Highlights

- TerraUSD stablecoin is believed to be the primary reason behind the fall of the Terra ecosystem

- A new version of Terra blockchain, with LUNA 2 as native token, is meant to revive the project

- LUNA 2 has so far remained unpredictable in price terms, and many forces can shape its future

The crypto market seems to have brought some relief for enthusiasts. The total crypto market cap is now above US$1.3 trillion, with Bitcoin (BTC) trading at over US$31,000 price, as of writing. Altcoins like Waves (WAVES), and Cardano (ADA) have also registered gains, of late.

One cryptoasset that has set many tongues wagging is the new version of LUNA, linked to the Terra 2.0 blockchain. How has LUNA 2 performed so far, and what all does Terra 2.0 offer? Let’s know.

What is Terra 2.0?

Terra’s latest version of blockchain uses the proof-of-stake method to support decentralised apps. In the official document, it is stated that the top 130 validators contribute to the validation process. Validators of any blockchain are essentially miners. Proof-of-stake consensus is believed to consume less energy as compared to the proof-of work method used by Bitcoin.

Terra 2.0 follows Terra, the fall of which was blamed for the decline in the wider crypto market in May 2022. The older Terra blockchain’s native token has now been renamed as LUNA Classic. It is said that Terra 2.0 also does away with stablecoins. TerraUSD (UST) was the stablecoin of original Terra.

Also read: Three altcoins to keep tabs on in June as cryptos begin to recover

What is LUNA 2?

LUNA 2 is the token linked to Terra 2.0, with primary role in the staking process. The Terra ecosystem is referring to LUNA 2 as LUNA. The earlier LUNA is now LUNA Classic, as stated earlier.

LUNA 2 follows a proposal that was cleared to set up the latest version of Terra network. Besides its usage in staking and validation, LUNA 2 will also act as the governance token of the new blockchain.

The maximum supply of LUNA 2 is said to be one billion tokens, of which 210 million tokens are believed to be in circulation right now. It is indicated that the users of the older Terra blockchain might get some LUNA 2 tokens, with lock-in features.

LUNA 2 price

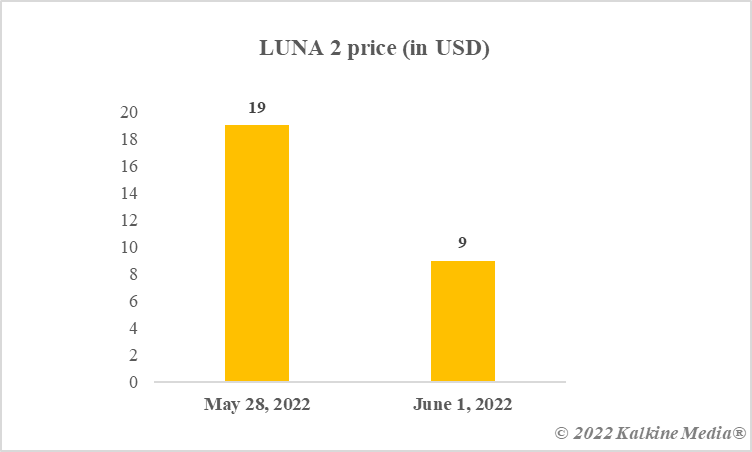

LUNA 2 started trading only a few days back, on May 28. The price has since manifested volatility.

CoinMarketCap data indicates that LUNA’s price peaked to over US$19 on the first day and then quickly fell to nearly US$4. On May 31, the price recovered and reached almost US$12. This limited recovery is said to have resulted from LUNA 2’s Binance listing news. As of writing, LUNA was trading at under US$9.

Data provided by CoinMarketCap.com

Bottom line

LUNA 2 is being projected as a token without any linkage with stablecoin. Since its launch, this native token of Terra 2.0 blockchain has mostly traded in the red. The adoption of Terra 2.0 by developers and how the wider crypto market behaves in the medium-term might shape LUNA 2’s price trajectory.

Also read: Decoding STEPN crypto and its two tokens – GST and GMT

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.