Highlights

- Stablecoins may not be as volatile as other cryptos, but caution is necessary here as well

- GYEN is pegged to the Japanese Yen, unlike USDT, which tracks the price of the US dollar

- GYEN crypto is not yet a high market cap cryptocurrency like Bitcoin and Ether

Though the term ‘crypto’ is widely used to refer to digital assets like BTC, ETH, and USDT, not every asset is the same with identical use cases. Bitcoin (BTC) is probably a competitor to fiat currencies, while Ether (ETH), the native token of Ethereum’s blockchain project, and Tether (USDT) are stablecoins.

While the values of BTC and ETH can change rapidly depending on their demand and supply, the price of a stablecoin largely remains constant.

This is because stablecoins are pegged to a certain asset, which has a fairly stable value, such as the US dollar or gold. This is one of the reasons why USDT mostly has the highest daily trading volume in the crypto verse.

That said, USDT is not alone, as many other stablecoins exist. Reportedly, Shiba Inu may also launch a stablecoin named SHI in the future.

But today, let’s know more about GYEN.

What is GYEN crypto?

Though referred to as crypto by many, GYEN is a stablecoin pegged to fiat currency Japanese Yen.

It was launched by GMO Trust, which has another stablecoin titled ZUSD that is pegged to the USD.

The project claims that holders of GYEN token can enjoy high liquidity at all times. They can redeem the tokens for fiat currency.

GMO Trust also claims that it enables an independent audit of the balance at the end of every month. Besides, there are no intermediaries, as mentioned in the whitepaper. Like many other native tokens, GYEN and ZUSD are both ERC-20 (Ethereum-based) assets.

Also read: APE and WAVES: 2 cryptos that made news in Q1 2022

GYEN crypto stats

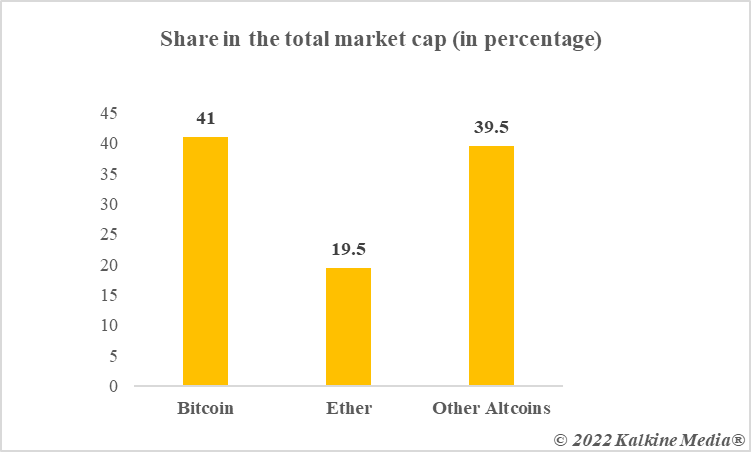

Though GYEN is a stablecoin like USDT, the former is not large-cap crypto. It is interesting to note that while USDT ranks third on the CoinMarketCap list -- BTC and ETH are the first and second, respectively -- GYEN does not feature in the top 500 assets.

Also read: Is EGL token a reminder of risks that ail crypto verse?

Its market cap was nearly US$22 million as of writing, and its price nearly mirrored the price of Yen due to the peg.

Its past 24-hour trade volume was in green. As per CoinMarketCap, over 2.73 billion tokens of GYEN stablecoin were in circulation.

Data provided by CoinMarketCap.com

Bottom line

Not all cryptos have the same function. BTC is said to be looking to become a legal tender, altcoins are mostly native tokens with use within a particular project, and stablecoins are pegged to a fairly stable asset like fiat currency and gold.

As discussed, GYEN crypto has a fairly low market cap as compared to the popular USDT stablecoin.

Also, though stablecoins may not manifest the volatility of BTC and other altcoins in terms of price, cryptos are still unpredictable, which is why due diligence is very necessary.

Also read: What is Sphynx cryptocurrency project and SPHYNX token all about?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website