Highlights

- Stablecoins like USDT and USDC are part of the same cryptoverse that has volatile assets like Bitcoin

- Stablecoins project themselves as safe, stable value assets. However, TerraUSD’s fall shows why they are not risk-free

- USD-pegged stablecoins claim to hold reserves to back the circulating supply of tokens, but experts doubt these claims

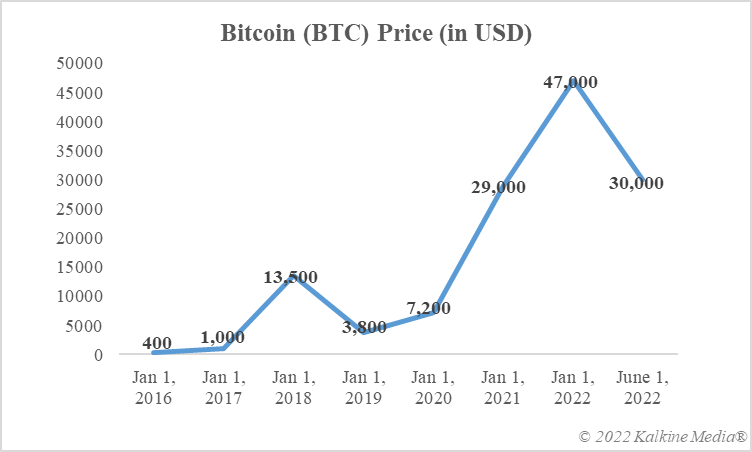

The term ‘safe’ is extremely important in the highly volatile and unpredictable world of cryptocurrencies. Bitcoin, created over a decade back, has yet to have a comfortable ride. Its price has dipped sharply this year, while cryptocurrencies dubbed altcoins, created after Bitcoin’s invention, are also facing the same headwinds. In altcoins, some assets are subcategorised as ‘stablecoins’.

The term stablecoin gives a clear message about its intention. In the extremely unstable world of cryptos, where prices fluctuate quickly, this category claims to provide stability. Most cryptos are based on blockchain tech, and stablecoins also harness the same distributed ledger platform. The difference is that stablecoins are pegged to traditional assets like gold or fiat currency. This means any stablecoin’s price should always be the same as the price of the asset it is pegged to.

But is everything so ‘stable’ in the world of stablecoins? Let us explore.

A ‘safe’ stablecoin

It is necessary to look at stablecoins as members of the wider cryptoverse. While assets like Bitcoin and Ether are traded on crypto exchanges, with prices decided by demand and supply forces, stablecoins like Tether (USDT) and USD Coin (USDC) also trade, but with price stability. Considering everything is okay, the price of a USDT or a USDC token is US$1 because of the peg with the US dollar.

By one measure, it means that stablecoins bring the advantages of the blockchain (speed and low cost) while maintaining predictable values. Bitcoin, many critics say, lacks this stability, which is the primary reason it is not dependable as a form of payment. USDT, on the other hand, can enable faster remittances with no price instability. However, this argument in favour of stablecoins failed when a major project called TerraUSD collapsed this year. The Terra episode proved that it is not yet possible to term any stablecoin, no matter its market cap, ‘safe’.

Data provided by CoinMarketCap.com

Reserves

Since any sovereign authority does not issue stablecoins like USDT and USDC, adequate reserves in cash and cash equivalents must be maintained. For example, if a new USDT token is to be issued over and above the existing supply of tokens, Tether should ideally add one more USD to its reserves. Whether the reserves backing USDT and USDC are adequate is a controversial debate.

Bottom line

It can be said that an absolutely safe stablecoin does not exist. This is because private players issue these cryptocurrencies without any backing from any sovereign authority. Cryptos like Bitcoin and Dogecoin have all lost value this year, and many popular names like Celsius and FTX fell from grace, which demands extreme caution on the part of stablecoin enthusiasts.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.