Highlights

- Tether, often referred to as the USDT token, is a stablecoin project with tokens pegged to fiat currencies and gold

- Bitcoin and USDT have fundamental differences as the latter claims to always maintain a stable price in the market

- USDT tokens supposedly find use in the trade of other typical cryptocurrencies like Bitcoin and Ethereum’s ETH

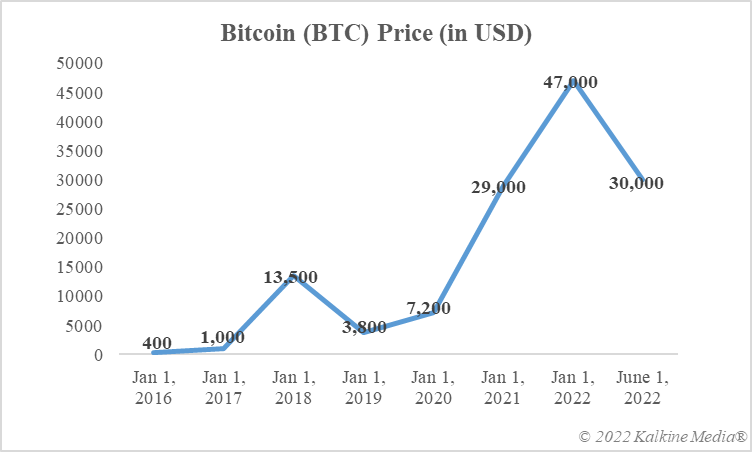

Stablecoins like Tether (USDT) are not a typical cryptocurrency like Bitcoin as the latter is a speculative asset that proponents can buy and sell to book capital gains given the price at the time of liquidating the asset is higher than the purchase price. In 2022, cryptocurrencies, including Bitcoin, booked heavy losses due to poor investor sentiment and falling prices. The USDT stablecoin, however, could steer clear of loss in value, perhaps because of the USD peg and the claim that reserves adequately back all USDT tokens.

Amidst such a scene, does it even make sense for anyone to hold a stablecoin like USDT? Tether asserts that the price would always be fixed at US$1 because of the peg. That said, platforms that promise returns on stablecoin deposits exist no matter how risky they are. Such intermediaries claim to pay interest on deposits held in the platform’s wallet. Let us explore this subject, the risks associated, but after a brief discussion on Tether.

What exactly is Tether?

Many identify Tether as the USDT stablecoin token, one of the biggest cryptocurrencies by market cap. However, the project is broader with more stablecoins like one pegged to the euro and another to gold. USDT represents the USD-pegged stablecoin, and it has the highest number of tokens launched in the market in comparison to all other Tether stablecoins. This could be the reason why Tether is often mentioned as USDT.

The answer to what is the utility of USDT is it supposedly acts as an enabler in the trade of other cryptocurrencies like Bitcoin. It is said that because USDT has a stable value, a trader can choose to buy and sell any cryptocurrency like Bitcoin in USDT denomination instead of having to convert it to a fiat currency on all occasions. If done via USDT, it is claimed that the amount can stay in the cryptocurrency wallet, meaning repeated crypto-to-fiat conversions can be evaded. Whether Tether’s reserves claim is dubious is a subject matter of a different discussion.

Data provided by CoinMarketCap.com

Interest on USDT

The Tether project claims to provide ‘liquidity’ to individuals and an easy medium of exchange for merchants. It does not, however, talk about any interest, like conventional banks offer to their depositors. As an alternative, there are other intermediaries like cryptocurrency exchanges that claim to provide interest on stablecoins deposited by the user. That said, such intermediaries can be risky, and the collapse of platforms like Voyager and now FTX comes as a reminder that the crypto world is excessively prone to big-ticket failures.

Takeaway

Tether’s USDT is claimed to be a USD-pegged stablecoin, and its purported use is as an enabler in the trade of other variable value cryptocurrencies. No interest accrues to the user on USDT holdings, however, there are intermediaries like exchanges which claim to provide interest income given the holding is deposited with them.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.