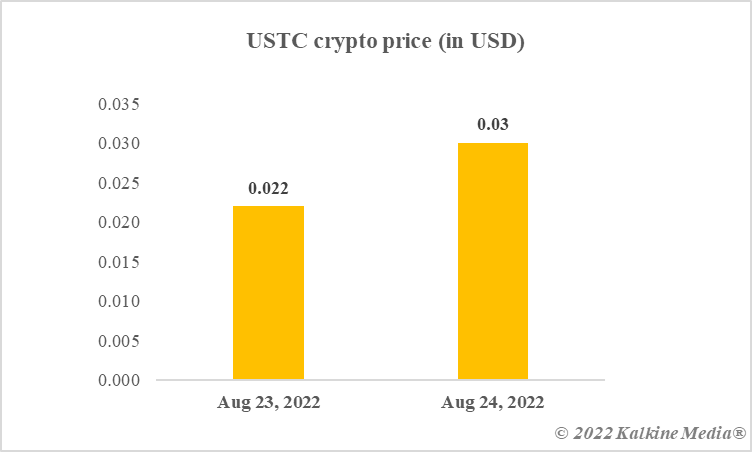

The USTC stablecoin continued its volatile run even after the name change. A few backers expected that the stablecoin might regain its peg to the US dollar, however, it has not happened so far. What is surprising now is a sudden 35% rise in USTC over the past 24 hours. The price has gone from nearly US$0.022 to over US$0.03.

The one-day trading volume of USTC is also up more than 300% as of writing. The market cap indicated by CoinMarketCap is nearly US$290 million.

Data provided by CoinMarketCap.com

Why is USTC crypto rising?

There is no definite event or announcement that this rally can be attributed. The Terra blockchain project to which the TerraUSD stablecoin and the LUNA token belonged had earlier rebranded itself Terra 2.0. The future of TerraUSD, now TerraClassicUSD (USTC), is extremely uncertain.

Many are calling this recent rise a pump that might soon fade away, although this is also speculation. Pump and dump is a way used by manipulators to first artificially fuel a rally in an asset and later dump it to book profits.

Bottom line

Cryptos can be very unstable. There is no evident reason right now behind the steep rally in USTC, the cryptocurrency which was earlier known as the TerraUSD stablecoin.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.

_09_03_2024_01_03_36_873870.jpg)