Highlights

- Even though Bitcoin has become a global sensation, it comes with huge risks, including a decline in value

- Besides price volatility, dangers include a sudden ban by a country on Bitcoin-related activities, as China did last year

- Companies in the cryptocurrency sector have yet to manifest their resilience, with names like FTX going bankrupt in 2022

Any asset can lose value and cause investment losses. There have been cases of sovereign debt defaults -- including by Argentina and Ukraine -- which tells us why even government bonds are not fully immune to failures. A company listed on the stock market can also be dealt a body blow, resulting in its delisting and heavy losses to equity investors. Even safe haven assets like gold can lose their value considerably within a few months.

That said, sovereign debt is one of the safest investments and is considered the least risky. Term deposits held with banks are also considered as safe. But what about one of the most trending speculative assets today -- Bitcoin (BTC)? Is Bitcoin safe or risky? If latter, what is the magnitude of this risk compared to other speculative assets like gold and listed stocks? Let us explore.

Is Bitcoin safe?

By all measures, Bitcoin, and later cryptocurrencies (called altcoins), are ultra-risky assets, and there are many reasons to prove this statement. In China -- the country that was home to extensive Bitcoin mining and trading -- the central bank declared all Bitcoin-related activities unlawful in September last year. The year 2021 was otherwise a good year for Bitcoin, with El Salvador becoming the first nation to legalise it as currency. China’s blanket ban meant the value of BTC holdings with enthusiasts suddenly became zero.

Second, it is not only about governments’ and regulators’ dislike of Bitcoin. Cryptocurrency-related businesses have failed to demonstrate their long-term viability. In 2022, a slew of such businesses, including Celsius Network, and FTX, filed for bankruptcy. The primary reason behind their collapse was the price volatility of Bitcoin and altcoins and the exodus of many enthusiasts from the cryptocurrency investment space.

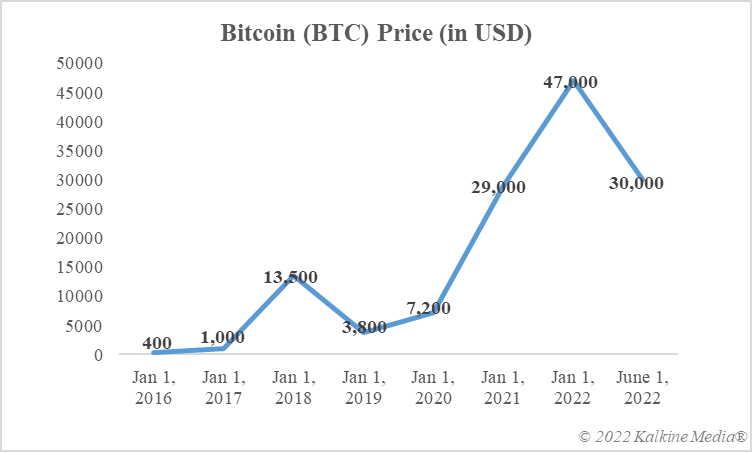

Data provided by CoinMarketCap.com

Does Bitcoin have a future?

For now, Bitcoin and altcoins like Dogecoin are listed on exchanges like Binance and are available for speculative trading. This is the biggest use case of cryptocurrencies at the moment. Critics, however, say this cannot last very long, and Bitcoin and blockchain would have to establish their real world utility to survive headwinds. Bitcoin’s main aim has always been to become a currency that can facilitate fast and cheap remittances. Experts say only if it can succeed in this regard, Bitcoin can expect a long and sustainable ride.

Bottom line

For now, Bitcoin is one of the riskiest speculative assets, regardless of its immense popularity. The biggest risk is the fear of a sudden ban by a regulator or sovereign authority on any or all Bitcoin-related activities. Second, cryptocurrency-related businesses have yet to become sustainable, with many filing for bankruptcy in 2022.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.